Ekonomika ISSN 1392-1258 eISSN 2424-6166

2024, vol. 103(3), pp. 40–56 DOI: https://doi.org/10.15388/Ekon.2024.103.3.3

Bayram Erkin Ay

Isparta University of Applied Sciences, Türkiye

Email: bayramay@isparta.edu.tr

ORCID: https://orcid.org/0009-0002-4089-6254

Gamze Göçmen Yağcilar

Süleyman Demirel University, Türkiye

Email: gamzeyagcilar@sdu.edu.tr

ORCID: https://orcid.org/0000-0002-5009-4696

Abstract. Efficient financial markets are important for pricing assets at fair value. In an efficient market, investors are rational in the face of fast and accurate information flow, evaluate the information correctly, and reflect it in their pricing decisions. However, particularly in times of crisis and uncertainty, it is observed that some market participants hesitate in their decision-making processes, imitate the behavior of other individuals whom they consider reputable because they cannot rely on their own knowledge and experience, and try to follow the trend. This tendency, which is called herd behavior, destroys market efficiency and prevents correct price formation. Therefore, it is important to identify its determinants. The purpose of the study is analyzing the precense and determinants of herding behavior in the Turkish banking sector during the period 17.10.2017–10.11.2023. Herd behavior is identified using the Hwang–Salmon method, and logistic regression analysis and the Kruskal–Wallis test are applied to identify its determinants. The findings reveal that herding behavior is associated with the rise in risks and returns as well as the fall in interest rates and exchange rates.

Keywords: Behavioral finance, Herd behavior, Hwang–Salmon Method, Logistic regression, Banking sector.

________

Received: 04/04/2024. Revised: 13/06/2024. Accepted: 07/07/2024

Copyright © 2024 Bayram Erkin Ay, Gamze Göçmen Yağcilar. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Financial decisions and market dynamics are important for economic systems and businesses to achieve sustainable success. In particular, financial decisions are highly strategic processes that require individuals and organizations to make the right investments, allocate their resources effectively and manage their risks consciously, and depend on an understanding of market dynamics. Although investors sometimes act behaviorally in accordance with these dynamics, sometimes they may change their behavior, decisions and market perceptions.

Rational models such as the Expected Utility Theory or the Efficient Markets Hypothesis fail to explain these perceptions. Behavioral models have been developed to compensate for this gap (Karan, 2013). With their Prospect Theory, Kahneman and Tversky (1979) argued that investors can not be rational all the time and sometimes decide unreasonably in risky situations. According to the Behavioral Finance view, which gained strength in the finance and economics perspective following the Expectation Theory, it states that investors may exhibit behaviors different from the rationality defined in traditional finance models, that these irrational behaviors may lead to erroneous formation of prices in the market and that the arbitrage mechanism may not be able to prevent this situation (Karan, 2022). Price anomalies in the markets cause financial asset prices to deviate from their true value and thus call traditional theories into question. Price anomalies also bring to the forefront the main actor of financial markets, the financial investor and financial investor behavior. This is explained by some cognitive biases in behavioral finance. In the study on Investor Psychology and Asset Pricing by David Hirshleifer (2001), four main groupings were identified. These groups are named as Self-Delusion, Shortcut Inference, Emotions and Self-Control, and Social Interaction. Cognitive biases that occur in the form of errors and biases are shown in Hirshleifer’s (2001) grouping and subheadings in Figure 1 (Başarır, 2021).

Social interaction means that individuals learn and are influenced by each other through mutual interaction/communication. Before making a decision about their investment, investors discuss these decisions and the opinions they receive from their environment affect their decisions (Nofsinger, 2017). Social interaction is examined under two groups: social contagion and herding behavior. There are many studies in the literature that investigate herd behavior with different methods. However, studies on the determinants of herd behavior are relatively limited. Revealing the factors that cause this behavior will contribute to managing the expectations of investors, portfolio managers and policy makers. In this context, the study aims to investigate the presence and determinants of herding behavior for banking stocks, which have an important place in BIST 100, the most frequently followed index of Borsa Istanbul. For this purpose in section 1, the concept of herd behavior is explained. In section 2, related literature is presented. Information about the methodology and data of the research is given in section 3. Findings are presented in section 4. The last section includes concluding remarks and discussions.

While the concept of herding appears in many fields such as neurology, sociology and zoology, in the fields of economics and finance, it is defined as actors generally imitating each other and shaping their decisions by determining the behavior of others as a basis (Spyrou, 2013). According to Raafat et al. (2009), herding behavior is defined as the alignment of ideas or behaviors of individuals within an environment through local interaction without central coordination, while according to Bikhchandani and Sharma (2000), herding behavior in financial markets is defined as a phenomenon in which investors shape their investments with the intention of mimicking the actions of other investors (Demirer and Kutan, 2006). The formation of a “herd” is triggered when an investor takes an action that he/she would not have taken if he/she had not known about the other investors. When the herd is formed and its presence is felt in the market, it is observed that investor behavior does not include new information about market fundamentals and the social learning process is interrupted (Decamps and Lovo, 2002). Measuring herd behavior is important because herding can lead to market-wide mispricing and trend shaping that alters individuals’ perception of the economic fundamentals of assets (Baddeley, 2013). Due to its importance, various measurement methods have been developed. Hachicha et al. (2007) stated that studies on herd behavior are divided into two categories. In their study, the LSV measure developed by Lakonishok, Shleifer and Vishny (1992) and the PCM measure of Wermers (1994) constitute the first category, which requires detailed information about investors’ trading activities and changes in their portfolios. The second category considers the phenomenon of herding behavior as the collective trading behavior of individuals in order to track the market and uses cross-sectional price movements for measurement. Christie and Huang (1995) (CSSD), Chang, Cheng, and Khorana (2000) (CSAD) and Hwang and Salmon (2001, 2004) are the contributors to this category of measurement (Hachicha et al., 2007). The LSV measurement method defines herd behavior as the imitation of simultaneous buying or selling by a group of fund managers. It uses subsets to measure specific characteristics or behaviors (Lakonishok et al., 1992) and therefore requires specialized information (Hwang and Salmon, 2004). The CH herd behavior measurement method proposed by Christie and Huang (1995) examines whether individual returns concentrate around the market in periods of market complexity and stress. This measurement method was later expanded by Chang, Cheng, and Khorana (2000). Using a nonlinear regression specification, they measured the relationship between the level of stock return distribution and the overall market return using the cross-sectional absolute deviation of returns (CSAD). They argue that the tendency of market investors to conform to the general market sentiment during periods of high price movements is sufficient to transform a linear relationship into a nonlinear one. Additionally, the importance of macroeconomic information for emerging markets is emphasized (Chang et al., 2000). Hwang and Salmon (2001) developed a method to measure herd behavior by considering linear factor models and observed conditions in fundamental movements. Similar to the CH method in terms of utilizing information present in the horizontal cross-section movements of the market, it differs in focusing on horizontal cross-sectional changes in factor sensitivities instead of using return values themselves. It utilizes the cross-sectional standard deviation of loadings in the linear factor model of individual assets and is calculated with the help of individual betas. The method automatically takes into account the effects of changes in the time series volatility included in the cross-sectional variance. It is also argued that herd behavior is a matter of degree, inseparable from any market taken into consideration, and therefore, rather than the presence or absence of herd behavior, it is advocated to use expressions like less herd behavior or more herd behavior. Furthermore, this method allows for a distinction between intentional and false herd behavior and focuses on intentional herd behavior (Caparelli et al., 2004). Investors can be driven towards the same point by informative content about the market, economic expectations, and investor sensitivities. This indicates that investors can also act based on their economic rationales. For example, traditional/nontraditional monetary policies can be given (Krokida et al., 2020). When individuals aim to maximize returns and avoid risks in their investments (Kuzu and Çelik, 2020), it is possible for them to follow preceding signals. In this case, even though an investor may perceive it as more rational to exhibit different behavior based on their unique information, the probability of conforming to the behavior of the majority with the support of previous signals is high (Banerjee, 1992). The foregoing discussion demonstrates the importance of identifying herd behavior in understanding investor behavior. Therefore, explaining the determinants of herd behavior as well as identifying herd behavior may help to clarify market dynamics.

The issue of herd behavior is among the topics that have been widely covered in the literature. It is possible to classify these studies according to their measurement methods. Although LSV, PCM, CH, CCK, Hwang and Salmon (2004) (hereafter HS-2004) measurement methods are encountered (Setyawan and Ramli, 2016; Pochea et al., 2017; Medhioub and Chaffai, 2019; Qasim et al., 2019; Choi and Yoon, 2020; Ferrouhi, 2021; Li et al., 2023; Hong et al., 2024), this study is limited within the scope of the method to be used here and the studies using the HS-2004 measurement method that are included in the literature. The studies using the HS-2004 herd behavior measurement method (relying on stock beta coefficients) started with the study conducted by Hwang and Salmon in 2001 resulting that more herd behavior is observed in developing countries (South Korea) than in developed countries (USA, UK). In the next study in 2004, Hwang and Salmon stated that they found herding behavior when the market rises or falls, and that they found significant movements and persistence, independent of market conditions.

Caparelli et al. (2004) found the existence of herding behavior in capital markets of Italy. Kallinterakis (2006) tests herding behavior in stock markets of 8 countries. Results on the impact of specific regulatory restrictions on market-wide herding behavior are presented.

Kallinterakis et al. (2007) detected herding behavior in MERVAL index during and after the Argentine financial crisis. Wang (2008) observed higher level of herding behavior in developing countries then developed countries. Demirer et al. (2010), another study on emerging economies, observed herding behavior. Amirat and Bouri (2009) and Hachicha et al. (2010) investigated herding behavior in Toronto stock market and in both studies herding behavior is observed.

Altay (2008) examined herding behavior in the Istanbul Stock Exchange (ISE). As a result of the study, although herd behavior was not observed in some periods, it was stated that the general tendency was in favor of herd behavior. Another study on ISE by Medetoğlu and Saldanlı (2019) found herding behavior features. Doğukanlı and Ergün (2015) investigated herding behavior on BIST by examining 15 different sectors. While they observed herding behavior in some periods, it was also stated that more significant observations were made at short frequencies. Akçaalan et al. (2019) argued that herding behavior increases as the trading volume of international investors increases and in reaction to increased volatility.

Some studies investigated the herding behavior in markets other than equity markets. De Gama Silva et al. (2019) revealed negative herd behavior during extreme periods in cryptocurrency market. Júnior et al. (2020) examined fifteen commodity markets and observed herding behavior.

In the literature, there are also studies that HS-2004 model did not find herd behavior in the market. For example; Abd-Alla (2020) did not find herd behavior in the Egyptian Stock Exchange after the COVID-19 pandemic. There are also studies conducted under financial psychology, where investors’ emotions should be taken into account. Filip and Pochea (2023) applied Hwang and Salmon’s (2004) approach by controlling for changes in investor sentiment, and suggested that herding is a permanent feature in the US and European stock markets.

When the accessible literature is reviewed it is observed that herding behavior was measured in different countries and markets. However, studies on investigating its determinants are insufficient. This study differs from other studies in the literature in that it focuses on the relating herding behavior to financial variables identifying its determinants. Analizing the variables (Return, CDS, Volatility, USD/TR, Liquidity, Vix) for identifying the determinants of herding behavior is expected to contribute to the literature.

In order to measure herd behavior, the linear factor model developed by Hwang and Salmon (2004) was used in the study. The process steps (1)–(10) of the Hwang and Salmon (2004) model are as follows.

In light of this information, firstly, logarithmic return is calculated using equation (1):

(1)

(1)

In equation (1),

ri,t: return of stock in time t,

Pt: the closing price of the relevant stock in period “t”,

Pt–1: the closing price of the relevant stock in period “t”-1.

Following the calculation of returns, excess returns are calculated using the “Two-Year Bond Yields” (derived from the Turkish two-year bond yield (TR2YT)). The calculation of HS-2004 for herd behavior is shown in equation (2):

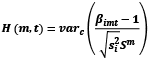

(2)

(2)

In equation (2),

H (m,t): hidden herding parameter,

βimt: the beta coefficient of stock “i” at time “t”,

si2 : the variance of the stock beta,

Sm: the variance of the market beta.

H(m,t) (the hidden herding parameter) is used to measure herding behavior. While calculating the beta values of stocks, estimation (3) from the Capital Asset Pricing Model is used (Doğukanlı and Ergün, 2015: 12).

(3)

(3)

ri,t – rf : the excess return in each period “t” of the stock in the period set as the benchmark,

rm,t – rf : the excess market return in each period “t” over the benchmark period.

However, Caparelli et al. (2004) offer a different perspective on the calculation of the beta value in the mentioned measure. As Doğukanlı and Ergün (2015) reported, Caparelli et al. (2004) stated that in order to reach the H(m,t) value, the t-test statistical values of the beta coefficients should be calculated through the specified regression and these values give the H(m,t) value of the horizontal cross-section variance.

In order to reach the t-test values, the regression model presentend in equation (4) was used:

(4)

(4)

Yi: (ri,t – rf ) is the risk premium of the stock and is the dependent variable,

Xi: (rm,t – rf ) independent variable values by expressing the market risk premium,

β1: constant of the regression,

β2: coefficient of regressors,

ui: the error term.

In order to reach the specified regression equation, the following steps should be taken. The methods of obtaining the values of  , se(

, se( ) and t are shown in equations (5) to (10). (In the equations mentioned, “n” denotes the number of stocks).

) and t are shown in equations (5) to (10). (In the equations mentioned, “n” denotes the number of stocks).

Step 1

: Estimated coefficient of the independent variable.

: Estimated coefficient of the independent variable.  (5)

(5)

Step 2

: Estimated constant term.

: Estimated constant term.  (6)

(6)

Step 3

: Estimated error term.

: Estimated error term.  (7)

(7)

Step 4

: Standard deviation of error terms.

: Standard deviation of error terms.  (8)

(8)

Step 5.

se( ) Standard error.

) Standard error.  (9)

(9)

Step 6

t: t-test value.  (10)

(10)

In this study, first the periods in which herding behavior emerges are identified with the approach of HS-2004 and then the determinants of herding behavior are investigated using the logistic regression method. The variables thought to be likely to trigger herd behavior are equity returns, USD/TL exchange rate, risk-free interest rate, volatility of equity returns, VIX fear index and Turkey 5-year CDS premiums.

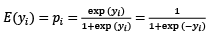

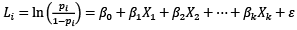

Logistic regression analysis is used when the dependent variable is a binary variable (0-1). Following Gujarati (1999, as cited in Budak and Erpolat, 2012), the methodology of logistic regression analysis is explained in equations (11) - (13):

Linear regression model for k independent variables is shown in equation (11).

(11)

(11)

Equation (12) expresses the curvilinear relationship established between the regressors and the response variable. This calculation assures the response variable to take values between 0 and 1

(12)

(12)

Equation (12) must be linearized to obtain a logit model as in equation (13):

(13)

(13)

By solving the model, it is possible to estimate parameters.

In the study, herd behavior is investigated for the period 17/10/2017–10/11/2023. In order to apply the Hwan–Salmon method, the data set was started from 03/01/2017 and daily data were used. Nontransaction days were excluded from the analysis. The datasets included in the study were bank stocks listed in BIST Liquid Bank Index (BIST_Bank; as of November 2023). Stock Returns, Dollar/TL Exchange Rate, Risk Free Interest Rate, Volatility of Stock Returns, VIX fear index and CDS premiums were determined as variables included in the study to explain the dependent variable. Investors in the index are considered within the scope of the study. The Borsa Istanbul (BIST) Bank Index typically encompasses stocks of entities engaged in the banking sector. These entities often consist of banks and financial institutions. Consequently, the entities indexed under the BIST Bank Index are typically favored and monitored by institutional investors. While individual investors can also trade in the entities encompassed in this index, institutional investors usually allocate larger sums and possess the potential to sway the index. The adjusted stock prices of banks were obtained through Finnet Elektronik Yayıncılık Data İletişim Ltd. Şti (Finnet Analysis Excel Module). The stock listed in the BIST_Bank are shown below.

|

Bileşen Kodu |

Bileşen Adı |

|

|

* |

XLBNK |

BIST LIKIT BANKA |

|

1 |

AKBNK.E |

AKBANK |

|

2 |

YKBNK.E |

YAPI VE KREDİ BANK. |

|

3 |

ISCTR.E |

IS BANKASI (C) |

|

4 |

GARAN.E |

GARANTI BANKASI |

|

5 |

VAKBN.E |

VAKIFLAR BANKASI |

|

6 |

HALKB.E |

T. HALK BANKASI |

|

7 |

TSKB.E |

T.S.K.B. |

|

8 |

SKBNK.E |

SEKERBANK |

|

9 |

ALBRK.E |

ALBARAKA TURK |

After applying the herding behavior measurement method of Hwang and Salmon (2004) to the BIST Liquid Bank Index, the variables determined to interpret the periodic results and to increase the level of explainability are presented in Table 2.

|

Variable |

Description |

Measurement method |

Source |

|

Stock returns |

It refers to the earnings that a stock provides to its investors. Equity return is generally obtained through the increase in the value of the stock purchased by the investor and dividend payments. |

Calculated as daily percentage returns of daily stock values. |

Obtained from Finnet Elektronik Yayıncılık Data İletişim Ltd. Şti. |

|

Index returns |

It provides an idea about the general trend in the equity market. |

Daily percentage change in BIST-100 index value |

Obtained from Finnet Elektronik Yayıncılık Data İletişim Ltd. Şti. |

|

USD/TRY rate |

US dollar–Turkish lira exchange rate. In short, it shows how many Turkish Liras an American dollar is worth. |

The data obtained by the source were organized daily and included in the study. |

Obtained form Finnet Elektronik Yayıncılık Data İletişim Ltd. Şti. |

|

Risk-free interest rate |

It refers to the minimum level of return that investors can obtain without risk. It is generally calculated by interest rates on government bonds and some financial instruments. |

In Türkiye, a 2-year bond yield is taken. In the study, the TR2YT variable is formed by dividing the annual bond yield by 36500. |

Obtained from investing.com.

|

|

Volatility of stock returns |

It expresses how much the stock values fluctuate within a certain range. It shows how much stock values fluctuate. It is usually measured in statistical terms such as standard deviation or variance. |

Conditional variance values obtained from the GARCH 1.1 model are used. |

Calculated from authors using data obtained by Finnet Elektronik Yayıncılık Data İletişim Ltd. Şti. |

|

VIX fear index |

It is an index used to measure volatility in financial markets. Its full name is „Chicago Board Options Exchange Volatility Index.“ |

The data obtained by the source were organized daily and included in the study. |

Obtained from investing.com.

|

|

CDS spreads |

„Credit Default Swap“ is a derivative instrument that protects against the risk of nonrepayment of a country‘s or company‘s debt. |

The data obtained by the source were organized daily and included in the study. Türkiye has been used daily for 5 years. |

Obtained from investing.com.

|

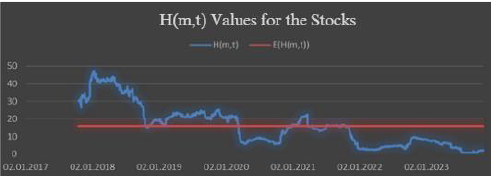

In this part of the study, the composite model developed in HS-2004 and contributed by Caparelli et al. (2004) is applied to the stocks in the BIST_Bank. In the study, data are used on a daily basis. The t statistics of the β (beta) coefficients of the stocks are determined through daily adjusted closing prices. Afterwards, the H(m,t) value was obtained by calculating the horizontal cross-section variances of the specified t statistics. This H(m,t) value is shown below with the help of a graph (Figure 2). The average value of H(m,t) can also be seen in Figure 2. in order to help to decide whether herd behavior exists. In the Hwang and Salmon measurement method, in order to decide whether there is herd behavior, E(H(m,t)) should be estimated by averaging the values of H(m,t). E(H(m,t)) is presented on the graph in Figure 2. In the method, if

H(m,t) < E(H(m,t)), herd behavior exists and if

H(m,t) > EH(m,t)), herd behavior doesn’t exist.

H(m,t) values generated by following the above calculation methods can be seen in Figure 1. The graph shows that some H(m,t) values are below the average (E(H(m,t)) periodically. As mentioned, the periods that are below the average are expressed as the part where the presence of the herd is visible in the HS-2004 method of measuring the herd behavior. In this context, the periods exhibiting herd behavior are presented in Table 3.

Herd behavior was detected in the date ranges specified in Table 3. When we look at the years 2018, 2020, 2021 and 2023, we see many political, geographical and economic events that may cause herd behavior. For example, in October 2018, a political crisis occured between Turkiye and the USA caused by pastor Brunson. In March 2020, the COVID-19 pandemic was declared by the World Health Organization. The war between Russia and Ukraine has raised concerns about a worlwide energy crisis. The inflationary environment that followed pandemic and the vulnerabilities caused by the rapid increase in the exchange rate have strengthened the perception of risk and uncertainty in the economy. The aforementioned uncertainty environment may have caused volatility in financial markets and investors may have been affected by such situations. Another striking feature of this period is that the banks that constitute the scope of the study announced the highest profits in history in 2020.

|

2018 |

* 25.10.2018 – 01.11.2018 * 06.11.2018 – 09.11.2018 * 16.11.2018 |

|

2020 |

*10.03.2020 – 28.12.2020 |

|

2021 |

* 24.03.2021 – 31.03.2021 * 02.04.2021 * 07.04.2021 – 09.04.2021 * 15.04.2021 – 16.04.2021 * 20.04.2021 – 05.07.2021 * 30.07.2021 – 02.07.2021 * 09.09.2021 – 23.09.2021 * 18.10.2021 – 25.10.2021 |

|

2021 – 2023 |

*27.10.2021 – 10.11.2023 |

For the determining the factors affecting herd behavior in bank stocks listed in BIST, both the logistic regression analysis and the Kruskal–Wallis test are applied. The results of the logistic regression analysis are presented in Table 4. Accordingly, R_USDTRY variable is found to be significant on herding behavior at 10% level, while all other variables are significant at 1% level. Among the significant variables, the coefficients of RETURN, LN_CDS and LN_VIX variables are positive, while the coefficients of R_USDTRY and TR2Y variables are negative. Therefore, it is understood that herding behavior is more likely during periods of high returns and volatility, when country risk and international risks are high. It is concluded that the probability of herding behavior decreases in periods when the dollar exchange rate and interest rates increase.

|

Dependent variable: Herd Behavior (dummy) |

|||||||

|

Variables |

Coefficient |

Std. Error |

Z statistic |

Prob. |

|||

|

RETURN |

15.9476 |

5.6079 |

2.8438 |

0.0045 |

|||

|

LN_CDS |

12.5715 |

0.8545 |

14.7113 |

0.0000 |

|||

|

LN_VIX |

2.5912 |

0.4034 |

6.4236 |

0.0000 |

|||

|

R_USDTRY |

-12.8698 |

6.7858 |

-1.8966 |

0.0579 |

|||

|

TR2Y |

-0.0671 |

0.0201 |

-3.3427 |

0.0008 |

|||

|

GARCH11 |

2508.75 |

751.6437 |

3.3377 |

0.0008 |

|||

|

C |

-83.4410 |

5.2793 |

-15.8054 |

0.0000 |

|||

|

McFadden R2: 0.6025 |

LR statistic: 1164.312 |

Prob.(LR): 0.0000 |

|||||

|

Hosmer–Lemeshow (HL) goodness of fit stat.: 9.169 |

Prob. (HL): 0.3282 |

||||||

As a result of the analysis, R2 value is 60%, LR statistic is significant and calculated as 1164.312. The probability value of the Hosmer–Lemeshow goodness of fit statistic is above 0.05 with 0.3282. The fact that the test result is not significant suggests that the model is a good fit to the data. If we want to explain the variables and herding behavior by examining Table 4; High return triggers herding behavior. The triggering of herding behavior with increasing returns may be due to the fact that when investors see the return potential, they start to move in the same direction in order not to miss this potential. In this case, it may be possible that as the return increases, similar behavior among investors may be observed and the herd effect may emerge.

The rise in the CDS value also appears as a factor that triggers herd behavior indicating that uncertainty and anxiety in the markets affect investors’ decisions. Investors generally seek more assurance during periods of heightened risk and financial instability, which may lead to a stronger herding effect. Table 4 shows a positive relationship between VIX and herding. The VIX index is an indicator that measures the level of volatility in the markets and generally reflects investors’ levels of fear and uncertainty. An increase in the VIX value can often indicate increased uncertainty in the markets and investors’ perception of risk. Under uncertainty and risk, investors may be more susceptible to environmental sensitivity and therefore may integrate herding behavior where they perceive it to be safe. Both CDS and VIX variables provide indicators of uncertainty in markets. The former provides information on domestic markets, while the latter reflects international risk perception. According to the results obtained, it is possible to interpret that the perception of risk and uncertainty triggers herd behavior.

It is observed that the decline in the value of USD/TL exchange rate triggers herd behavior. From the investors’ point of view, when the value of USD/TRY decreases; investors may experience fear of loss by worrying that the exchange rates will fall further, and as a precaution against this, they may seek alternative investment instruments. At this point, investors can be expected to turn to the stock market by engaging in herd behavior in choosing an alternative. In addition, psychological and social effects may trigger herd behavior due to concepts such as information asymmetry.

Similarly, a decrease in the value of the variable TR2YT (Republic of Turkey 2-Year Bond Yield also triggers herding behavior. This can be explained by the social and psychological impact (other investor behavior, news about the decline in interest rates and private information) caused by investors’ belief that future interest rates will decrease. Finally, volatility of equity returns (GARCH 1.1) has a positive and significant coefficient. The volatility variable is an indicator that points to the perception of uncertainty, as for the CDS and VIX variables. In times of uncertainty, investors are expected to be hesitant to act on their own and to act collectively with those they believe to be more knowledgeable and experienced than themselves.

After identifying the determinants of herd behavior, it is investigated whether the relevant variables take different values in periods when herd behavior is observed and when it is not observed. In order to decide on the type of test to be applied, it was investigated whether the variables fit the normal distribution. Results are presented in Table 5.

|

Shapiro–Wilk W test |

|||||

|

Variables |

Observation |

W |

V |

z |

Prob>z |

|

RETURN |

1427 |

0.9388 |

53.343 |

9.988 |

0.0000 |

|

LN_CDS |

1427 |

0.9838 |

14.1210 |

6.6500 |

0.0000 |

|

LN_VIX |

1399 |

0.9787 |

18.2460 |

7.2880 |

0.0000 |

|

R_USDTRY |

1427 |

0.5619 |

382.072 |

14.933 |

0.0000 |

|

TR2Y |

1427 |

0.9532 |

40.8440 |

9.3180 |

0.0000 |

|

GARCH11 |

1427 |

0.6366 |

316.901 |

14.464 |

0.0000 |

Examining the results obtained from the Shapiro–Wilk test, it is seen that the probability values are less than 0.05 which means variables do not exhibit normal distribution. The Kruskal–Wallis test was preferred to evaluate whether there is a difference between groups in time series that do not fit the normal distribution.

|

RETURN |

R_USDTRY |

TR2Y |

LN_CDS |

LN_VIX |

GARCH |

|

|

Statistics |

14.892 |

13.423 |

2.333 |

827.059 |

412.341 |

227.00 |

|

p-value |

0.0001 |

0.0002 |

0.1267 |

0.0001 |

0.0001 |

0.0001 |

|

Average (1) |

0.010658 |

0.001845 |

16.54951 |

6.284386 |

3.114956 |

0.000404 |

|

Average (0) |

-0.00042 |

0.000984 |

16.48373 |

5.890667 |

2.757201 |

0.000317 |

When the Kruskal–Wallis test results are analyzed, it is seen that all variables except the TR2Y variable are significant. Significant findings indicate that there are differences in the averages of the relevant variable between the periods when herding behavior is observed and the periods when it is not observed. The direction of the difference can be determined by looking at the averages. Accordingly, index and foreign exchange returns, volatility, CDS premiums and the VIX fear index are higher in periods when herding behavior is observed (Average (1)).

This study attempts to identify herding behavior in financial markets by using the bank stocks listed in BIST_Bank. As a measurement method, the composite model developed in HS-2004 and contributed by Caparelli et al. (2004) is used. Following the identification of herd behavior, its determinants were investigated. The variables analyzed for their possible influence on herd behavior are equity returns, USD/TL exchange rate, risk-free interest rate, volatility of equity returns, VIX fear index and Turkey 5-year CDS premiums. As a result of the research covering the period 17/10/2017–10/11/2023, it was found that the banks listed in BIST_Bank are subject to herding behavior at certain intervals of the restricted period. It supports many studies in the literature (Kallinterakis et al. (2007); Amirat and Bouri (2009); Hachicha et al. (2010); Altay (2008); Medetoğlu and Saldanlı (2019); Doğukanlı and Ergün (2015)) using the method of HS-2004.

It is possible to make different interpretations by evaluating the periods when herd behavior is observed. The unprecedented COVID-19 pandemic can be interpreted with situations such as expectations of an increase in inflation, an increase in situations where social media comments are effective, and interest rate policies. The financial interpretation part trying to explain indicators and determinants is the most important point that distinguishes this study from the literature. According to the regression analysis conducted with the identified variables, CDS, VIX and GARCH 1.1 (Volatility of Equity Returns) variables are found to trigger herding behavior. This situation can be interpreted as investors tend to herd behavior with the increase in the perceived risk level in the markets. Göçmen Yağcılar (2021), Kumar et al. (2021), Akçaalan et al. (2020), Adem and Eren Sarıoğlu (2020), Balcılar and Demirer (2015) and Tan et al. (2008) are among the authors who have found that herding behavior is associated with periods of high volatility. Indars et al. (2019) find that herding behavior is associated with crisis periods in the Moscow stock market. Akçaalan et al. (2020) find that herding behavior increases during politically tense periods.

Another finding of the study is that herding behavior is associated with periods of high returns. Bouri et al. (2019), Yarovaya et al. (2021) found that herding behavior increases during periods of high returns. Çakan and Balagyozyan (2014), in their research on banking stocks, found that herding behavior accompanies rising markets.

It is also observed that herding behavior is triggered as the values of USD/TL and TR2YT fall. To the best of our knowledge, this is the only study linking herding behavior with exchange rates and interest rates. Therefore, the findings are expected to contribute to the literature. This paper aims to combine both obtaining values that can be interpreted with financial literacy information and increasing the level of explainability with the determined variables in explaining herd behavior and thus tries to fill the gap in the literature. It is thought that it will shed light on explaining herding behavior in financial markets through financial variables in future studies and will provide information about the variables to researchers who will study the subject later.

Abd-Alla, M. H. (2020). Sentimental herding: The role of COVID-19 crisis in the Egyptian stock market. Copernican Journal of Finance & Accounting, 9(3), 9-23.

Adem, A. M. & Eren Sarıoğlu, S. (2020). Analysis of investor herding behavior: An empirical study from İstanbul Stock Exchange. European Journal of Business and Management Research, 5(2), 1-11. http://dx.doi.org/10.24018/ejbmr.2020.5.2.250

Akçaalan, E., Dindaroğlu, B. & Binatlı, A. O. (2020). International investors, volatility, and her behavior: Borsa İstanbul, 2001-2016. International Journal of Economics and Innovation, 6(2), 247-259.

Akçaalan, E., Dindaroğlu, B., & Binatlı, A. O. (2019). International Investors, Volatility, and Herd Behavior. Uluslararası Ekonomi ve Yenilik Dergisi, 6(2), 247-259.

Altay, E. (2008). Sermaye piyasasında sürü davranışı: İMKB’de piyasa yönünde sürü davranışının analizi. BDDK Bankacılık ve Finansal Piyasalar Dergisi, 2(1), 27-58.

Amirat, A., & Bouri, A. (2009). A New Measure of Herding Behavior: Derivation and Implications. International Journal of Psychological and Behavioral Sciences, 3(6), 1287-1301.

Baddeley, M. (2013). Herding, social influence and expert opinion. Journal of Economic Methodology, 20(1), 35-44. https://doi.org/10.1080/1350178X.2013.774845

Balcilar, M. & Demirer, R. (2015). Effect of Global Shocks and Volatility on Herd Behavior in an Emerging Market. Emerging Markets Finance & Trade, January–February 2015, Vol. 51, No. 1, Symposium: Productivity, Trade, and Development in Latin America (January–February 2015), pp. 140-159

Banerjee, A. V. (1992). A Simple Model Of Herd Behavior. The Quarterly Journal Of Economics, 107(3), 797-817. https://doi.org/10.2307/2118364

Başarır, Y. (2021). Yatırım kararlarının alınmasında sürü davranışı: literatür taraması. Ekonomi ve Finansal Araştırmalar Dergisi, 3(2), 129-141.

Berger, S., Feldhaus, C., & Ockenfels, A. (2018). A Shared İdentity Promotes Herding İn An İnformation Cascade Game. Journal Of The Economic Science Association, 4, 63-72. https://doi.org/10.1007/s40881-018-0050-9

Bikhchandani, S., & Sharma, S. (2000). Herd behavior in financial markets. IMF Staff papers, 47(3), 279-310.

Bouri, E., Gupta, R. & Roubaud, D. (2019). Herding behavior in cryptocurrencies. Finance Research Letters, 29, 216-221. https://doi.org/10.1016/j.frl.2018.07.008

Budak, H. & Erpolat, S. (2012). Kredi riski tahmininde yapay sinir ağları ve logistic regresyon analizi karşılaştırması. Online Academic Journal of Information Technolgy, 3(9), 22-30.

Caparrelli, F., D’Arcangelis, A. M., & Cassuto, A. (2004). Herding in the Italian stock market: a case of behavioral finance. The Journal of Behavioral Finance, 5(4), 222-230.

Chang, E. C., Cheng, J. W., & Khorana, A. (2000). An examination of herd behavior in equity markets: An international perspective. Journal of Banking & Finance, 24(10), 1651-1679.

Choi, K. H., & Yoon, S. M. (2020). Investor sentiment and herding behavior in the Korean stock market. International Journal of Financial Studies, 8(2), 34. https://doi.org/10.3390/ijfs8020034

Christie, W. G., & Huang, R. D. (1995). Following the pied piper: do individual returns herd around the market?. Financial Analysts Journal, 51(4), 31-37.

Çakan, E. & Balagyozyan, A. (2014). Herd behavior in the Turkish banking sector. Applied Economics Letters, 21(2), 75-79.

Da Gama Silva, P. V. J., Klotzle, M. C., Pinto, A. C. F., & Gomes, L. L. (2019). Herding behavior and contagion in the cryptocurrency market. Journal of Behavioral and Experimental Finance, 22, 41-50.

Demirer, R., & Kutan, A. M. (2006). Does herding behavior exist in Chinese stock markets?. Journal of International Financial markets, institutions and money, 16(2), 123-142.

Demirer, R., Kutan, A. M., & Chen, C. D. (2010). Do investors herd in emerging stock markets?: Evidence from the Taiwanese market. Journal of Economic Behavior & Organization, 76(2), 283-295.

Doğukanlı, H., & Ergün, B. (2015). BIST’te sürü davranışı: Hwang ve Salmon Yöntemi ile bir araştırma. Finans Politik ve Ekonomik Yorumlar, (603), 7-24.

Ferrouhi, E. M. (2021). Herding behavior in the Moroccan stock exchange. Journal of African Business, 22(3), 309-319. https://doi.org/10.1080/15228916.2020.1752598

Filip, A. M., & Pochea, M. M. (2023). Intentional and spurious herding behavior: A sentiment driven analysis. Journal of Behavioral and Experimental Finance, 38, 100810.

Göçmen Yağcılar, G. (2021). Borsa İstanbul’da Piyasa Yönünde Sürü Davranışının Araştırılması: Banka Hisseleri için CSSD ve CSAD Modellerinin Analizi. In book: İktisadi ve İdari Bilimlerde Araştırma ve Değerlendirmeler – I, Gece Kitaplığı, Aralık 2021.

Gujarati, D.N. (1999). Temel Ekonometri, (Şenesen, Ü. & Şenesen, G.G., Çev.), İstanbul: Literatür Yayıncılık; as cited in Budak, H. & Erpolat, S. (2012). Kredi riski tahmininde yapay sinir ağları ve logistic regresyon analizi karşılaştırması. Online Academic Journal of Information Technology, 3(9), 22-30.

Hachicha, N. (2010). New sight of herding behavioural through trading volume. Economics E-journal, Discussion Paper Nr. 2010-11.

Hachicha, N., Bouri, A., & Chakroun, H. (2007). The herding behaviour and the measurement problems: Proposition of dynamic measure. Journal of Business and Policy Research, 3(2), 44-63.

Hirshleifer, D. (2001). Investor psychology and asset pricing. The Journal of Finance, 56(4), 1533-1597.

Hong, H., Jiang, L., Zhang, C., & Yue, Z. (2024). Do conventional and new energy stock markets herd differently? Evidence from China. Research in International Business and Finance, 67, 102120. https://doi.org/10.1016/j.ribaf.2023.102120

Hwang, S., & Salmon, M. (2004). Market stress and herding. Journal of Empirical Finance, 11(4), 585-616.

Hwang, S., & Salmon, M. H. (2001). A New Measure of Herding and Empirical Evidence. Financial Econometrics Research Centre, 01(12), 1-23

Indars, E. R., Savin, A. & Lubloy, A. (2019). Herding behaviour in an emerging market: Evidence from the Moskow Exchange. Emerging Markets Review, 38, 468-487. https://doi.org/10.1016/j.ememar.2018.12.002

Investing. (2023). CDS Data. Access Address: https://tr.investing.com/rates-bonds/turkey-cds-10-years-usd-historical-data (12.11.2023).

Investing. (2023). TR2YT Data. Access Address: https://tr.investing.com/rates-bonds/turkey-2-year-bond-yield-historical-data (12.11.2023).

Investing. (2023). VIX . Access Address: https://tr.investing.com/indices/volatility-s-p-500-historical-data (12.11.2023).

Júnior, G. D. S. R., Palazzi, R. B., Klotzle, M. C., & Pinto, A. C. F. (2020). Analyzing herding behavior in commodities markets–an empirical approach. Finance Research Letters, 35, 101285.

Kahneman, D. (1979). Prospect theory: An analysis of decisions under risk. Econometrica, 47, 278. https://doi.org/10.2307/1914185

Kallinterakis, V. (2006). Herding and feedback trading: an empirical investigation (Doctoral dissertation, Durham University).

Kallinterakis, V., Gavriilidis, K., & Micciullo, P. (2007). The Argentine Crisis: A Case for Herd Behaviour?. Available at SSRN 980685.

Karan M.B. (2022). Yatırım Analizi ve Portföy Yönetimi, Gazi Kitapevi, Ankara 8th Edition

Karan, M. B (2013). Yatırım analizi ve portföy yönetimi, Gazi Kitapevi, Ankara 4th Edition

Krokida, S. I., Makrychoriti, P., & Spyrou, S. (2020). Monetary policy and herd behavior: International evidence. Journal of Economic Behavior & Organization, 170, 386-417. https://doi.org/10.1016/j.jebo.2019.12.018

Kumar, A., Badhani, K. N., Bouri, E. & Saeed, T. (2021). Herding behavior in the commodity markets of the Asia-Pacific region. Finance Research Letters, 41, 101813. https://doi.org/10.1016/j.frl.2020.101813

Kuzu, S., & Çelik, İ. E. (2020). Borsa İstanbul’da Sürü Davranışı Varlığının Test Edilmesi: Borsa İstanbul Üzerine Bir Uygulama. Mehmet Akif Ersoy Üniversitesi Uygulamalı Bilimler Dergisi, 4(2), 363-375. https://doi.org/10.31200/makuubd.783034

Lakonishok, J., Shleifer, A., & Vishny, R. W. (1992). The impact of institutional trading on stock prices. Journal of financial economics, 32(1), 23-43.

Li, T., Chen, H., Liu, W., Yu, G., & Yu, Y. (2023). Understanding the role of social media sentiment in identifying irrational herding behavior in the stock market. International Review of Economics & Finance, 87, 163-179. https://doi.org/10.1016/j.iref.2023.04.016

Lovo, S., & Decamps, J.P. (2002). Risk aversion and herd behavior in financial markets (No. 758). HEC Paris.

Medetoğlu, B., & Saldanlı, A. (2019). Sürü davranışının hisse senedi fiyat hareketliliğine etkisi: BİST 100 örneği. İşletme Araştırmaları Dergisi, 11(2), 1191-1204.

Medhioub, I., & Chaffai, M. (2019). Islamic finance and herding behavior theory: a sectoral analysis for Gulf Islamic stock market. International Journal of Financial Studies, 7(4), 65. https://doi.org/10.3390/ijfs7040065

Nofsinger, J. R. (2017). The psychology of investing. Routledge. New York, Routledge

Publishing. https://doi.org/10.4324/9781315230856

Pochea, M. M., Filip, A. M., & Pece, A. M. (2017). Herding behavior in CEE stock markets under asymmetric conditions: a quantile regression analysis. Journal of Behavioral Finance, 18(4), 400-416. https://doi.org/10.1080/15427560.2017.1344677

Qasim, M., Hussain, R., Mehboob, I., & Arshad, M. (2019). Impact of herding behavior and overconfidence bias on investors’ decision-making in Pakistan. Accounting, 5(2), 81-90. DOI: 10.5267/j.ac.2018.7.001

Raafat, R. M., Chater, N., & Frith, C. (2009). Herding in humans. Trends in cognitive sciences, 13(10), 420-428.

Setyawan, I. R., & Ramli, I. (2016). Herding behavior in the Indonesian stock exchange: The roles and contributions of foreign investors during the period 2006 to 2011. Jurnal Pengurusan, 46, 125-135. http://dx.doi.org/10.2139/ssrn.2313036

Spyrou, S. (2013). Herding in financial markets: a review of the literature. Review of Behavioral Finance, 5(2), 175-194.

Tan, L., Chiang, T. C., Mason, J. R. & Nelling, E. (2008). Herding behavior in Chinese stock markets: An examination of A and B shares. Pacific-Basin Finance Journal, 16, 61-77. doi:10.1016/j.pacfin.2007.04.004

Wang, D. (2008). Herd behavior towards the market index: Evidence from 21 financial markets. IESE Business School-University of Navarra, 776, 1-39

Wermers, R. (1994). Herding, trade reversals, and cascading by institutional investors. Available at SSRN 5644.

Yarovaya, L., Matkovskyy, R. & Jalan, A. (2021). The effect of a “black swan” event (COVID-19) on herding behavior in cryptocurrency markets. Journal of International Financial Markets, Institutions & Money, https://doi.org/10.1016/j.intfin.2021.101321