Socialinė teorija, empirija, politika ir praktika ISSN 1648-2425 eISSN 2345-0266

2024, vol. 29 pp. 23–38 DOI: https://doi.org/10.15388/STEPP.2024.29.2

Ageless Assets: Social Investment and Active Aging Profiles in Lithuania

Violeta Vilkoitytė

Lietuvos socialinių mokslų centras

violeta.vilkoityte@gmail.com

https://orcid.org/0000-0002-1444-6666

Summary. This article argues that the aging population significantly affects the welfare state. Social investment strategies could respond to a changed economic and social order by enhancing active aging. While the social investment perspective has been a topic of discussion for decades, certain aspects remain underexplored. This study, therefore, aims to assess the impact of social investments on active aging. The study, based on the social investment approach and active aging model, analyzes quantitative data from Wave 8 of the Survey of Health, Ageing and Retirement in Europe (SHARE). The Lithuania sample included 1437 participants. In the analytical phase, Principal Component Analysis and Cluster Analysis were utilized (SPSS ver. 26). The findings unveil four active aging profiles (low activity, moderate activity, balanced activity, and high activity). The two groups are distinguished by aging conditions, such as poor health, lack of social investment, and high reliance on social benefits. The positive impact of social investment is underscored by the improved aging conditions outlined in the last two profiles. This study enriches the social investment research domain by providing valuable insights into the influence of social investment policies on the lives of older individuals and their potential to age actively.

Keywords: social investment, active aging, welfare state, Lithuania

Received: 2024-01-02. Accepted: 2024-06-22.

Copyright © 2024 Violeta Vilkoitytė. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Introduction

In recent decades, welfare states have encountered various new social risks and changes. The impact of demographic changes is one of the most pressing challenges we face today. These changes have far-reaching consequences that affect every aspect of our society – from healthcare and education to the economy and politics. The aging of society in many countries is related to increased spending on old age pensions, healthcare services, long-term care, and social security (Adema & Ladaique, 2009; Hinrichs & Lynch, 2010). This situation has forced countries to adapt their social policies to new social and economic circumstances. In the postindustrial world, it is crucial to implement new methods to address the challenges and maintain economic growth, employment, and well-being in society (Esping-Andersen et al., 2002; Bonoli, 2012; Hemerjick, 2012; 2017; Hemerijck & Ronchi, 2021).

Social investment strategies could answer the growing challenges of aging populations and the welfare state. It is a promising concept that could have a significant impact on society. Given the increasing number of aging individuals in society, implementing social investment policies can aid in establishing a fairer and more sustainable social security system. These policies can equip people with the necessary resources and skills to thrive in a rapidly evolving world and help older people maintain an active lifestyle and avoid early retirement (Kvist, 2015; Hemerjick, 2017). Despite theoretical discussions, current literature lacks empirical evidence on how social investment policies affect older individuals. Most empirical attempts to assess the impact of social investment focus on objective material socioeconomic conditions such as employment and poverty among working-age groups (Cantillon & Vandenbroucke, 2014; Rovny, 2014; Bakker & Van Vliet, 2021).

Although social investment is a growing area of interest in Lithuania, research in this field is still relatively new and has primarily followed established empirical paths. A study conducted by Skučienė et al. (2018) examined the effect of social benefits on poverty. The social security expenditures of the Baltic countries were also analyzed (Skučienė & Lazutka, 2019). Recent studies suggest that social security benefits do not offer sufficient protection against poverty or provide a minimum income. Active labor market policy (ALMP) from the point of view of social investment has also been studied (Skučienė, 2021). Tereškinas (2022) conducted a thorough analysis of the implementation of ALMP, focusing on the territorial level. The studies showed that investment in human capital was uneven across regions, resulting in weak inclusion of the unemployed in the labor market. The distribution of social risk by social class was studied to ensure a more targeted social investment policy (Skučienė & Markevičiūtė, 2021). Concerning the social investment paradigm, the latest attempts analyzed the territorial availability of preschool education services and perspectives of vocational training (Maslauskaitė, 2022; Bučaitė-Vilkė, 2022).

As the importance of social investment continues to gain recognition, there is a clear need for more innovative and diverse research to explore this approach’s potential impact. While most research focuses on the macro level, this study investigates social investment at the micro level. Specifically, the study focuses on elderly individuals and aims to assess the impact of social investments on active aging. This quantitative research uses Principal Component Analysis and Cluster Analysis to reduce dimension and identify different aging profiles.

The paper is structured as follows: First, an overview of the scientific literature on the social investment approach is given. Next, a discussion of active aging within the social investment framework is presented. This will be followed by an explanation of the research methodology and the presentation of the research findings. Finally, the study’s findings will be discussed in the context of existing literature on social investment and active aging.

The concept of social investment

Recently, countries have adopted elements of social investment (Hemerijck & Ronchi, 2021). As a new perspective of the welfare state, social investment contains new principles, goals, and social policy measures. The framework emphasizes investing in human capital and social infrastructure to promote employment and social mobility. This approach shifts the focus from providing welfare assistance to fostering human capital development and social inclusion. The goal is to empower individuals to reach their full potential and reduce dependency on social welfare programs in the long term.

It is important to note that social investment has been criticized for prioritizing economic growth over addressing issues related to gender, age, and class (Cantillon, 2011; Nolan, 2013; Pintelon et al., 2013). According to Jessop (2002), the welfare state is being replaced by a competitive workfare state, where reliance on welfare is decreasing, and dependence on the labor market is increasing. A singular emphasis on personal responsibility and labor market participation disregards the needs of vulnerable groups (Morel, Palier, & Palme, 2012). However, traditional welfare state measures are still necessary, as people will continue to retire, get sick, or lose their jobs despite the changes (Esping-Andersen, 2002; Toots & Lauri, 2017). Recent literature has shown that social benefits and services are integral parts of social investment (Hemerijck, 2013; 2017; Kvist, 2015). Viewing them as complementary components of the same strategy is essential to achieve comprehensive and sustainable results.

Within the social investment framework, there are defined three main interrelated policy functions of the modern welfare state: buffer provides safety nets and adequate financial resources; flow related to work and life balance, regulating working conditions; and stock refers to the formation and development of the human capital stock through life-time (Hemerijck, 2013; 2017). These policy interventions across different life stages of individuals may influence different dimensions and have multiplying effects, too. The advanced welfare reforms should focus on balancing these components to ensure sustainable social protection.

Aging and the Welfare State

Social investment strategies are crucial in addressing the challenges posed by aging populations (Kvist, 2015). Changes in demographic population structures have significant implications for economics and the sustainability of welfare state systems (Lindh, 2012). It is important to note that the welfare state’s ability to sustain itself depends heavily on the ratio of beneficiaries to employment (Figure 1) (Myles, 2002; Hemerijck, 2017; Hemerijck, Ronchi & Plavgo, 2022). In other words, the more people rely on welfare versus those employed and paying into the system, the more strain there is on the system. Therefore, it is crucial to strive for a balance between those who benefit from welfare and those who contribute to it through employment.

Figure 1. Equation of carrying capacity of the welfare state

Source: building on Myles, 2002; Hemerijck, 2017; Hemerijck, Ronchi and Plavgo, 2022

However, according to data from the State Social Insurance Fund (2023), an aging population can decrease the labor force. In Lithuania, by the end of 2023, the number of the oldest labor market participants, aged over 60, has grown the fastest. Their number increased by 10 thousand during the year, constituting 14 percent of all labor market participants. The number of employees under 30 has decreased significantly by 5.5 thousand compared to the previous year. This means that as individuals over the age of 60 retire, a smaller number of employees will take their place in the labor market. As more people retire, a greater demand for pensions, social security, healthcare, and long-term care services exists. It is crucial to note that the at-risk-of-poverty rate among retired individuals in the country remains significantly high (Vilkoitytė & Skučienė, 2022). This puts pressure on welfare states, and governments may need to reevaluate the sustainability of such programs and make adjustments to ensure their financial viability. A stable tax base is one of the most essential elements to fulfilling welfare commitments, requiring many paid workers. Social investment policies can potentially increase the number and quality of paid workers. This expands the tax base necessary to guarantee the financial sustainability of welfare spending (Myles, 2002; Hemerijck, 2017; Hemerijck, Ronchi & Plavgo, 2022).

Active aging within the social investment framework

The concept of active aging goes beyond the traditional notion of aging and highlights the potential for continued growth, participation, and contribution to society in later life. This could delay the transition from work to retirement and reduce spending on old-age insurance and care needs. Also, it renders existing and future welfare commitments such as pensions more sustainable (Hemerijck, 2013; Hemerijck, Ronchi & Plavgo, 2022). In many countries, pension reforms followed a general trend of raising the retirement age (Kvist, 2015) and moving to privately funded schemes (Hinrichs & Lynch, 2010).

Critics argue that this perspective tends to emphasize individual responsibility for success and overlooks the role of structural barriers, such as ageism, discrimination, limited access to healthcare, and socioeconomic inequalities, which can significantly impact older adults’ ability to age actively. Timonen (2016) notes the disjuncture between successful aging and active aging, which arises from the fact that policy operates without any more profound understanding of the population’s health, social, and economic outcomes. Successful aging is more widespread among the higher socioeconomic status groups, who tend to have a longer life expectancy, better health, and better social connectivity (Timonen, 2016).

Active aging within the social investment framework aims to remove structural barriers and empower older adults by increasing active, independent, healthy living (Kvist, 2015; Hemerjick, 2017). Active aging extends beyond employment, and it is a multidimensional concept that refers to optimizing opportunities for lifelong learning, health, participation, and security (World Health Organization, 2002; Zaidi, 2015; Rojo-Perez et al., 2022). Zaidi (2015) identified the following four main pillars.

• The lifelong learning pillar promotes continuous learning and intellectual engagement throughout life through formal and informal education programs that provide the knowledge and skills needed by modern labor markets.

• The health pillar covers physical and mental well-being. Early preventive measures can delay age-related mental and physical disorders (Marmot et al., 2012). Low-risk factors are associated with better health, so older people need less expensive treatment and care, which prevents them from early retirement.

• The participation pillar highlights the significance of maintaining social connections and engaging in cultural and community activities. Meaningful volunteer work and social interactions promote mental and emotional well-being, combat social isolation, and help individuals remain productive members of society.

• The security pillar encompasses physical, social, and financial security requirements. It fosters an environment that enables older individuals to maintain independence and autonomy. It includes rights to protection in old age when individuals can no longer support and protect themselves.

All these pillars support opportunities for older individuals to remain active, and employment in old age is an integral part of active aging. It is essential to mention that social investment interventions have the most significant impact when starting in the earlier stages of life as preventive measures.

Data and methods

The data source is the Survey of Health, Ageing and Retirement in Europe (SHARE) wave 8. Selecting a SHARE representative study is based on its relevance to the research and availability of active aging determinants. The target population of the study is anyone aged 50 and over. If the spouse who participated in the survey was under 50 years old, a younger age may apply (Börsch-Supan & Jürges, 2021). This information is crucial to consider while interpreting the survey results for an accurate analysis. Information on data collection, sampling, ethical standards, and other technical issues has been placed in the methodology book (Börsch-Supan & Jürges, 2021).

The original SHARE dataset consists of 30 thematic data files. The variables of interest in this research were reviewed and selected from these files. The original variables and generated variables calculated by SHARE (Börsch-Supan & Jürges, 2021) were assigned to the four pillars of active aging according to Rojo-Perez et al. (2022) (Appendix 1). After the filtration procedure, participants were retained for Lithuania (N = 1437).

Statistical analysis was conducted using SPSS version 26. First, data quality checks were performed to identify and address missing values, outliers, and inconsistencies. Before applying analytical methods, the data were standardized to have zero mean and unit variance, which ensures that each variable contributes equally to the analysis. This is important because some variables are measured in different units.

Principal Component Analysis (PCA) was used to reduce dimensionality and extract principal components. PCA was conducted for each set of variables based on the active aging pillars. The Rotation Method was Varimax with Kaiser Normalization. Based on the extracted components, new variables were created. In the next analytical phase, Cluster Analysis (CA) was carried out on distinct segments of subjects based on similarities in their characteristics. For grouping, the K-means method was used. Cross-validation was used to determine the best number of clusters in K-means clustering. The dataset was divided into two sets – the training set and the validation set. Different numbers of clusters were used to perform K-means clustering on the training set, and the clustering performance was evaluated on the validation set using a metric. The best number of clusters was selected based on the best performance on the validation set. Four profiles of older adults were classified based on their active aging conditions. The titles of profiles were generated from their representative content.

A potential limitation of this study is that it was difficult to find data on active aging or social investment, as there are few empirical attempts in Lithuania. The SHARE survey was not originally designed to study active aging or social investment, so this dataset may not include all the theoretically defined information. Another limitation is that most respondents were already retired, which could be the reason for the high number of subjects with poor and average aging results, potentially introducing a bias into the results. Third, while PCA simplifies the data by reducing dimensionality, the resulting principal components may not always be directly interpretable regarding the original variables, especially when dealing with many components. It should be noted that in PCA and CA analysis, the groups are named at the researcher’s discretion. Although a more thorough analysis that considers sociodemographic characteristics and class inheritance could be conducted, but it goes further than the original idea and beyond the scope of this article’s press unit requirement. However, it is essential to highlight that a more detailed examination would likely provide valuable insights and illuminate essential aspects that may have been overlooked. This analysis is intended for future research purposes. Despite these limitations, the results are significant as they demonstrate the impact of social investment on active aging outcomes and contribute to the field of social investment research in Lithuania.

Results

The sample consisted of 1437 participants, with a mean age of 68.3 years (minimum: 45; maximum: 95); 62.8% were women, and 37.2% were men. 18.6% of respondents completed primary or lower secondary education, 44.3% completed upper secondary or postsecondary nontertiary education, and 34% completed short cycle, bachelor or equivalent level education. 57.4% of the subjects were retired, 28.8% remained active in the labor market, 5% were unemployed, 7% were permanently sick or disabled, and 1.8% were housekeepers. 57.9% of older adults were married or living with a partner.

The Lifelong Learning Pillar provided two principal components (explained variance 77.7 %) (Table 1). The first component (L1) represents writing, reading, and computer-using skills. The second (L2) means educational level and training involvement in the last 12 months.

Table 1. Components of Lifelong Learning Pillar

|

L1– writing, reading, |

L2 – educational and |

|

|

Self-rated reading skills |

.900 |

-.170 |

|

Self-rated writing skills |

.923 |

-.178 |

|

Computer skills |

.633 |

.284 |

|

Education |

.098 |

.923 |

|

Attended an educational or training course the last 12 months |

.067 |

.948 |

|

Component Explained variance 77.7 (%) |

||

The Health Pillar comprises five components, explaining 69.9 % of the variance (Table 2). The first component (H1) represents bad health conditions because it is related to bad self-perceived health, hospital use, chronic diseases, and depression. The second (H2) shows physical limitations and the need for help to function. The third (H3) means sensory health, such as eyesight and hearing function. The fourth (H4) means unhealthy habits such as smoking. The fifth (H5) represents a higher body mass index (BMI).

Table 2. Components of Health Pillar

|

H1 – |

H2 – |

H3 – |

H4 – |

H5 – |

|

|

Smoked daily |

.054 |

.121 |

.055 |

.689 |

.199 |

|

BMI categories |

-.061 |

.079 |

.082 |

-.039 |

.860 |

|

Number of chronic diseases |

.707 |

.265 |

.087 |

-.110 |

.230 |

|

Self-perceived health |

.669 |

.089 |

.107 |

.043 |

-.111 |

|

Stayed overnight in hospital for last 12 months |

.497 |

.223 |

.180 |

-.102 |

.415 |

|

Times talked to medical last 12 months |

.628 |

-.292 |

-.033 |

-.061 |

.301 |

|

Depression scale EURO-D |

.491 |

.106 |

.109 |

.376 |

-.023 |

|

Limitations with activities of daily living |

.700 |

.109 |

.240 |

-.053 |

-.145 |

|

Eyesight reading |

.016 |

.084 |

.869 |

.041 |

.034 |

|

Hearing |

.459 |

.066 |

.582 |

-.123 |

.030 |

|

Mobility |

.462 |

.691 |

-.107 |

-.061 |

-.058 |

|

Activities requiring a moderate level of energy |

.٠١٨ |

.623 |

.198 |

.089 |

-.020 |

|

Limitations with instrumental activities of daily living |

.316 |

.809 |

-.059 |

-.018 |

.082 |

|

Component Explained variance 69.9 (%) |

|||||

In the Participation Pillar, 58.5% of the variance was explained by three principal components (Table 3). The first component (P1) represents involvement in voluntary, charity, political, and community activities. The second (P2) shows reading and calculation activities related to good cognitive performance. The third component (P3) represents a sizeable social connectedness scale and involvement in social activities such as sports or social clubs.

Table 3. Components of Participation Pillar

|

P1 – volunteering |

P2 – cognitive |

P3 – high social |

|

|

Done voluntary/charity work the last 12 months |

.771 |

-.014 |

-.145 |

|

Taken part in a political/community organization for the last 12 months |

.708 |

.031 |

.105 |

|

Read books and newspapers the last 12 months |

-.039 |

.803 |

-.200 |

|

Did word or number games the last 12 months |

.087 |

.641 |

.368 |

|

Played cards or chess for the last 12 months |

.016 |

.114 |

.673 |

|

The scale of social connectedness |

.187 |

-.223 |

.494 |

|

Gone to a sport or social club the last 12 months |

.187 |

-.223 |

.494 |

|

Component Explained variance 58.5 (%) |

The Security Pillar comprises five components, explaining 76.5% of the variance (Table 4). The first component (S1) represents household economic status, including total household income, real assets (investments in physical assets such as real estate), and net financial assets (other investments). The second (S2) shows different kinds of pensions. The third component (S3) means the total value of household expenditure. The fourth (S4) represents unemployment benefits. The fifth (S5) means sickness benefits.

Table 4. Components of Security Pillar

|

S1 – |

S2 – |

S3 – |

S4 – |

S5 – |

|

|

Total household income |

.797 |

.065 |

-.034 |

-.023 |

-.029 |

|

Household real assets |

.737 |

-.001 |

-.130 |

.172 |

-.060 |

|

Household net financial assets |

.702 |

-.098 |

.193 |

-.119 |

.170 |

|

Old age, early retirement, and survivor pensions |

.057 |

.654 |

.487 |

-.138 |

-.183 |

|

Disability pensions and benefits |

.020 |

.896 |

-.152 |

-.069 |

-.080 |

|

Total household expenditure |

.010 |

-.034 |

.909 |

-.020 |

-.075 |

|

Unemployment benefits/insurances |

.027 |

-.004 |

.006 |

.979 |

-.001 |

|

Sickness benefits |

.037 |

.007 |

-.046 |

-.001 |

.973 |

|

Component Explained variance 76.5 (%) |

|||||

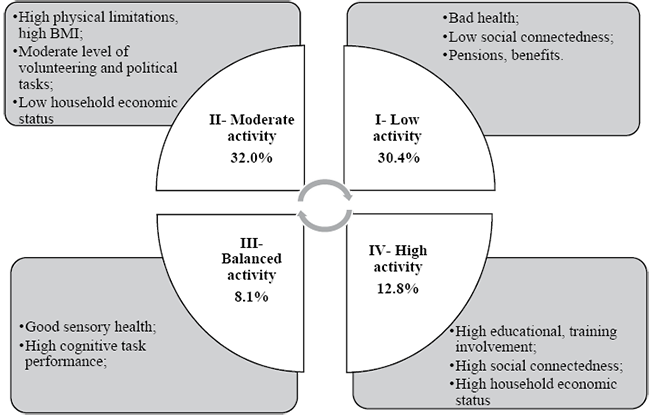

Figure 1. Active Aging Profiles

The grouped subjects resulted in four profiles (Figure 1). The first profile represents that 30.4% of respondents had low active aging conditions, characterized by poor health, low social connectedness, and a high share of pensions and unemployment benefits. The second profile associated with moderate aging activity comprised 32% of respondents, consisting of individuals with high physical limitations, high BMI, moderate engagement in volunteering and political tasks, and low household economic status. The third profile (8.1% of respondents) included subjects with good sensory health and high cognitive task performance. The last profile represents a group of respondents (12.8%) who are experiencing good active aging conditions. They are characterized by high levels of educational and training involvement, high social connections, and a good economic status within their households. A nongrouped sample could also be distinguished as a group. This represents 16.7% of respondents.

Discussion

Social investment and active aging are closely interconnected concepts that have gained significant attention in academic and policy discussions. However, empirical results are lacking. This study attempts to explore the relationship between social investment and active aging results.

The results show different aging outcomes. In the I profile, the relatively poor aging effect is linked to ill health, low social connections, and a high proportion of pensions or other benefits. Poor health and chronic conditions can significantly impact the ability to work, often resulting in frequent absences and even withdrawal from the labor market. The high proportion of pension and benefit recipients in the I profile indicates that older individuals are inactive in the labor market. It is essential to consider that as people age, they often choose to retire from work when the time comes. However, an individual’s health condition can also affect their decision to retire (Marmot et al., 2012). From a social investment perspective (according to Hemerijck (2013; 2017)), pension and benefits acts as a buffer. The pension can provide the financial security necessary to comfortably leave the workforce and make that transition smoother (Hemerijck, 2013). In comparison, those who are unable to retire may rely on sick leave and unemployment benefits. Sometimes, it is a survival strategy for those who age before their time (Bello & Galasso, 2020). However, recent studies indicate the risk that social security in Lithuania does not provide a minimum income (Skučienė et al., 2018).

It is also essential to consider that isolation brought on by poor health can be detrimental to connections with others. Over time, social bonds can start to weaken and fray, leading to a sense of loneliness and disconnection. In the PCA, the H1 component is not only associated with chronic diseases and frequent hospital visits but is also worth paying attention to high depression. The profile indicates a potential for a more significant investment in human health. This can lead to better health outcomes, increased social connectedness, and (according to Kvist (2015) and Hemerjick (2017)) a reduced need for early retirement. This would contribute to better aging conditions.

The II profile shows that moderate aging is characterized by high physical limitations, higher BMI, a moderate level of volunteering and political tasks, and low household income. When an individual experiences physical limitations, their ability to perform work-related tasks may be limited, resulting in poor economic conditions. It is important to consider that this issue may still be linked to older age, as mentioned in the first profile. This case also indicates a potential for more significant investment in human health, as well as providing adequate financial resources and safety nets. It is important to note that physical capacity does not affect social activities in this case. This indicates that an individual with physical limitations can still enjoy a social life, which is important for active aging (Zaidi, 2015).

The III profile is defined by good sensory health and high performance in cognitive tasks. Good health and cognitive function are closely linked to better work performance and are crucial in determining an individual’s capacity to work. Good health is necessary for a long and sustainable career. It reduces the risk of early retirement due to health issues (Hemerjick, 2017).

Active aging results in the IV profile are related to high educational and training involvement, high social connectedness, and good household economic status. According to Kvist (2015) and Hemerijck, Ronchi and Plavgo (2022), social investments tend to accumulate throughout life. Higher education can lead to better job opportunities and financial security in old age, as it allows for accumulating financial assets earlier in life. When determining a good financial position, it is important to consider other factors such as class, inheritance, and personal investments. Although social investment argues for breaking social inheritance patterns (Esping-Andersen, 2002), it probably cannot limit the inheritance of a good-standing position. These factors can play a crucial role in shaping one’s financial stability and security for the future. Timonen (2016) mentions that higher social class groups experience better aging due to longer life expectancy, improved health, and greater social connectivity.

The profile also shows social investment, such as participation in training programs. Encouraging older individuals to engage in training is a wise decision as it allows them to fully utilize their expertise and knowledge. Rojo-Perez et al. (2022) emphasized the importance of lifelong learning for active aging. It is positive because people can stay up-to-date with the latest labor market trends, enhancing their skills. This, in turn, enables them to ensure a longer working career and make meaningful contributions to society.

Conclusion

The social investment perspective highlights the significance of taking proactive steps and implementing policies that ensure the well-being and inclusion of individuals throughout their lives, especially in their later years. Moreover, it acknowledges that active aging is not only the responsibility of individuals but also requires supportive policies. Active aging is a concept that aims to involve older adults in a variety of social, economic, and cultural activities. It emphasizes their participation, engagement, and empowerment. From a social investment perspective, active aging is seen as a strategic approach to maximize the potential and contributions of older adults. It recognizes that older adults possess valuable skills, knowledge, and experience. By investing in initiatives that promote active aging, the welfare state can benefit from the continued engagement of older adults. This can lead to improved sustainability, productivity, and overall quality of life.

The I and II profiles serve as warning signs for potential barriers to active aging and highlight the crucial need for social investments in healthcare. Investing in social healthcare can help us overcome these barriers. Also, profiles suggest the presence of social investment buffers, but a more detailed study would be necessary to determine whether they provide adequate protection from financial hardship. The III and IV profiles suggest that investing in education and training may positively impact active aging. However, it can also be noted that active and successful aging could be more widespread among the younger and higher socioeconomic status groups.

Societies can create an inclusive and supportive environment for older adults by aligning social investment perspectives that cater to their diverse needs and preferences. This includes ensuring access to healthcare, lifelong learning opportunities, work arrangements, and social support networks. Societies can promote the sustainability of welfare and enable people to lead fulfilling and purposeful lives as they age.

References

Adema, W., & Ladaique, M. (2009). How expensive is the welfare state?: Gross and net indicators in the OECD Social Expenditure Database (SOCX). DOI: https://doi.org/10.1787/1815199X

Bakker, V., Verburg, P. H., & van Vliet, J. (2021). Trade-offs between prosperity and urban land per capita in major world cities. Geography and Sustainability, 2(2), 134-138. DOI: 10.1016/j.geosus.2021.05.004

Bello, P., & Galasso, V. (2020). Old before their time: The role of employers in retirement decisions. International Tax and Public Finance, 27(5), 1198-1223.

Bonoli, G. (2012). Active labor market policy and social investment: a changing relationship. In N. Morel, B. Palier & J. Palme (Eds.), Towards a Social Investment Welfare State? Ideas, Policies and Challenges (pp. 181–204). Bristol Policy Press. DOI: https://doi.org/10.2307/j.ctt9qgqfg

Börsch-Supan, A. & Jürges, H. (Ed.). (2021). SHARE Wave 8 Methodology: Collecting Cross-National Survey Data in Times of COVID-19. Munich Center for the Economics of Aging (MEA). DOI: 10.18148/srm/2020.v14i2.7738

Börsch-Supan, A. (2022). Survey of Health, Ageing and Retirement in Europe (SHARE) Wave 8. Release version: 8.0.0. SHARE-ERIC. Data set. DOI: 10.6103/SHARE.w8.800

Bucaite-Vilke, J. (2022). Social investment and vocational education and training policy: The architecture of combining national standardization and territorial needs. In J. Bucaite-Vilke (Ed.), Social investment and territorial inequalities: mapping policies and services in the Baltic states (pp. 189-229). Peter Lang International Academic Publishers. DOI: 10.3726/b19662

Cantillon, B., & Vandenbroucke, F. (Eds.). (2014). Reconciling work and poverty reduction: How successful are European welfare states?. Oxford University Press.

Esping-Andersen, G. (2002). Why we Need a New Welfare State. Oxford: Oxford University Press.

Hemerijck, A. (2012). Two or three waves of welfare state transformation? In N. Morel, B. Palier & J. Palme (Eds.), Towards a Social Investment Welfare State? Ideas, Policies and Challenges (pp. 33-61). Bristol Policy Press. DOI: https://doi.org/10.2307/j.ctt9qgqfg

Hemerijck, A. (2013). Changing Welfare States. Oxford University Press.

Hemerijck, A. (2017). Social investment and its critics. In Hemerijck, A. (Ed.), The uses of social investment (pp. 3-42). Oxford University Press.

Hemerijck, A., & Ronchi, S. (2021). Social investment reform in the twenty-first century. In D. Béland (Ed.) et al. The Oxford Handbook of the Welfare State (2nd. ed., pp. 112–130). Oxford University Press. DOI: https://doi.org/10.1093/oxfordhb/9780198828389.013.7

Hemerijck, A., Ronchi, S. & Plavgo I. (2022). Social investment as a conceptual framework for analysing well-being returns and reforms in 21st century welfare states. Socio-Economic Review, 21(1), 479–500. DOI: https://doi.org/10.1093/ser/mwac035

Hinrichs, K. & Lynch, J. (2010). Old-age pensions. In H. Obinger, C. Pierson, F.G. Castles, S. Leibfried & J. Lewis (Eds.), The Oxford Handbook of Comparative Welfare States (pp. 353–66). Oxford: Oxford University Press.

Jessop, B. (2002). The future of the capitalist state. Cambridge: Polity Press.

Kvist, J., (2014). A framework for social investment strategies: Integrating generational, life course and gender perspectives in the EU social investment strategy, Comparative European Politics, 1–19. DOI: 10.1057/978-1-137-58179-2_3

Lindh, T. (2012). Social investment in the ageing populations of Europe. In N. Morel, B. Palier & J. Palme (Eds.), Towards a Social Investment Welfare State? Ideas, Policies and Challenges (pp. 261–284). Bristol Policy Press. DOI: https://doi.org/10.2307/j.ctt9qgqfg

Marmot, M., Allen, J., Bell, R., Bloomer, E., & Goldblatt, P. (2012). WHO European review of social determinants of health and the health divide. The Lancet, 380(9846), 1011-1029.

Maslauskaitė, A. (2022). Promoting social investment policy through the development of early childhood education and care policy. In J. Bucaite-Vilke (Ed.), Social investment and territorial inequalities: mapping policies and services in the Baltic states (pp. 117-150). Peter Lang International Academic Publishers. DOI: 10.3726/b19662

Myles, J. (2002). A new social contract for the elderly. In Esping-Andersen G., Gallie D., Hemerijck A. & Myles J. (Eds.), Why We Need a New Welfare State (pp. 130–172). Oxford University Press.

Nolan, B. (2013). What use is „social investment?“, Journal of European Social Policy vol. 23, no. 5 p. 459–468 https://journals.sagepub.com/

Pintelon, O. et al. (2013). The social stratification of social risks: the relevance of class for social investment strategies, Journal of European Social Policy Vol.23, No.1, pp.52–67. https://doi.10.1177/0958928712463156.

Rojo-Perez, F., Rodriguez-Rodriguez, V., Molina-Martinez, M. A., Fernandez-Mayoralas, G., Sanchez-Gonzalez, D., Rojo-Abuin, J. M., & Forjaz, M. J. (2022). Active ageing profiles among older adults in Spain: A Multivariate analysis based on SHARE study. PloS one, 17(8). DOI: https://doi.org/10.1371/journal.pone.0272549

Rovny, A. E. (2014). The capacity of social policies to combat poverty among new social risk groups. Journal of European Social Policy, 24(5), 405–423. DOI: 10.1177/0958928714542732

Skučienė, D., Lazutka, R., Čižauskaitė, A. & Markevičiūtė, J. (2018). Socialinių išmokų vaidmuo mažinant skurdą ir pajamų nelygybę „naujų” socialinės rizikos grupių gyvenimo kelyje. Vilnius University Press.

Skučienė, D. & Lazutka, R. (2019). Social investment in the Baltic States: benefits against poverty and the distribution of social risks over the life course. Corvinus Journal of Sociology and Social Policy, 11(20), 35–50. DOI: 10.14267/CJSSP.2019.2.2

Skučienė, D. (2021). Lithuanian Active Labour Market Policy in 2009–2020: a Social Investment Perspective. Labor et educatio, (9), pp. 153–167. DOI: 10.4467/25439561LE.21.010.15364

Skuciene, D., & Markeviciute, J. (2021). Social Risks and Class in the Baltic States: Insights for Social Investment Strategy. Journal of Developing Societies, 37(1), 83-97. DOI: 10.1177/0169796X21999306

State Social Insurance Fund (2023). Gyventojų darbo pajamų apžvalga 2023. https://www.sodra.lt/

Tereškinas, A. (2022). Active labor market policies as a part of social investment approach. In J. Bucaite-Vilke (Ed.), Social investment and territorial inequalities: mapping policies and services in the Baltic states (pp. 151-189). Peter Lang International Academic Publishers. DOI: 10.3726/b19662

Timonen, V. (2016). Critique of Active Ageing Models. In Beyond Successful and Active Ageing (pp. ٣٥–60). Policy Press.

Toots, A. & Lauri, T. (2017). Varieties of Social Investment Policies on Two Sides of the Baltic Sea: Explaining Routes to Endurance. Social Policy & administration 51(4), 550–576. DOI: https://doi.org/10.1111/spol.12313

Vilkoitytė, V. & Skučienė, D. (2022). Social investment in the context of the COVID-19 pandemic: the case of Lithuania. Social Sciences Bulletin, 35(2): 59–77. https://doi.org/10.9770/szv.2022.2(3)

Zaidi, A. (2015). Active Ageing Index: A Legacy of the European Year 2012 for Active Ageing and Solidarity between Generations. European Centre Policy Brief.

Appendix 1. Variables

|

Variables for Learning Pillar |

Measurement Scale |

Total (%) |

Missing(%) |

|

Self-rated reading skills |

Recoded 1: Poor; 2: Fair; 3: Good; 4: Very good; 5: Excellent |

99.4 |

0.6 |

|

Self-rated writing skills |

Recoded 1: Poor; 2: Fair; 3: Good; 4: Very good; 5: Excellent |

99.4 |

0.6 |

|

Computer skills |

Recoded 0: I never used a computer; 1: Poor; 2: Fair; 3: Good; 4: Very good; 5: Excellent |

99.8 |

0.2 |

|

Education |

Higher scores indicate more years of education |

99.9 |

0.1 |

|

Attended an educational or training course during the last 12 months |

0: No; 1:Yes |

99.6 |

0.4 |

|

Variables for Health Pillar |

|||

|

Smoked daily |

0: No; 1:Yes |

99.9 |

0.1 |

|

BMI categories |

1: <18.5; 2: 18.5–24.9; 3: 25–29.9; 4: >30 |

97.9 |

2.1 |

|

Number of chronic diseases |

Based on the list. Higher score indicate more chronic conditions |

99.9 |

0.1 |

|

Limitations with activities of daily living (dressing, walking, eating) |

Based on the list. Higher scores indicate more limitations |

99.9 |

0.1 |

|

Mobility (arm function and fine motor limitations) |

Based on the list. Higher scores indicate more limitations |

99.8 |

0.2 |

|

Self-perceived health |

Recoded 1: Poor; 2: Fair; 3: Good; 4: Very good; 5: Excellent |

99.9 |

0.1 |

|

Stayed over night in hospital last 12 months |

Higher scores indicate a higher number of times |

99.8 |

0.2 |

|

Times talked to medical doctor last 12 months |

Higher scores indicate a higher number of times |

99.3 |

0.7 |

|

Depression scale EURO-D |

0: Not depressed to 12: Very depressed |

97.7 |

2.3 |

|

Eyesight reading |

Recoded 1: Poor; 2: Fair; 3: Good; 4: Very good; 5: Excellent |

99.7 |

0.3 |

|

Hearing |

Recoded 1: Poor; 2: Fair; 3: Good; 4: Very good; 5: Excellent |

99.9 |

0.1 |

|

Activities requiring a moderate level of energy |

1: Hardly ever, or never; 2: One to three times a month; 3: Once a week; 4: More than once a week |

99.9 |

0.1 |

|

Limitations with instrumental activities of daily living (leaving the house independently, accessing transportation services) |

Based on the list. Higher scores indicate more limitations |

99.9 |

0.1 |

|

Variables for Participation |

|||

|

Scale of social connectedness |

Higher score indicate a higher connectedness |

99.7 |

0.3 |

|

Done voluntary/charity work during the last 12 months |

0: No; 1:Yes |

99.5 |

0.5 |

|

Taken part in a political/community organization during the last 12 months |

0: No; 1:Yes |

99.5 |

0.5 |

|

Read books, newspapers during the last 12 months |

0: No; 1:Yes |

99.5 |

0.5 |

|

Did word or number games during the last 12 months |

0: No; 1:Yes |

99.5 |

0.5 |

|

Played cards or games such as chess during the last 12 months |

0: No; 1:Yes |

99.5 |

0.5 |

|

Gone to a sport/social/other kind of club during the last 12 months |

0: No; 1:Yes |

99.5 |

0.5 |

|

Variables for Security Pillar |

|||

|

Total household income |

Higher score indicate a higher value |

99.9 |

0.1 |

|

Household real assets (value of main residence, the value of own business, value of cars, value of other real estate) |

Higher score indicate a higher value |

99.9 |

0.1 |

|

Household net financial assets (the sum of bank accounts, bond, stock and mutual funds; savings for long-term investments) |

Higher score indicate a higher value |

99.9 |

0.1 |

|

Old age, early retirement, and survivor pensions |

Higher score indicate a higher value 0–37.9% |

99.9 |

0.1 |

|

Disability pensions/benefits |

Higher score indicate a higher value 0–90.1% |

99.9 |

0.1 |

|

Total household expenditure |

Higher score indicate a higher value |

99.9 |

0.1 |

|

Unemployment benefits/insurances |

Higher score indicate a higher value 0–98.6% |

99.9 |

0.1 |

|

Sickness benefits |

Higher score indicate a higher value 0–97.6% |

99.9 |

0.1 |