Ekonomika ISSN 1392-1258 eISSN 2424-6166

2024, vol. 103(3), pp. 91–105 DOI: https://doi.org/10.15388/Ekon.2024.103.3.6

Mai Yasser

October University of modern sciences and arts, Egypt

Email: myasser@msa.edu.eg

ORCID: https://orcid.org/0000-0002-2067-8113

Doaa Salman

October University of modern sciences and arts, Egypt

Email: dsalman@msa.edu.eg

ORCID: https://orcid.org/0000-0001-5050-6104

Mohamed Essam

October University of modern sciences and arts, Egypt

Email: mohamed.esssam23@msa.edu.eg

ORCID: https://orcid.org/0009-0009-7707-8555

Abstract. This study explores the relationship between oil prices and the Human Development Index (HDI) in the Gulf Cooperation Council (GCC) countries. It investigates whether oil prices remain the primary driver of economic growth and development in the region. The analysis employs a Cross-Sectional Autoregressive Distributed Lag (CS-ARDL) approach and Cointegrated Autoregressive Distributed Lag (CCEMG) methods, following unit root and stationarity tests. The findings reveal an insignificant correlation between oil prices and HDI in the overall GCC countries. However, significant relationships are observed at the individual country level. These results suggest that policymakers in the region should prioritize economic diversification and focus on sectors such as tourism in Dubai and the specific policies implemented in Saudi Arabia to foster sustainable development.

Keywords: oil prices, government expenditures, Human Development Index (HDI), Gulf Cooperation Council (GCC)

_________

Received: 12/04/2024. Revised: 15/07/2024. Accepted: 10/08/2024

Copyright © 2024 Mai Yasser, Doaa Salman, Mohamed Essam. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

The Gulf Cooperation Council (GCC) countries have long been shaped by their oil wealth. This reliance on oil revenue, a cornerstone of their economies, raises a critical question: does oil remain the key driver of progress in the region? This study delves into the relationship between oil prices and the Human Development Index (HDI) in the GCC, specifically Saudi Arabia, Kuwait, and the UAE. The global energy landscape has been a roller coaster since the 1973 oil crisis, with oil prices experiencing dramatic swings. This volatility disrupts investment plans and diverts resources away from oil production, potentially hindering industrial growth traditionally fueled by rising oil consumption (Algahtani, et al., 2015). For instance, in Saudi Arabia, oil has been the lifeblood of the economy for over half a century.

The GCC countries, particularly Saudi Arabia and Qatar, have historically been heavily reliant on oil exports to fill their government coffers and drive exports. In Saudi Arabia, oil sales accounted for a staggering 87.5% of government revenue and 71.1% of exports in 2014 [3]. Qatar tells a similar story, with oil exports exceeding 70% of government income until recently. The UAE, Oman, and Kuwait also depend heavily on oil revenue. However, the dramatic plunge in oil prices from $130 to $28 per barrel in early 2016 exposed the vulnerability of these economies to oil price fluctuations. Since the 1970s, GCC countries like Saudi Arabia, Kuwait, and the UAE have been particularly dependent on crude oil exports to finance their governments (Faheem et al., 2021).

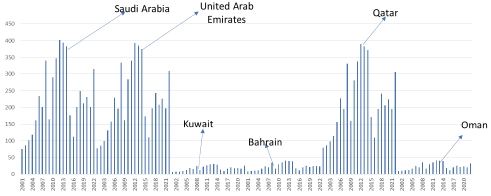

Early in the 2000s, GCC oil prices hovered around $20–$40 per barrel (refer to Figure 1). A surge in global demand, coupled with geopolitical jitters and speculation in the oil market, sent prices skyrocketing to $147 per barrel between 2006 and 2008 (refer to Figure 1). However, the 2008 financial crisis and the resulting recession triggered a slump in demand, causing oil prices to plunge back below $40 per barrel in 2009 (refer to Figure 1). Following the crisis, oil prices gradually recovered, rising from $80 to $110 per barrel by 2014 (refer to Figure 1). This trend came to an abrupt halt in late 2014, when a confluence of factors – the U.S. shale boom, geopolitical tensions, and a global economic slowdown – led to a glut of oil, driving prices down to below $30 per barrel by early 2016 as shown in Figure 1.

The Gulf nations have witnessed a fascinating interplay between oil income, government spending, and human development over the past two decades. Let’s take a closer look at some key examples. In Saudi Arabia, the Kingdom’s spending exceeded $231 billion in 2020, driven by factors such as oil revenue, efforts to diversify the economy outlined in Vision 2030, and unexpected events like the COVID-19 pandemic, see Figure 1.

The United Arab Emirates (UAE), with its less centralized financial structure, has made strategic adjustments to maintain fiscal stability, responding to fluctuations in oil prices, economic growth, and social needs. Kuwait, heavily reliant on oil, has experienced increased government spending on public salaries and foreign aid, impacting its budget balancing efforts. Bahrain, amidst rising oil prices, social unrest, and political upheaval, is working on diversifying its economy and improving its fiscal health, which significantly affects its finances. Qatar’s expenditures have risen due to preparations for the COVID-19 pandemic and the FIFA World Cup, as well as considerations for the evolving energy landscape. Oman, highly dependent on oil exports, is shaping its spending policies to enhance resilience, drive economic transformation, and prioritize public welfare, all while facing concerns about stability, pandemics, and the need for economic diversification. These contrasting national trends highlight the complex economic realities of the Gulf region and the delicate balancing act that governments must navigate for long-term prosperity. Additionally, the Gulf region’s countries often attribute significant value to the family unit as a pillar of society, recognizing its crucial role in shaping human development, as measured by indicators such as life expectancy, standard of living, and education, as reflected in the Human Development Index (HDI) (Erdoğan et al, 2020). Human Development Index is considered as one of the main important indices that most economists and policy makers use in investigating the human development. The countries in the Gulf region depend on the family as an important unit in the society that helps in shaping the human development in the region (Khan et al, 2017).

The goal of this study is to analyze the relationship between oil prices and the Human Development Index (HDI) in the GCC countries. As the GCC countries have undergone social and cultural changes, there has been a growing emphasis on decreasing government expenditures, particularly in light of recent circumstances in the Middle East. To achieve the study’s objectives, a regression analysis is conducted using the Cross-Sectional Autoregressive Distributed Lag (CS-ARDL) and Cointegrated Autoregressive Distributed Lag (CCEMG) methods. These approaches allow for an examination of the relationship between oil prices and HDI, while controlling for other relevant variables. The study also considers the impact of government expenditures on HDI and explores potential variations across individual GCC countries.

The rest of this paper is organized into 5 sections with Section 1 being the introduction. Section 2 provides a comprehensive literature review on the relationship between oil prices, government expenditures, and HDI. Section 3 describes the data sources and methodology employed in the analysis. Section 4 presents the results of the regression analysis. Finally, Section 5 discusses the findings, implications, and offers recommendations for policymakers.

This section will examine the literature reviews in three ways as the first first will tackle the literataures deal with the relationship between oil prices and governemnt expenditures. The second will deal with HDI and governemnt expenditures and the final section will deal with the relationship between oil prices, government expenditures and HDI.

Many previous studies have studied the impact unexpected oil price on government expenditure plans. The increase in oil prices affects the government expenditures but this effect was different in short run more than the long run (Abdel-Latif, et al, 2018). This effect varies according to the sector that will benefit from the changes in oil prices and the governemnt expenditures in Saudi Arabia. This was resulted depending on nonlinear autoregressive distributed lag model (NARDL). But (Hamdi & Sbia , 2013) found that the oil prices are considered the main source of governemnt expenditures in Bahrain. Therefore the oil prices have a positive relationship with governemnt expenditures in accelerating economic growth in Bahrain using vector error model (VECM) since 1960 till 2010.

A study conducted by researchers in oil-importing and oil-exporting nations analyzed the impact of oil price shocks on government spending between 1980 and 2018. The findings indicate that government capital spending responds differently to oil price shocks, benefiting exporters while adversely affecting importers. This conclusion was supported by the variance decomposition, impulse response function, and vector autoregressive model used in the analysis. Interestingly, both groups of nations, despite their divergent economic positions, exhibited an increase in government spending in response to oil price shocks (Raouf, 2021).

Another study conducted in Saudi Arabia from 1970 to 2018 examined the effects of symmetric oil price shocks on government expenditure and the real exchange rate. Utilizing the ARDL and SVAR models, the research confirmed previous predictions related to the Dutch disease phenomenon. The study revealed that symmetric oil price shocks lead to increases in government spending and a rise in the real exchange rate. However, when it comes to asymmetric oil price shocks, their impact cancels each other out, resulting in an unaffected exchange rate. More broader, (Faheem et al, 2021) studied this relatonship in three Gulf countries, that is, Saudi Arabia, United Arab Emirates and Kuwait, since 1997 till 2017 using ARDL and Granger causality model. This study ended that oil prices has a positive impact on governemnt policies in Saudi Arabia and Kuwait only, with no relationship in United Arab Emirates (UAE) due to the diversity of governemnt expenditures sources in UAE

Although the governemnt expenditures affect the human development especially in decreasing the poverty levels (Haque & Khan, 2019), the studies examining this relationship were limited in respect of using the oil prices. In Nigeria, (Edeme, et al, 2017) found that there is a positive relationship between governemnt expenditures on agriculture, health, education and rural development from one side and human development from the other side. This was consistent with (Iheoma, 2014) that examined the positive impact of government expenditures on education and human development. Thus many studies found that there is a positive relationship between HDI and government expenditures (Razmi & Mohammadi, 2012; Mirahsani, 2016; Maharda & Aulia, 2020).

The oil prices are one of the important macroeconomic tools in Gulf cooperation countries (GCC) as it was considered as the main source of financing the government budget in these countries (Zakaria, et al, 2023). This relationship was not significant in all countries as (Nikzadian, et al, 2019) found that this relationship in the sense of the abundance of oil resources since 2000 till 2015. It concluded that oil resources and prices have no effect on HDI in all countries as it is significant in GCC, Africa and Latin America compared to other countries that have high HDI with no oil or limited oil prices.

(Haque & Khan, 2019) studied this relationship in Saudi Arabia in the period between 1990 till 2016 and they concluded that there is a positive relationship between the oil prices, governemnt expenditures and HDI and negative relationship between expenditure on health sector and economic growth. Then this positive relationship was found in oil exporting countries in Africa as (Imeokparia, et al., 2023) concluded that this positive relationship can be achieved over the long run but it was not significant for the poverty alleviation. But this relationship was not significant in Ghana as (Akoto, et al , 2021) and Nigeria (Victor, et al, 2016). Therefore the oil prices’ effect on the government expenditure and HDI was examined in few literature.

|

Literature |

Sample |

Method |

Results |

|

(Akoto, et al , 2021) |

Ghana |

OLS |

No relationship |

|

(Haque & Khan, 2019) |

Saudi Arabia |

OLS |

Positive |

|

(Imeokparia, et al., 2023) |

African oil exporting countries |

ARDL |

Positive |

|

(Marza, et al, 2018) |

Iraq |

EGARCH |

Positive |

|

(Nikzadian, et al, 2019) |

Some OPEC countries |

FMOLS |

Insignificant in some countries |

|

(Norouzi & Bank, 2014) |

Iran |

Threshold regression |

Negative |

|

(Ologunde, et al, 2020) |

African oil producing countries |

PMG-ARDL |

Negative |

|

(Victor, et al, 2016) |

Nigeria |

OLS |

No relationship |

Thus the literature review regarding the relationship between the oil prices, government expenditures and Human Development Index (HDI) were so limited and especially in GCC as there is no literature to tackle this relationship. Therefore this study will examine the impact of oil prices and government expenditures on HDI in GCC countries. This will be done by testing the following hypotheses:

H1: there is a significant positive impact between the oil prices on government expenditures in GCC countries.

H2: there is a significant positive impact between the oil prices on HDI in GCC countries.

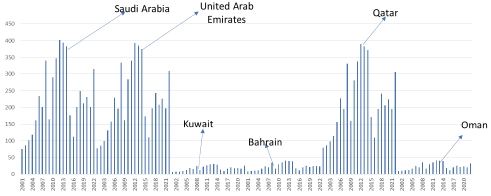

This study aims to assess the influence of oil prices and government expenditures on the Human Development Index (HDI) in six Gulf countries from 2001 to 2022. The countries under investigation are Oman, Saudi Arabia, UAE, Kuwait, Bahrain, and Qatar. Prior to conducting the analysis, the authors calculated average monthly oil prices to obtain yearly prices. The Gulf Cooperation Council (GCC) nations are primarily interested in identifying the variables that impact HDI. To address this, a graphical model is employed to outline the study’s approach. The model identifies seven independent factors that have an effect on human development, with the HDI serving as the dependent variable. Examples of the chosen independent variables include oil prices, government expenditures, consumer price inflation, unemployment rate, population growth rate, and GDP per capita. The conceptual framework depicted in Figure 2 provides further clarification of these relationships.

Therefore the adopted model used five main independent variables – oil price, government expenditures, unemployment rate, population growth rate and GDP per capita growth rate – and one dependent variable, that is, HDI. Table 2 shows the dependent and independent variables and their sources.

|

Variable |

Symbol |

Units |

source |

|

Dependent Variable: |

|||

|

Human Development Index |

HDI |

Index |

UNDP |

|

Independent Variables: |

|||

|

Oil prices |

OIL |

US $ |

Mundi Index |

|

Government Expenditures |

GOV |

000 $ |

World Bank |

|

Unemployment rates |

UMP |

% |

World Bank |

|

Population Growth |

POP |

% |

World Bank |

|

GDP per capita growth rates |

GDP |

% |

World Bank |

The above equation shows that the independent variables are linearly related to HDI. With all other factors held constant, the marginal influence of each independent variable on HDI is represented by the coefficient (β). The purpose of the model is to shed light on the relationship between HDI and oil price fluctuations, changes in government spending, unemployment, and GDP per capita growth rates for the GCC countries over a certain time frame.

HDIit = β0 + β1OILt + β2govt + β3unpt + β4GDPt + β5POPt + εt (1)

Here,

• t: represents the time index (2001 to 2022).

• 0β0: is the intercept term.

• 1β1 to 6β5: are the coefficients representing the impact of each independent variable.

• εt: is the error term capturing unobserved factors affecting oil prices.

Then logarithmic model will be used for data to decrease the multicollinearity and the variability of values between variables, that is represented by the following equation 2:

logHDIit = β0 + β1logGOVt + β2logUMPt + β3logPOPt + β4logGDPt +

β5logOILt + εt (2)

The authors of this study will employ panel analysis, also known as panel data analysis or longitudinal data analysis, to examine data collected over time from multiple cross-sectional units, such as individuals, companies, or nations. By utilizing this data format, researchers can gain additional insights by analyzing both types of variability, cross-sectional and time-series. The study will begin by testing for unit roots in the time series variables of the panel dataset. Unit root tests in panel data help identify overall nonstationary behavior or distinctive trends within individual entities (Herranz, 2017). In line with the literature review conducted, which is presented in Table 1, most studies rely on the use of ARDL regression. Consequently, the authors will explore the variables in a similar manner but will employ the cross-sectional mean group (CS-MG) and Common Correlated Estimator Mean Group (CCEMG) tests. These tests are suitable for analyzing cross-panel data as they account for the differences among countries and the heterogeneity within the region (Hill, 2018).

Before running the model to examine the impact of oil rents and government expenditures on HDI in GCC, descriptive data were compiled in Table 3. The maximum found in government expenditures was 29.32 in Saudi Arabia while it reached its minimum 6.732 in UAE. The highest mean was experienced is government expenditure compared to the lowest government expenditure in GDP per capita that is -0.1092.

|

HDI |

OIL |

GOV |

GDP |

POP |

UNP |

|

|

Mean |

0.742389 |

4.109204 |

17.58236 |

-0.109219 |

4.089738 |

2.577119 |

|

Median |

0.818500 |

4.019595 |

17.13367 |

-0.078660 |

3.156617 |

2.184500 |

|

Maximum |

0.920000 |

5.995232 |

29.32164 |

14.71064 |

19.36043 |

7.450000 |

|

Minimum |

0.262000 |

1.856298 |

6.732998 |

-17.14539 |

-2.648532 |

0.100000 |

|

No |

126 |

126 |

126 |

126 |

126 |

126 |

To ensure that the model that will used, diagnostic test should be run. These tests will include cross-sectional independence and heterogeneity after running the correlation test in Table 4. Then unit root test will be conducted to test the multicollinearity. The results of correlation in Table 4 show a strong correlation between most of variables with HDI except for GDP per capita growth rate. Therefore this correlation shows the absence of multicollinearity.

|

Correlation |

||||||

|

Probability |

HDI |

GOV |

OIL |

GDP |

POP |

UNP |

|

HDI |

1 |

|||||

|

GOV |

-0.516855*** |

1 |

||||

|

OIL |

-0.281305*** |

-0.265064*** |

1 |

|||

|

GDP |

-0.083999 |

0.017341 |

0.081256 |

1 |

||

|

POP |

0.158188* |

-0.447171*** |

0.139824 |

-0.367776*** |

1 |

|

|

UNP |

-0.808893*** |

0.469323*** |

0.157362* |

-0.030002 |

-0.230254*** |

1 |

Before conducting the unit root test and cointegration tests, the study employed a cross-sectional test within the panel data regression. To estimate the results of the cross-sectional test, the authors relied on a cross-sectional dependence test, as highlighted by Pesaran (2015). The significance of cross-sectional independence was emphasized, as ignoring it can introduce estimation bias. The findings presented in Table 5 indicate that the null hypothesis, which assumes strong cross-sectional independence, was rejected at a significance level of 1%. This suggests the presence of cross-sectional dependence among the variables. Additionally, the heterogeneity test yielded results with a probability of less than 0.05, that emphasizes the rejection the null hypothesis and the acceptance of the first hypothesis, indicating the presence of heterogeneity between the variables.

|

Cross-sectional independence test |

Heterogeneity test |

||

|

Test |

Statistic |

Test |

Statistic |

|

Breusch–Pagan LM |

73.16922**** |

∆ |

4.592*** |

|

Pesaran scaled LM |

10.62020*** |

∆ adj |

5.624*** |

|

Pesaran CD |

4.281392*** |

||

Then a unit root test should be conducted to test the stationarity between data and to avoid biased results. The findings were investigating by implementing the augmented Dickey–Fuller (ADF) test and the Philips–Peron (PP) test in the order of I(0) and I(1). This was done to test the two following hypotheses:

Ho: the series has a unit root;

H1: the series is stationary.

Thus the results show that the series is stationary which leads to refuse the null hypothesis (Ho) and accept the alternative hypothesis (H1) at I(1)as shown in Table 6. Therefore this meets the main requirements of the CS-ARDL model that will be conducted later.

|

Panel A: ADF results |

||||

|

Level |

First difference |

|||

|

Constant |

Constant with trend |

Constant |

Constant with trend |

|

|

HDI |

9.64146 |

7.26551 |

32.0963*** |

25.0392** |

|

GOV |

11.0651 |

14.8821 |

39.4416*** |

29.1742*** |

|

OIL |

21.2761** |

6.29315 |

36.9825*** |

27.7748*** |

|

POP |

18.0963 |

25.9229** |

42.7498*** |

35.8188*** |

|

UNP |

5.11654 |

14.4521 |

45.0667*** |

43.3325*** |

|

GDP |

32.4156*** |

23.7163** |

63.9904*** |

43.9571*** |

|

Panel B: PP results |

||||

|

Level |

First difference |

|||

|

Constant |

Constant with trend |

Constant |

Constant with trend |

|

|

HDI |

10.1841 |

10.2243 |

69.8543*** |

60.5931*** |

|

GOV |

12.4158 |

11.7366 |

73.3971*** |

64.0466*** |

|

OIL |

22.2595** |

7.81483 |

83.1655*** |

74.2320*** |

|

POP |

4.47579 |

2.71218 |

26.1575** |

32.6804*** |

|

UNP |

11.7938 |

13.9924 |

82.2647*** |

65.9709*** |

|

GDP |

42.5051*** |

31.8472*** |

137.629*** |

93.2779*** |

Table 7 shows the results of the Pedroni cointegration test within dimensions and between dimensions of the data in panel A. The results show the cointegration of the data depending on three tests with 3 tests with 10% and 1 test with 5% comparing to other three tests were insignificant. Thus these results of the Pedroni test was confirmed by the Kao cointegration test in Panel B in Table 7 that was significant at 5%.

|

Panel A: Pedroni cointegration test |

|||

|

Statistic |

result |

||

|

Within dimensions |

Panel v-Statistic |

0.891572 |

No cointegration |

|

Panel rho-Statistic |

0.376653 |

No cointegration |

|

|

Panel PP-Statistic |

-3.392867*** |

Cointegration |

|

|

Panel ADF-Statistic |

-1.751834** |

Cointegration |

|

|

Between dimensions |

Group rho-Statistic |

1.334220 |

No cointegration |

|

Group PP-Statistic |

-3.525454*** |

Cointegration |

|

|

Group ADF-Statistic |

-2.124920** |

Cointegration |

|

|

Panel B: Kao integration test |

ADF |

-1.720510** |

Cointegration |

These panel cointegration results – estimated in Table 7 – show that there is a long run cointegration relationship between the variables but they did not show the magnitude of this cointegration. Therefore the authors adopted the pooled mean group estimator in Table 8. This test will be used to estimate the number of structural breaks in each country separately.

|

Country |

Number of breaks |

When |

|

|

Bahrain |

1 |

2014 |

- |

|

Kuwait |

2 |

2008 |

2014 |

|

Oman |

2 |

2007 |

2014 |

|

Qatar |

1 |

2014 |

- |

|

Saudi Arabia |

2 |

2008 |

2014 |

|

UAE |

2 |

2012 |

2015 |

Finally the results of long run effects of oil prices and government expenditures on HDI were presented in Tables 9 and 10 using CS-ARDL and CCEMG. The results show that the relationship between HDI, oil prices and government expenditures was significant in Saudi Arabia and Oman only, with no significance in Bahrain. While the relationship between HDI and government expenditures were significant in UAE and Qatar. Oil prices have only significant negative relationship with HDI. In other words, oil prices have negative relationships with HDI in all countries except Qatar. Also the government expenditures have negative relationships with HDI in all GCC countries except Bahrain where they have insignificant relationship.

|

Independent: HDI |

Coefficients |

|||||

|

Variable |

Saudi |

UAE |

Kuwait |

Bahrain |

Qatar |

Oman |

|

_ec |

-4.76X 1013 |

1.27 x 1013*** |

-3.68 x 1014 |

8.98 x 1014 |

-1.14 x 1013*** |

-1.14x1013*** |

|

D1(LN_OIL) |

-0.008311*** |

-0.0041299 |

-0.0084055* |

-0.0028041 |

0.0019711 |

0.0078555** |

|

GOV |

-0.0131407*** |

-0.0039751*** |

-0.0021913 |

0.0028667 |

-0.0039069*** |

-0.0029807** |

|

C |

-0.0281691** |

0.0061808 |

0.032349** |

0.0094857 |

0.0314886*** |

0.0011969 |

Comparing to the results of Table 10 that shows the CCEMG results, there is a negative relationship between HDI and oil prices with high significance at 1% but this relationship is negatively insignificant between HDI and government expenditures in GCC countries. Then all variables are insignificant with HDI except GDP per capita and oil prices. This is consistent with (Norouzi & Bank, 2014; Nikzadian, et al, 2019). The findings are insignificant relationships between governemnt expenditures and HDI and significant with oil prices.

|

variable |

coefficient |

|

Ln_oil |

-0.0160532*** |

|

Gov |

-0.0012207 |

|

GDP |

0.0002908* |

|

POP |

0.0008628 |

|

UNP |

0.0104192** |

|

Common dynamic process |

1.089741*** |

|

C |

0.7313636*** |

|

Root MG |

0.0043 |

As this paper aims to study the relationship between oil prices, government expenditures, and HDI, our results show that there are significant relationships between HDI and all other factors except GDP expenditures in GCC using CCEMG statistical technique. Oil revenues have negative relationship with HDI as any increase in oil revenues will have negative impact on HDI that was consistent with (Norouzi & Bank, 2014). Moreover this relationship between HDI and oil revenues is affected by the changes in unemployment rates and GDP per capita in GCC countries as a whole.

This negative relationship was not constant in all GCC countries as shown in Table 9. The results regarding this relationship were significantly negative in all countries except Qatar, UAE and Oman. This can be explained by the dependence of these countries on other sources of government expenditures rather than oil revenues such as tourism in UAE that is considered one of the strongest destinations in attracting tourists in the world and the first in Middle East region.

Thus the problem of the use of oil revenues can be explained by the quality of spending and to which sector or kind of spending they will be used. Also the management of the use of these oil revenues is very crucial to be investigated in further studies.

Any change in oil revenues can affect human development and sustainable development negatively because of some reasons that can explained in the following points.

First, the presence of Dutch disease that confirms the negative relationship between economic development and natural resources’ rents as oil revenues is stated by (Ologunde et al, 2020).

Secondly, the overdependence of the GCC countries on oil revenues in its economic growth in the short run then begin to diversify the sources of government revenues that appears after depending on some renewable resources.

This was validated by using diagnostic tests for testing heteroskedasticity, stability and cross-sectional independence.

This paper studied the long run dynamic relationship between oil prices, government expenditures and HDI in GCC countries using some variables as GDP per capita, population growth rate and unemployment rate. This region is characterized by homogenous charcteristics as the same history, culture and nealy same income levels.

The authors began by diagnostic test to be sure that there is no heterogeneity or cross-sectional dependence between variables. Then the use of both of CS-ARDL and CCEMG methods help the authors to test the impact of this relationship in the long and short run across the region and in each country separately. The results by using CCEMG show an insignificant relationship between HDI, government expenditures and population growth rate in the long run in the GCC region. But by using CS-ARDL, this relationship was significant only in Saudi Arabia, Kuwait and Oman which is consistent with (Norouzi & Bank, 2014). But this relationship was insignificant in UAE, Bahrain and Qatar, and it can be explained by the diversity of government revenues rather than oil prices as tourism in UAE, and the high dependence on the highly reputable universities and schools in the world that have campuses in both of Bahrain and Qatar. Therefore GCC countries began to divert their governemnt expenditures and revenues as some countries appear nowadays as hubs for tourism as UAE and Saudi Arabia. Also these countries can depend on other sources of energy as the solar energy because of the presence of the sun all over the year.

Further research can be applicable for comparison of oil exporting countries in GCC, Latin America and Africa that will need more data transperancy and acted as an obstacle to adopt them here in the paper.

Recently most of the countries are looking how to divert the sources of financing for the governemnt expenditures, the GCC countries began to decraese their dependence on oil revenues and look for other new sources.

• As more attention was given to human development aspects in GCC but their citizens are not characterized by worlalcolic as they should depend on others. Therefore more incentives should be given to those who can work and increase the productivity.

• Oil is nonrenewable resource that will be depleted by time, this encourages countries to look for other resources of financing the government expenditures. This does not work well in all GCC countries as in Oman and Bahrain. So the cooperation in the field of the efficient use of resources should be used.

• The introduction of using the renewable energy resources that will be more cleaner and cheaper besides the exporting of oil in its different produced shapes rather than the crude oil ones may help in decreasing its negative impacts on the environment.

Abdel-Latif, H., Ahmed, H., & Osman, R. (2018). Asymmetric impacts of oil price shocks on government expenditures: Evidence from Saudi Arabia. Cogent Economics and finance, https://doi.org/10.1080/23322039.2018.1512835.

Akoto, R. N., Afayori, M., Abu, E., & Simon Acheamfoh , A. (2021). Assessment of Oil Revenue and Its Impact on Human Development in Ghana. Open Journal of Social Science, DOI: 10.4236/jss.2021.99026.

Algahtani, G., Abusaaq, H., Alfi, A., Alsadoun, N., Callen, T., Khandelwal, P., et al. (2015). Assessing the importance of oil and interest rate spillovers for Saudi Arabia. IMF staff papers, retrieved from https://www.sama.gov.sa/en-US/EconomicResearch/Quarterly%20Workshops/Second%20quarter%202015%20First%20Presentation%20(A).pdf on 29th of jan 2024 at 1 pm.

Ali, A. (2021). Volatility of Oil Prices and Public Spending in Saudi Arabia: Sensitivity and Trend Analysis. International Journal of Energy economics and Policy, DOI: https://doi.org/10.32479/ijeep.10601.

Bentour, E. (2020). Government expenditure multipliers under oil price swings. Arab Monetary Fund, retrieved from https://www.researchgate.net/publication/339842578_Government_Expenditure_Multipliers_Under_Oil_Price_Swings on 29th of jan 2024 at 12 pm.

Edeme, R. K., Nkalu, C., & Ifelunini, I. (2017). Distributional impact of public expenditure on human development in Nigeria. International Journal of Social Economics 44.12, 1983-1693. DOI 10.1108/IJSE-05-2016-0152.

Erdoğan, S., Çevik , E., & Gedi, A. (2020). Relationship between oil price volatility and military expenditures in GCC countries. Environmental sciences and pollution resources, https://doi.org/10.1007/s11356-020-08215-3.

Faheem, M., Azali, M., Chin, l., & Mazlan, N. (2021). Does oil price spur public expenditures in Saudi Arabia, Kuwait and United Arab Emirates? Journal of Public Affairs , https://doi.org/10.1002/pa.2604.

Fossaceca, A. (2019). Assessing the Determinants of the Human Development Index in Oil-Dependent Nations. undergraduate economic review 16 (1), retrieved from https://digitalcommons.iwu.edu/uer/vol16/iss1/19 on 29th of jan 2024 at 4 pm.

Hamdi, H., & Sbia , R. (2013). Dynamic relationships between oil revenues, government spending and economic growth in an oil-dependent economy. economic modelling, https://doi.org/10.1016/j.econmod.2013.06.043.

Hansen, B. (1999). Threshold effects in non-dynamic panels: Estimation, testing, and inference. journal of econometrics 93 (2), https://doi.org/10.1016/S0304-4076(99)00025-1.

Haque, M. I., & Khan, M. (2019). Role of Oil Production and Government Expenditure in Improving Human Development Index: Evidence from Saudi Arabia. International Journal of Energy Economics and policy, 251-256, https://doi.org/10.32479/ijeep.7404.

Herranz, E. (2017). unit root tests. Wiley Interdisciplinary Reviews: Computational Statistics 9(3), DOI: 10.1002/wics.1396.

Hill, C. (2018). Principles of econometrics. John Wiley and sons. .

Hussein, M. A. (2009). Impacts of Foreign Direct Investment on Economic Growth in the Gulf Cooperation Council (GCC) Countries. International Review of Business Research Papers 5(3), 362-376.

Iheoma, C. (2014). Impact of social spending on human development in Sub Saharan Africa. american journal of social sciences

Imeokparia, L., Peter, O., Bello, B., Osabohien, R., Aderemi, T., Greshon, O., et al. (2023). A Panel Analysis of Crude Oil Exports and Poverty Reduction in African Oil Producing Countries: Implication for the Sustainable Development Goal One. International Journal of Energy Economics and Policy 13(4), 169-174. DOI: https://doi.org/10.32479/ijeep.14579 .

Khan, H., Hussein, S., & Deane, J. (2017). Nexus Between Demographic Change and Elderly Care Need in the Gulf Cooperation Council (GCC) Countries: Some Policy Implications. ageing international 42(4), DOI: 10.1007/s12126-017-9303-9.

Maharda, J. B., & Aulia, B. (2020). Government Expenditure and Human Development in Indonesia. Jambura Equilibrium Journal, DOI: https://doi.org/10.37479/jej.v2i2.6901.

Marza, M., Shaaibith, S., & Daly, S. (2018). Impact of Oil Price Fluctuations on Human Development: A Standard Study of Iraq. Munaf Marza* & Sundus Jasim Shaaibith & Shatha Salem Daly, 2018. “The Journal of Social Sciences Research, 396-399. DOI: https://doi.org/10.32861/jssr.spi5.396.399.

Mina, W. (2010). Are the GCC FDI Location Determinants Favorable? Economics Discussion Paper No. 2007-23, http://dx.doi.org/10.2139/ssrn.1716383.

Mirahsani, Z. (2016). The relationship between health expenditures and human development index. Journal of Research & Health, 373-377. DOI: 10.7508/jrh.2016.03.011.

Nikzadian, A., Agheli, L., Arani, A., & Sadeghi, H. (2019). The Effects of Resource Rent, Human Capital and Government Effectiveness on Government Health Expenditure in Organization of the Petroleum Exporting Countries. International journal of energy economics and policy, DOI: https://doi.org/10.32479/ijeep.7575.

Norouzi, A., & Bank, R. (2014). .Human Development and Iranian Economy; Rethinking about Resource Curse Hypothesi. Journal of Applied Science and Agriculture, retrieved from https://www.aensiweb.com/old/jasa/rjfh/2014/1062-1065.pdf on 29th of jan 2024 at 6 pm.

Ologunde, I. A., Sibanda , K., & Kapingura, F. (2020). Sustainable Development and Crude Oil Revenue: A Case of Selected Crude Oil-Producing African Countries. International Journal Of Environmental Research and Public Health, doi:10.3390/ijerph17186799 .

Pesaran, M. H. (2015). testing weak cross sectional dependence in large panels. econometric reviews, https://doi.org/10.1080/07474938.2014.956623 CrossMark Logo.

Raouf, E. (2021). Oil Prices Shocks and Government Expenditure. International Journal of Energy economics anf Policy, 78-84. DOI: 10.32479/ijeep.11172.

Razmi, M. J., & Mohammadi, S. (2012). Investigating the Effect of Government Health Expenditure on HDI in Iran. Journal of Knowledge Management, Economics and Information Technology (5), retrieved from https://www.researchgate.net/profile/Seyed-Mohammad-Javad-Razmi/publication/340492299_Investigating_the_Effect_of_Government_Health_Expenditure_on_HDI_in_Iran on 29th of jan 2024 at 3 pm.

Sama, J. M., Sapnken, F., Mfetoum, I., & Tamba, J. (2023). unravelling the dynamics of human development and economic growth on crude oil production based on ARDL and NARDL models. MethodsX, https//doi.org/10.1016/j.mex.2023.102404.

Victor, O. I., Madueke, N., Francis, M., & Okonkwo, I. (2016). petroleum revenue and economic growth in Nigeria. IOSR Journal of Polymer and Textile Engineering (IOSR-JPTE) , 39-55. DOI: 10.9790/019X-03023955.

Zakaria, N. B., Kazi , M., Mohamed, N., AbdulRahman, R., & Azmi, A. (2023). The Impact of Oil Price and Government Expenditure on Economic Growth in Malaysia. IPN Journal of Research and Practice in Public Sector Accounting and Management , 17-36, https://doi.org/10.58458/ipnj.v13.01.02.0086 .