Ekonomika ISSN 1392-1258 eISSN 2424-6166

2024, vol. 103(3), pp. 122–142 DOI: https://doi.org/10.15388/Ekon.2024.103.3.8

Enkeleda Lulaj

Haxhi Zeka University, Kososvo

Email: enkeleda.lulaj@unhz.eu

ORCID: https://orcid.org/0000-0002-5325-3015

Abstract. This paper investigated the wealth puzzle by examining the relationships among personal finance (PF), expenditure behavior (EB), and financial management (FM). Data from a diverse sample of 2000 individuals across regions such as Kosovo, Ghana, Kenya, Nigeria, Turkey, Pakistan, Nepal, Uganda, Cameroon, Ethiopia, India, Indonesia, Albania, Oman, and Egypt were collected through an online questionnaire from 2023 to 2024, and processed through exploratory and confirmatory factor analyses using AMOS and SPSS programs. Results revealed the robust relationships among PF, EB, and FM, indicating their resilience and strong internal consistency, and underscoring their pivotal role in shaping individuals’ financial stability and well-being. Notably, EB emerged as a crucial determinant, highlighting the importance of aligning spending habits with family priorities, moderating excesses, and consistently reviewing for improvements. Moreover, critical variables within PF and FM underscored the necessity for strategic financial planning, efficient spending optimization, and the cultivation of resilience against unforeseen financial obstacles. This research has significantly advanced the understanding of wealth dynamics and provided practical insights for policymakers and educators to design targeted financial education initiatives that can improve financial well-being and long-term prosperity. Future research should concentrate on understanding underlying mechanisms and assessing intervention effectiveness across more variables and countries.

Keywords: Wealth Puzzle, Global Finance, Personal Finance, Expenditure Behavior, Financial Management

_________

Received: 26/04/2024. Revised: 08/06/2024. Accepted: 21/07/2024

Copyright © 2024 Enkeleda Lulaj. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

The importance of understanding the intricate dynamics of personal finance (PF), expenditure behavior (EB), and financial management (FM) cannot be overstated. In today’s rapidly evolving financial environment, characterized by globalization and technological advances, this understanding is paramount for individuals and families striving to achieve long-term financial stability and prosperity. In terms of the meaning of the wealth puzzle, according to Wang (2023), the importance of preserving family wealth is emphasized by significantly promoting innovations brought by family wealth that have a positive impact on wealth. As emphasized by Zhao et al. (2023), families with high financial literacy are more inclined to invest in financial assets, highlighting the correlation between financial management (FM), economic behavior (EB), and personal finance (PF), which facilitates the distribution of wealth within vulnerable families. Furthermore, Dash and Mohanta (2024) emphasize that an individual’s financial awareness and spending behavior have a direct impact on the sustainable financial and economic performance of both families and individuals. Similarly, Wang et al. (2023) point out that financial management and expenditure behavior are influenced by a family’s digital capabilities for financial transactions, with implications for wealth risk. In addition, Baker et al. (2024) emphasize that accurate financial management can lead to increased wealth and better personal finances for families. Zeng and Yu (2024) emphasize that families can increase their wealth through careful financial management and responsible personal finance decisions, particularly for families engaged in work, underlining the importance of these decisions in their financial outcomes. Siegel and Thaler (1997) highlight the ongoing necessity for further research on the wealth puzzle. They underline that if an empirical result is challenging to rationalize, it qualifies as an anomaly, indicating the need for continued investigation.

Thus, the novelty of this paper lies in its comprehensive examination of the intricate relationships among personal finance (PF), expenditure behavior (EB), and financial management (FM), exploring their global dimensions beyond traditional approaches. While previous studies have highlighted the importance of individual components such as financial literacy or spending behavior, this paper integrates these elements into a holistic framework to reveal the underlying patterns and dynamics that shape individuals’ financial outcomes. The purpose of this paper is twofold: first, to uncover the underlying patterns and dynamics that shape individuals’ financial well-being and wealth accumulation; second, to provide insights that inform strategies for improving financial literacy, optimizing spending habits, and implementing effective financial management practices. The research questions guiding this study are: How do PF, EB, and FM interact to influence individuals’ financial well-being and wealth accumulation? And what are the implications of these findings for policymakers, financial institutions, and individuals seeking to improve financial literacy and promote long-term financial stability? By addressing these research questions, this paper aims to contribute to a deeper understanding of the wealth puzzle and provide actionable insights for promoting financial resilience and prosperity in an increasingly complex and dynamic environment.

The intricate interplay between personal finance (PF), expenditure behavior (EP), and financial management (FM) has a significant impact on the daily lives of households worldwide. Understanding these dynamics is crucial to navigating the complexities of the modern financial environment and promoting long-term financial well-being. A comprehensive literature review will delve into existing research to elucidate the multifaceted relationships among these factors and shed light on their implications for household financial stability, wealth accumulation, and economic resilience. Olafsson and Pagel (2024) emphasized that the wealth puzzle is about transaction levels (PF, EB, and FM), which document that individuals pay off their debts and save more after retirement, reduce spending from personal finances, and make effective financial management of the puzzle wealth (pension consumption, pension savings).

Thus, regarding the (PF, EXP, and FM) factors, Louhaichi et al. (2016) emphasize that financial incentives from the state in the form of payments to families increase financial stability and improve their well-being and puzzle wealth. Additionally, Liu et al. (2024) emphasized that financial knowledge of personal finance increases financial stability and wealth through financial management and the accurate expenditure behavior, which helps to reduce financial stress. Furthermore, Abokyi et al. (2024) emphasized that correct spending behavior and financial management influence healthy consumption for individuals and families. Çelik and Doğan (2024) emphasize the existence of a positive and statistically significant relationship between climate policy uncertainty and economic growth, which in turn affects the well-being of the population. Furthermore, Lulaj (2024) then highlights the complex relationships between money, climate change, sustainable finance and consumer spending patterns, emphasizing the need to address the gap between expected and desired spending values for the global economy in transition economies. According to Altunöz (2024), it is emphasized that there is a long-term relationship between unemployment variables in most OECD countries that affect the personal finances of individuals and families. Philippe (1989) examines how nonexpected utility preferences affect asset pricing. Despite relaxing traditional constraints, the study fails to resolve the Mehra–Prescott equity premium puzzle. Instead, it introduces a new puzzle – the risk-free rate puzzle – raising questions about why the risk-free rate remains low despite agents’ strong aversion to intertemporal substitution. In addition, Ingale and Paluri (2022), emphasized that financial education and financial behavior have developed over a period of time as an interdisciplinary field focused on the demographic and socioeconomic determinants of countries, providing insights into the construction of hypotheses.

Preliminary research on the wealth puzzle has been conducted in other studies, as highlighted in the introduction and literature review. This section elaborates on the wealth puzzle through three factors: personal finance (PF), expenditure behavior (EB), and financial management (FM), which are crucial for individuals and families. According to Pulina (2024), the accumulation of liquid assets and credit card debt in euro-area countries has a significant impact on personal finance, spending behavior, and financial management. This underlines the direct link between PF and FM, as asset and debt management affect overall financial health and stability.

Therefore, the following hypothesis is proposed:

Hypothesis 1: There is a significant positive relationship between personal finance and financial management in the context of cracking the wealth puzzle.

Hong (2022) suggests examining the wealth puzzle through the capital premium with transaction costs, highlighting the importance of expenditure behavior in financial decision-making. Goyal et al. (2021) further emphasize that demographic, socioeconomic, psychological, social, cultural, financial literacy and technological factors influence the relationships between PF, EB, and FM. These findings suggest that expenditure behavior and financial management are deeply interconnected.

Hence, the next hypothesis is proposed:

Hypothesis 2: There is a significant positive relationship between expenditure behavior and financial management in the context of cracking the wealth puzzle.

Wong et al. (2023) highlight that differences among families due to financial knowledge, which includes financial management and spending behavior, potentiate the relationship between EB and PF. Nyakurukwa and Seetharam (2024) argue that increased financial literacy boosts individuals’ well-being and wealth, enhancing the importance of FM and PF. Xiao et al. (2021) find that debt is negatively related to happiness, underlining the relationship between EB and FM. These studies underscore the interconnectedness of spending behavior and personal finance.

Therefore, the following hypothesis is proposed:

Hypothesis 3: There is a significant positive relationship between expenditure behavior and personal finance in the context of cracking the wealth puzzle.

Furthermore, Kachepa and Mumtaz (2023) indicate that FM and savings-oriented EB are significantly influenced by increasing income, education, and age. Gambacorta et al. (2021) find that large segments of the population in European countries suffer economically from austerity measures, affecting PF, FM, and EB. Kukk (2017) finds that higher family responsibilities are associated with lower financial asset holdings, affecting PF and FM. Singh and Malik (2022) suggest that higher financial literacy, better money management skills, and less impulsiveness in financial behavior reduce financial vulnerability. They recommend financial education programs to improve financial literacy and management skills, thereby linking PF, FM, and EB. Cardona-Montoya (2022) asserts that individuals with more financial education are better equipped to deal with negative financial impacts, thereby reducing financial vulnerability and stress.

Drawing upon insights from existing literature, hypotheses were formulated, bolstering the theoretical framework of this research. This process establishes a robust groundwork to investigate the interconnections between personal finance (PF), expenditure behavior (EB), and financial management (FM) within the overarching context of the wealth puzzle.

Figure 1 depicts the conceptual model aimed at cracking the wealth puzzle by investigating the interactions among personal finance (PF), expenditure behavior (EB), and financial management (FM). Following this conceptual framework, the utilization of Exploratory Factor Analysis (EFA) and Confirmatory Factor Analysis (CFA) is pivotal for developing and constructing hypotheses (H1: PF<--> FM; H2: EB<-->FM; and H3: EB<-->PF) that suggest specific relationships among the factors. H1 implies a relationship between PF and FM, indicating that strong personal finance habits may lead to effective financial management strategies and vice versa. Similarly, H2 and H3 propose relationships between EB, FM, and PF, respectively, shedding light on the interconnectedness of these factors. In summary, the conceptual model and the hypotheses derived from it provide a model for understanding of the intricate relationships between personal finance, expenditure behavior, and financial management, contributing to the broader goal of unraveling the wealth puzzle.

It is aimed at cracking the wealth puzzle through the interplay of three factors: personal finance, expenditure behavior, and financial management among individuals and families in different countries. Therefore, the purpose of this paper is to crack the wealth puzzle by investigating the relationships between personal finance (PF), expenditure behavior (EB), and financial management (FM). By delving into the interplay of these factors (PF, EB, and FM), the paper seeks to uncover the underlying patterns, dynamics, and implications that shape individuals’ financial well-being and wealth accumulation worldwide. So, through this research, families and individuals can improve their financial literacy, optimize their spending habits, and implement effective financial management strategies. Ultimately, these efforts aim to foster long-term financial stability and prosperity in a dynamic environment.

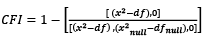

The data underwent exploratory factorial analysis (EFA) and its associated tests. As advocated by Watkins (2018), it is an important multivariate statistical technique used to develop and validate research theories and measures. EFA, a widely utilized statistical method across various disciplines including economics and reliability analysis, was chosen for its efficacy. Moreover, employing Confirmatory Factor Analysis (CFA) entails establishing relationships between constructs via Structural Equation Modeling (SEM) Shrestha et al. (2023) across the three factors (PF, EB, and FM). According Phakiti (2018), CFA and SEM are statistical methodologies employed by researchers to examine hypotheses or theories in a multivariate context. Structural equation modeling (SEM) finds widespread application in the analysis of such data for the factors of personal finance, expenditure behavior, and financial management. Furthemore, Yuan et al. (2017), the Comparative Fit Index (CFI) gauges the enhancement in fit when transitioning from the baseline model to the proposed model (PF, EB, and FM).

(1)

(1)

Here, FK and F0 denote the minimum value of a certain discrepancy function for the proposed model and the baseline model, respectively. Shi et al. (2019a)

(2)

(2)

Here, (x20 ) and (df0) indicate the chi-square statistic and degrees of freedom for the baseline model, while (x2k ) and (dfk) represent the chi-square statistic and degrees of freedom for the postulated model, respectively. The Comparative Fit Index (CFI) serves as a normalized fit index, ranging from 0 to 1, whith higher values signifying a better fit. A widely accepted benchmark for a satisfactory fit is a CFI ≥ .95. Shi et al. (2019)

However, the range between 0.05 and 0.08 shows the most desirable result, providing the best fit. In addition, the CFI (Comparative Fit Index) is not only less affected by sample size, but is also based on comparing the hypothesized model to the null model (Xia and Yang, 2019)

(3) Shi et al. (2019b)

(3) Shi et al. (2019b)

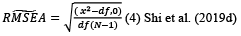

The RMSEA quantifies the discrepancy attributed to approximation per degree of freedom in the following manner:

(3) Shi et al. (2019c)

(3) Shi et al. (2019c)

Here, (Fk) represents the minimum value of a particular discrepancy function between the population covariance matrix (Σ) and the model-implied covariance matrix (Σ0) for the hypothesized model. The estimated RMSEA from the sample is defined as follows:

(4) Shi et al. (2019d)

(4) Shi et al. (2019d)

The data was collected from a diverse sample of (n=2000) individuals who voluntarily participated in an online questionnaire from July 2023 to February 2024. Representing various regions including Kosovo, Ghana, Kenya, Nigeria, Turkey, Pakistan, Nepal, Uganda, Cameroon, Ethiopia, India, Indonesia, Albania, Oman, and Egypt, these families contributed to the study. This diverse representation ensures a comprehensive examination of the wealth puzzle. Participants were assured of the confidentiality of their responses and informed of the purpose of the research. They participated voluntarily, recognizing the study’s goal of exploring sustainable financial practices through the interplay of PF, EB, and FM. Responses were collected using a Likert scale ranging from 1 (strongly disagree) to 5 (strongly agree).

|

Code |

Items |

Source |

|

EB1 EB2 EB3 EB4 EB5 EB6 EB7 EB8 EB9 EB10 EB11 EB12 EB13 |

Expenditure Behavior (EB) |

Randazzo and Piracha (2019) Basu (2021) |

|

Confident in effectively managing family expenditures Carefully plan and budget for family expenditures monthly Consider family expenditures reasonable relative to income Prioritize essential needs in family spending Reduce unnecessary expenditures to improve budget management Satisfied with the distribution of family expenses across categories Family spending habits align with values and priorities Adjust family spending to match changes in income or circumstances Believe family spending is controlled and not excessive Ensure fair distribution of family expenditures among members Regularly review family spending for improvement opportunities Maintain transparency in discussing household expenses Ensure household expenditures align with needs |

||

|

PF1 PF2 PF3 PF4 PF5 PF6 PF7 PF8 PF9 |

Personal Finance (PF) |

Xiao and Tao (2021) Mahdzan et al. (2023) |

|

Household expenses tracked regularly to monitor spending patterns Household expenses allow for future savings without sacrificing essentials Family expenses compare favorably to others in similar situations Family spending aligns with long-term financial goals. Family expenses optimized to increase savings Comfortable balance between core and discretionary spending in the budget Household expenses support a comfortable standard of living Confidence in the ability to handle unexpected financial challenges related to expenses Household expenses adjusted to accommodate changes in income or financial goals |

||

|

FM1 FM2 FM3 FM4 FM5 FM6 FM7 |

Financial Management (FP) |

Zehra and Singh (2023) Yu et al. (2023) |

|

Concerned about rising costs affecting household expenses Concerned about inflation impacting household expenses Proud of budget adherence and responsible expense management Worried about unexpected expenses breaking the budget Believe household expenses are influenced by external factors Worried about debt burden from family expenses Stressed about expenses exceeding the budget |

Table 1 presents the description of the variables related to cracking the wealth puzzle in the context of investigating the interplay between personal finance (PF), expenditure behavior (EB), and financial management (FP). Through exploratory factor analysis, three main factors were created: PF(1-9), EB(1-13), and FM(1-7) factors with their variables.

In today’s dynamic economic and financial environment, characterized by rapid globalization, technological advances, and shifting socioeconomic paradigms, understanding the intricacies of personal finance, expenditure behavior, and financial management is more important than ever. Zhao et al. (2024) emphasized that the wealth puzzle through personal finance, expenditure behavior, and financial management means choosing the puzzle of risk-free rates through C-CAPM (Consumption Capital Asset Pricing Model). Smed et al. (2022) found no evidence to support a pension (food) consumption puzzle. According to (Bacchetta and Wincoop, 2021), cracking the wealth puzzle through (PF, EB, and FM) is related to interest rates and exchange rates for families by potentiating the puzzle of delayed excess, the puzzle of forward discounting, the puzzle of return predictability, the puzzle of high interest rates, the puzzle of discounting. Moreover, as individuals navigate an increasingly complex financial terrain, the ability to make informed decisions about savings, investments, and consumption patterns becomes paramount to securing financial well-being by improving the efficiency of information dissemination and enhancing financial participation (Li and Sui, 2023). In summary, while the discussion provides a comprehensive theoretical framework and explores the multifaceted nature of individual financial decisions, it would benefit from a more robust examination of the practical economic implications. By elucidating how theoretical concepts translate into actionable strategies for individuals, the research can improve its relevance and applicability in addressing real-world financial challenges. As such, the following findings provide a detailed analysis of the practical economic implications of the research findings and offer insights for individuals seeking to navigate the complexities of wealth accumulation in a globalized world. For this reason, the following section presents detailed results and discussion for each of the three factors.

|

Item |

Construct |

Factor Loading λ |

KMO and Bartlett’s Test |

Variance Explained (VE) Cronbach’s Alpha |

Interpretation |

|

Expenditure Behavior (EB) |

|||||

|

EB1 |

Confident in effectively managing family expenditures |

.762 |

KMO=.951 χ2= 1967.7511 df=78 Sig.=.000 |

62.9% α =.950 |

Valid results |

|

EB2 |

Carefully plan and budget for family expenditures monthly |

.698 |

|||

|

EB3 |

Consider family expenditures reasonable relative to income |

.807 |

|||

|

EB4 |

Prioritize essential needs in family spending |

.800 |

|||

|

EB5 |

Reduce unnecessary expenditures to improve budget management |

.724 |

|||

|

EB6 |

Satisfied with the distribution of family expenses across categories |

.813 |

|||

|

EB7 |

Family spending habits align with values and priorities |

.799 |

|||

|

EB8 |

Adjust family spending to match changes in income or circumstances |

.844 |

|||

|

EB9 |

Believe family spending is controlled and not excessive |

.781 |

|||

|

EB10 |

Ensure fair distribution of family expenditures among members |

.838 |

|||

|

EB11 |

Regularly review family spending for improvement opportunities |

.788 |

|||

|

EB12 |

Maintain transparency in discussing household expenses |

.831 |

|||

|

EB13 |

Ensure household expenditures align with needs |

.819 |

|||

|

Personal Finance (PF) |

|||||

|

PF1 |

Household expenses tracked regularly to monitor spending patterns |

.803 |

KMO=.937 χ2= 1185.506 df=36 Sig.=.000 |

64.9% α=. 933 |

Valid results |

|

PF2 |

Household expenses allow for future savings without sacrificing essentials |

.814 |

|||

|

PF3 |

Family expenses compare favorably to others in similar situations |

.807 |

|||

|

PF4 |

Family spending aligns with long-term financial goals. |

.819 |

|||

|

PF5 |

Family expenses optimized to increase savings |

.806 |

|||

|

PF6 |

Comfortable balance between core and discretionary spending in the budget |

.814 |

|||

|

PF7 |

Household expenses support a comfortable standard of living |

.819 |

|||

|

PF8 |

Confidence in the ability to handle unexpected financial challenges related to expenses |

.804 |

|||

|

PF9 |

Household expenses adjusted to accommodate changes in income or financial goals |

.768 |

|||

|

Financial Management (FM) |

|||||

|

FM1 |

Concerned about rising costs affecting household expenses. |

.804 |

KMO=.887 χ2=808.939 df= 21 Sig.=.000 |

62.4%% α =.897 |

Valid results |

|

FM2 |

Concerned about inflation impacting household expenses. |

.851 |

|||

|

FM3 |

Proud of budget adherence and responsible expense management. |

.620 |

|||

|

FM4 |

Worried about unexpected expenses breaking the budget. |

.870 |

|||

|

FM5 |

Believe household expenses are influenced by external factors. |

.747 |

|||

|

FM6 |

Worried about debt burden from family expenses. |

.801 |

|||

|

FM7 |

Stressed about expenses exceeding the budget. |

.811 |

|||

Table 2 shows the Component Matrix (in PCA) derived from the Exploratory Factor Analysis (EFA), underscoring the significance of the EB (Expenditure Behavior), PF (Personal Finance), and FM (Financial Management) factors in cracking the wealth puzzle. All factors have values above 0.50, underscoring their importance and relevance. The Kaiser–Meyer–Olkin (KMO) test confirms the robust fit of the data to the models (EB, KMO=.951; PF, KMO=.937; FM, KMO=.887), while Bartlett’s sphericity test indicates a significant and meaningful correlation between the factors (Sig.=.000). Furthermore, the reliability analysis (Cronbach’s Alpha) demonstrates a high level of internal consistency within the data for all factors (EB, PF, and FM, .80 ≤ α ≤ .95, .93, .90), while the Eigenvalues (VE) highlight the substantial variance captured by each factor, exceeding 50% in all cases (1-3). The results underscore the critical importance of Expenditure Behavior (EB), Personal Finance (PF), and Financial Management (FM) factors in understanding and addressing the wealth puzzle. With robust fit to the data, significant correlations, and high internal consistency, these findings have practical and theoretical implications for financial decision-making. They suggest that interventions and strategies aimed at improving financial literacy and promoting responsible financial behaviors should consider the influence of EB, PF, and FM factors to effectively improve individuals’ financial decisions and outcomes.

Table 3 presents the results of the confirmatory factor analysis (CFA) related to unraveling the wealth puzzle by exploring the interplay of personal finance (PF1-9), spending behavior (EB 1-13), and financial management (FP1-7). According to the estimates, all variables in the three factors (EB, PF, and FM) have statistically significant influences on the model, with regression weights greater than 0.5 at the 0.1% significance level (p<0.001). In terms of Expenditure Behavior (EB) factor, the most significant variables are EB7 (0.843***), EB9 (0.838***), EB11 (0.812***), and EB13 (0.806***), suggesting that spending habits should align with the family’s priorities and importance, be controlled to avoid excessiveness, regularly reviewed for improvement, and ensured to meet the family’s needs. Furthermore, in the personal finance (PF) factor, the most significant variables are PF7 (0.820***), PF5 (0.797***), PF6 (0.789***), and PF3 (0.789***), indicating that family expenses should support a comfortable standard of living, be optimized to increase savings, maintain a balance between basic and discretionary expenses in the budget, and be planned based on similar situations. Moreover, in the financial management (FM) factor, the most important variables are FM4 (0.860***) and FM2 (0.848), indicating that individuals and families experience financial stress from unexpected expenses disrupting their budgets, along with anxiety stemming from inflation impacting significant family expenditures. The results emphasize practical economic implications, stressing the critical role of managing personal finance, spending behavior, and financial management for achieving financial stability amidst the wealth puzzle. This necessitates aligning spending with priorities, optimizing expenses for savings, and addressing financial stress. Theoretically, these findings underline the significance of holistic wealth management strategies, including financial education and support mechanisms to navigate financial uncertainty. Overall, managing personal finance, expenditure behavior, and financial management practices is crucial for achieving financial well-being and stability in the wealth puzzle.

|

Path Variables |

Covariances |

Correlation |

Interpretation |

|||

|

Estimate |

S.E. |

C.R. |

P value |

Estimate |

||

|

PF <--> FM EB <--> FM EB <--> PF |

.577*** .708*** .850*** |

.089 .108 .117 |

6.491 6.539 7.272 |

p < 0.001 p < 0.001 p < 0.001 |

.673 .720 .934 |

Positive and significant relationship |

Table 4 presents the results showing the relationships between the factors, including covariance and correlation values, standard error (S.E.), critical ratio (C.R.), and significance levels, in the context of investigating the wealth puzzle through the interplay of personal finance (PF), expenditure behavior (EB), and financial management (FM), along with their respective variables. For the relationship PF<--> FM, the values of Cov (0.577***), Cor (0.673), and (p<0.001) indicate a significant and positive relationship between personal finance and financial management. A change in PF affects the change in FM at the 0.1% significance level. Regarding the relationship EB<-->FM, the values of Cov (0.708***), Cor (0.720), and (p<0.001) highlight a significant and positive relationship between expenditure behavior and financial management. A change in EB affects the change in FM at the 0.01% significance level. Lastly, for the relationship EB<-->PF, the values of Cov (0.850***), Cor (0.934), and (p<0.001) emphasize a significant, strong, and positive relationship between expenditure behavior and personal finance. A change in EB affects the change in PF at the 0.1% significance level. So, these findings suggest that there are strong interrelationships between personal finance, expenditure behavior, and financial management. The findings underscore significant and positive relationships between personal finance (PF), expenditure behavior (EB), and financial management (FM), indicating their interconnectedness in addressing the wealth puzzle. These results have practical and theoretical implications for financial decision-making. Understanding the holistic interaction between these factors is crucial for developing effective strategies to promote financial well-being on a larger scale. By considering these interrelationships, interventions can be designed to address the complexities of wealth management more comprehensively, ultimately leading to more robust solutions for individuals and societies alike.

|

Measure |

Estimate |

Threshold |

Interpretation |

Cutoff Criteria* |

|||

|

CMIN |

579.832 |

-- |

-- |

||||

|

DF |

361 |

-- |

-- |

Measure |

Terrible |

Acceptable |

Excellent |

|

CMIN/DF |

1.606 |

Between 1 and 3 |

Excellent |

CMIN/DF |

> 5 |

> 3 |

> 1 |

|

CFI |

0.953 |

>0.95 |

Excellent |

CFI |

<0.90 |

<0.95 |

>0.95 |

|

SRMR |

0.052 |

<0.08 |

Excellent |

SRMR |

>0.10 |

>0.08 |

<0.08 |

|

RMSEA |

0.055 |

<0.06 |

Excellent |

RMSEA |

>0.08 |

>0.06 |

<0.06 |

|

PClose |

0.151 |

>0.05 |

Excellent |

PClose |

<0.01 |

<0.05 |

>0.05 |

Table 5 presents the findings of the FIT model, designed to uncover and assess potential relationships among the variables and factors (EB, PF, and FM) pertinent to unraveling the wealth puzzle. This model investigates the interplay of personal finance (PF), expenditure behavior (EB), and financial management (FM), along with their respective variables. The model exhibits a chi-squared value (CMIN/χ2) of 579.832, with a ratio (X2/df) of 361 at the 5% significance level (0.05), indicating a strong fit and statistical significance in model effectiveness. Various model performance indices, including CMIN/DF (1.606), CFI (0.953), SRMR (0.052), and Pclose (0.151), collectively denote a high degree of fit. Additionally, the RMSEA index of 0.055 further supports the model’s suitability for the data. The FIT model’s findings indicate a strong fit and statistical significance in understanding the interplay of personal finance (PF), expenditure behavior (EB), and financial management (FM) concerning the wealth puzzle. With various performance indices denoting high fit and suitability for the data, these outcomes carry practical and theoretical implications for financial decision-making. Understanding the relationships and interactions between these factors can inform more effective strategies for promoting financial well-being and addressing challenges in wealth management. By leveraging insights from this model, interventions can be tailored to better navigate the complexities of financial decision-making and enhance overall financial stability on a broader scale.

Figure 2 presents the relationship related to cracking the wealth puzzle in the context of investigating the interplay of personal finance (PF), expenditure behavior (EB), and financial management (FP) and their variables. According to the path diagram, the following findings are highlighted. The relationship PF (Personal Finance)<-->SC(Financial Management), correlation 0.673, shows a significant positive relationship between personal finance and financial management, suggesting that an improvement in PF has a positive impact on FM. The relationship EB (Expenditure Behavior)<-->FM (Financial Management), correlation 0.720, shows a significant positive relationship between spending behavior and financial management, suggesting that changes in EB affect FM. The relationship EB (Expenditure Behavior)<-->PF(Personal Finance), correlation 0.934, shows a significant and very strong positive relationship between spending behavior and personal finance, suggesting that the change in EB affects PF. The analysis reveals significant correlations among personal finance (PF), expenditure behavior (EB), and financial management (FM). Firstly, a noteworthy positive correlation of 0.673 between PF and FM indicates that improvements in personal finance positively impact financial management practices. Secondly, the correlation of 0.720 between EB and FM underscores the influence of spending behavior on financial management, suggesting that changes in expenditure habits affect overall financial strategies. Thirdly, the striking correlation of 0.934 between EB and PF highlights the strong link between spending behavior and personal finance, emphasizing the pivotal role of managing spending habits in maintaining healthy financial portfolios. These findings suggest the importance of prioritizing personal finance education and literacy to enhance financial management skills. Encouraging prudent spending behaviors and providing tools for effective expenditure tracking can contribute to better financial outcomes for individuals, ultimately leading to improved financial well-being.

Table 6 shows the results from the parameter estimates. It provides valuable insight into the relationships between three key factors: Expenditure Behavior (EB), Financial Management (FM), and Personal Finance (PF). For Expenditure Behavior (EB), the intercept (B) is estimated at 3.678, indicating the expected value of EB when all other variables are zero. The scale coefficient of 0.909 suggests the effect of the predictor variable on EB. This relationship is statistically significant (p = 0.000), as indicated by the Wald Chi-Square statistic of 2977.486. In the case of Financial Management (FM), the intercept (B) is estimated at 3.334, with a scale coefficient of 0.969. Similarly, this relationship is statistically significant (p = 0.000), with a Wald Chi-Square statistic of 2293.074. Regarding Personal Finance (PF), the intercept (B) is estimated at 3.483, with a scale coefficient of 0.928. So, this relationship is statistically significant (p = 0.000), with a Wald Chi-Square statistic of 2615.020. Furthermore, regarding the interrelatedness of (EB, FM, and FP) factors, it is emphasized that the intercept, which indicates the expected value when other variables are zero, is 3.498, statistically significant (p = 0.000). The scale coefficient is 0.760, indicating the effect of the predictor variables on the combined factor. The narrow confidence intervals and the significant Wald Chi-Square statistic (3221.181, df = 1, p = 0.000) confirm the stability and robustness of the model. Therefore, these results indicate that all three factors – EB, FM, and PF – are significantly associated with their respective predictor variables. The confidence intervals provide further insight into the precision of these estimates, with narrow intervals suggesting higher precision. Overall, these findings strengthen our understanding of the relationships between these factors and provide a robust foundation for further analysis and interpretation within the context of the model.

|

Parameter Estimates |

||||||||

|

Factors |

Parameter |

B |

Std. Error |

95% Wald Confidence Interval |

Hypothesis Test |

|||

|

Lower |

Upper |

Wald Chi-Square |

df |

Sig. |

||||

|

EB |

(Intercept) |

3.678 |

0.0674 |

3.546 |

3.810 |

2977.486 |

1 |

0.000 |

|

(Scale) |

0.909a |

0.0909 |

0.747 |

1.105 |

||||

|

FM |

(Intercept) |

3.334 |

0.0696 |

3.197 |

3.470 |

2293.074 |

1 |

0.000 |

|

(Scale) |

0.969a |

0.0969 |

0.797 |

1.179 |

||||

|

PF |

(Intercept) |

3.483 |

0.0681 |

3.350 |

3.617 |

2615.020 |

1 |

0.000 |

|

(Scale) |

0.928a |

0.0928 |

0.763 |

1.129 |

||||

|

Cracking_the_Wealth_Puzzle |

(Intercept) |

3.498 |

0.0616 |

3.378 |

3.619 |

3221.181 |

1 |

0.000 |

|

(Scale) |

0.760a |

0.0760 |

0.625 |

0.924 |

||||

Table 7 provides strong support for the relationship between EB, PF, and FM, confirming the hypotheses and demonstrating an excellent model fit. Each factor (EB, PF, and FM) plays a crucial role in cracking the wealth puzzle in the context of investigating the interplay of personal finance (PF), expenditure behavior (EB), and financial management (FP) and their variables. The positive and statistically significant associations between these factors emphasize their interdependence. The FIT model and path diagram analysis further confirm the significant relationships. The implications of these findings extend to both practical applications and future research endeavors. Practically, policymakers and financial educators can utilize these insights to design targeted interventions and educational programs that address the interconnected nature of personal finance, expenditure behavior, and financial management. Future studies could delve deeper into understanding the mechanisms underlying these relationships, exploring additional variables that may influence individuals’ financial decisions, and conducting longitudinal research to assess the long-term effectiveness of interventions aimed at improving financial well-being.

|

Hypotheses |

Elaboration |

Tests |

Rejected/ Accepted |

Future Research /Implications |

|

H1 |

PF <--> FM |

Excellent Model Fit C.I ≈99,9%, 0.90 ≥ α; 0.05≥λ RMSEA, (90% CI), p=0.055

|

Accepted |

The findings have practical implications for policymakers and educators to develop targeted financial education interventions. Future research should focus on understanding underlying mechanisms and assessing intervention effectiveness through longitudinal studies. |

|

H2 |

EB <--> FM |

Accepted |

||

|

H3 |

EB <--> PF |

Accepted |

The paper delved deep into the intricate dynamics that influenced individuals’ financial well-being and wealth accumulation worldwide. Through meticulous examination of the relationships among personal finance (PF), expenditure behavior (EB), and financial management (FM), the research uncovered hidden patterns and offered actionable strategies to boost financial literacy, refine spending habits, and implement effective financial management techniques. Drawing on data from a diverse sample of 2000 individuals across regions like Kosovo, Ghana, Kenya, Nigeria, Turkey, Pakistan, Nepal, Uganda, Cameroon, Ethiopia, India, Indonesia, Albania, Oman, and Egypt, the study explored the nuances of PF, EB, and FM. Using exploratory and confirmatory factor analyses, along with regression and correlation analyses, the research highlighted the importance of these factors in decoding the wealth puzzle.

Results revealed strong associations among PF, EB, and FM, demonstrating their resilience and high internal consistency. Significant correlations underscored their central role in shaping individuals’ financial stability and well-being. In particular, spending behavior emerged as a critical factor, underscoring the need to align spending habits with family priorities, curb excesses, and regularly review for improvement. The study also highlighted critical variables within PF and FM, underscoring the need for strategic financial planning, optimizing spending, and building resilience to unexpected financial challenges. The robustness of the FIT model further validated the effectiveness of the proposed framework in unraveling the complexities of the wealth puzzle.

The implications of this research extend beyond academia, offering tangible benefits for individuals, families, and policymakers alike. By delving deeply into the complex dynamics of personal finance (PF), expenditure behavior (EB), and financial management (FM), this study provides actionable strategies to enhance financial literacy, refine spending habits, and promote long-term financial stability. For individuals and families, the findings offer practical insights to optimize financial decision-making. By aligning spending habits with personal priorities and implementing effective financial management techniques, individuals can strengthen their financial well-being and lay the foundation for future prosperity. Moreover, the emphasis on regular review and adaptation encourages a proactive approach to financial planning, empowering individuals to navigate unforeseen challenges and capitalize on growth opportunities.

At the policy level, the research underlines the importance of integrating financial education initiatives into national agendas. By incorporating financial literacy programs into school curricula and adult education initiatives, policymakers can equip citizens with the knowledge and skills necessary to make informed financial decisions. Furthermore, targeted interventions aimed at promoting responsible spending behavior and fostering a culture of savings can help mitigate the risk of financial instability and reduce inequalities in wealth accumulation.

Additionally, policymakers can leverage the insights gained from this study to design evidence-based policies that address systemic barriers to financial inclusion and resilience. By expanding access to affordable financial services, particularly in underserved communities, governments can empower marginalized populations to participate more fully in the formal economy and build assets over time. Moreover, initiatives aimed at promoting financial planning and building resilience to economic shocks can help safeguard individuals and families against unforeseen disruptions, fostering greater economic security and stability.

In summary, this research underscores the practical applications of understanding wealth dynamics and offers actionable strategies for individuals, families, and policymakers to improve financial well-being and promote long-term prosperity. Incorporating these insights into policy and practice can build a more resilient and inclusive financial system that empowers individuals to achieve their financial goals and aspirations. However, it’s important to note limitations such as sample size and regional representation. Despite this, the implications are substantial, aiding families in enhancing financial literacy. Future studies could explore cultural influences on financial behavior for a more comprehensive understanding.

Abokyi, E., Appiah-Konadu, A., Oteng-Abayie, E., F., and Tangato, K., F. (2024). Consumption of clean and dirty cooking fuels in ghanaian households: The role of financial inclusion. Cleaner and Responsible Consumption, 13, https://doi.org/10.1016/j.clrc.2024.100187.

Altunöz, U. (2024). In the Context of Okun Law, the Relationship Between Real Output and Unemployment Rate in Oecd: a Panel Error Correction and Panel Ardl Approaches”, Ekonomika, 103(1), pp. 6–24. https://doi:10.15388/Ekon.2024.103.1.1.

Bacchetta, P., and van Wincoop, E. (2021). Puzzling exchange rate dynamics and delayed portfolio adjustment. Journal of International Economics, 131, https://doi.org/10.1016/j.jinteco.2021.103460.

Baker, S., R., Johnson, S., and Kueng, L. (2024). Financial returns to household inventory management. Journal of Financial Economics, 151, https://doi.org/10.1016/j.jfineco.2023.103758.

Basu, B. (2021). Do institutional norms affect behavioral preferences: A view from gender bias in the intra-household expenditure allocation in Iran. Economic Modelling, 97, pp. 118-134, https://doi.org/10.1016/j.econmod.2020.12.024.

Cardona-Montoya, R.A., Cruz, V. and Mongrut, S.A. (2022). Financial fragility and financial stress during the COVID-19 crisis: evidence from Colombian households“, Journal of Economics, Finance and Administrative Science, 27 (54), pp. 376-393. https://doi.org/10.1108/JEFAS-01-2022-0005

Dash, D., and Mohanta, G. (2024). Fostering financial inclusion for attaining sustainable goals: What contributes more to the inclusive financial behaviour of rural households in India? Journal of Cleaner Production, 449, https://doi.org/10.1016/j.jclepro.2024.141731

Gambacorta, R., Rosolia, A. and Zanichelli, F. (2021). The Finances of European Households Throughout the Pandemic. Bandyopadhyay, S. (Ed.) Research on Economic Inequality: Poverty, Inequality and Shocks(Research on Economic Inequality, Vol. 29), Emerald Publishing Limited, Leeds, pp. 249-267. https://doi.org/10.1108/S1049-258520210000029011.

Goyal, K., Kumar, S. and Xiao, J.J. (2021). Antecedents and consequences of Personal Financial Management Behavior: a systematic literature review and future research agenda. International Journal of Bank Marketing, 39 (7), pp. 1166-1207. https://doi.org/10.1108/IJBM-12-2020-0612

Hong, S. (2022). Transactions costs and the equity premium puzzle. Finance Research Letters, 49, https://doi.org/10.1016/j.frl.2022.103145.

Ingale, K.K. and Paluri, R.A. (2022). Financial literacy and financial behaviour: a bibliometric analysis. Review of Behavioral Finance, 14 (1), pp. 130-154. https://doi.org/10.1108/RBF-06-2020-0141

Kachepa, P. and Mumtaz, M.Z. (2023). What factors influence household financial decisions in Malawi?. African Journal of Economic and Management Studies, Vol. 14 No. 4, pp. 741-756. https://doi.org/10.1108/AJEMS-11-2022-0470

Kukk, M. (2017). How does household debt affect financial asset holdings? Evidence from euro area countries. Studies in Economics and Finance, 34 (2), pp. 194-212. https://doi.org/10.1108/SEF-02-2016-0031

Li, X. and Sui, S. (2023). Unraveling the influence and mechanism of digital inclusive finance on household financial substitution: evidence from China. Asia Pacific Journal of Marketing and Logistics, 35 (10), pp. 2466-2483. https://doi.org/10.1108/APJML-09-2022-0799

Liu, T., Fan, M., Li, Y., and Yue, P. (2024). Financial literacy and household financial resilience. Finance Research Letters, 63. https://doi.org/10.1016/j.frl.2024.105378

Louhaichi, M., Yigezu, Y., A., Werner, J., Dashtseren, L., El-Shater, T., and Ahmed, M. (2016). Financial incentives: Possible options for sustainable rangeland management? Journal of Environmental Management, 180, pp 493-503. https://doi.org/10.1016/j.jenvman.2016.05.077

Lulaj, E. (2024). Money Talks: A Holistic and Longitudinal View of the Budget Basket in the Face of Climate Change and Sustainable Finance Matters”, Ekonomika, 103(1), pp. 91–107. https://doi.org/10.15388/Ekon.2024.103.1.6

Mahdzan, N.S., Sabri, M.F., Husniyah, A.R., Magli, A.S. and Chowdhury, N.T. (2023). Digital financial services usage and subjective financial well-being: evidence from low-income households in Malaysia. International Journal of Bank Marketing, 41 (2), pp. 395-427. https://doi.org/10.1108/IJBM-06-2022-0226

Nyakurukwa, K. and Seetharam, Y. (2024), „Household stock market participation in South Africa: the role of financial literacy and social interactions“, Review of Behavioral Finance, 16 (1), pp. 186-201. https://doi.org/10.1108/RBF-03-2022-0083

Olafsson, A., Pagel, M. (2024). Retirement puzzles: New evidence from personal finances. Journal of Public Economics, 234, https://doi.org/10.1016/j.jpubeco.2024.105103.

Phakiti, A. (2018). Confirmatory Factor Analysis and Structural Equation Modeling. In: Phakiti, A., De Costa, P., Plonsky, L., Starfield, S. (eds) The Palgrave Handbook of Applied Linguistics Research Methodology. Palgrave Macmillan, London. https://doi.org/10.1057/978-1-137-59900-1_21

Philippe, W. (1989). The equity premium puzzle and the risk-free rate puzzle. Journal of Monetary Economics. 24 (3), Pages 401-421. https://doi.org/10.1016/0304-3932(89)90028-7

Pulina, G. (2024). Credit card debt puzzle: Evidence from the euro area. Economics Letters, 236, https://doi.org/10.1016/j.econlet.2024.111586.

Randazzo, T., and Piracha, M. (2019). Remittances and household expenditure behaviour: Evidence from Senegal. Economic Modelling, 79, pp 141-153. https://doi.org/10.1016/j.econmod.2018.10.007

Savaş Çelik, B. and Özarslan Doğan, B. (2024) “Does Uncertainty in Climate Policy Affect Economic growth? Empirical Evidence from the U.S”., Ekonomika, 103(1), pp. 44–55. https://doi:10.15388/Ekon.2024.103.1.3.

Siegel, J. J., & Thaler, R. H. (1997). Anomalies: The Equity Premium Puzzle. The Journal of Economic Perspectives, 11(1), 191–200. http://www.jstor.org/stable/2138259

Singh, K.N. and Malik, S. (2022). An empirical analysis on household financial vulnerability in India: exploring the role of financial knowledge, impulsivity and money management skills. Managerial Finance, 48 (9/10), pp. 1391-1412. https://doi.org/10.1108/MF-08-2021-0386

Smed, S., Rønnow, H., N., and Tetens, I. (2022). The retirement (food)-consumption puzzle revisited - A panel data study from Denmark. Food Policy, 112, https://doi.org/10.1016/j.foodpol.2022.102330.

Shi, D., Lee, T., & Maydeu-Olivares, A. (2019). Understanding the Model Size Effect on SEM Fit Indices. Educational and Psychological Measurement, 79(2), 310-334. https://doi.org/10.1177/0013164418783530

Shrestha, R., Kadel, R., and Mishra, B., K. (2023). A two-phase confirmatory factor analysis and structural equation modelling for customer-based brand equity framework in the smartphone industry. Decision Analytics Journal, Volume 8, https://doi.org/10.1016/j.dajour.2023.100306.

Wang, Sh., Li, Ch., Wang, Z., and Sun, G. (2023). Digital skills and household financial asset allocation. Finance Research Letters, 58. https://doi.org/10.1016/j.frl.2023.104566

Wang, W., Liu, J., Wang, J., Huang, X., and Liu, Y. (2023). The puzzle of household wealth preservation and corporate innovation. International Review of Financial Analysis, 90, https://doi.org/10.1016/j.irfa.2023.102893.

Wong, Z.Y., Kusairi, S. and Abdul Halim, Z. (2023). The nexus between households’ indebtedness and consumption: the role of gender, geographical area and income groups. International Journal of Development Issues, 22 (1), pp. 72-90. https://doi.org/10.1108/IJDI-07-2022-0155.

Xia, Y., and Yang, Y. (2019). RMSEA, CFI, and TLI in structural equation modeling with ordered categorical data: The story they tell depends on the estimation methods. Behav Res 51, pp. 409–428. https://doi.org/10.3758/s13428-018-1055-2

Xiao, J.J. and Tao, C. (2021). Consumer finance/household finance: the definition and scope. China Finance Review International, Vol. 11 No. 1, pp. 1-25. https://doi.org/10.1108/CFRI-04-2020-0032.

Xiao, J.J., Yan, C., Bialowolski, P. and Porto, N. (2021). Consumer debt holding, income and happiness: evidence from China. International Journal of Bank Marketing, 39 (5), pp. 789-809. https://doi.org/10.1108/IJBM-08-2020-0422.

Yu, C., Jia, N., Li, W. and Wu, R. (2022). Digital inclusive finance and rural consumption structure – evidence from Peking University digital inclusive financial index and China household finance survey. China Agricultural Economic Review, 14 (1), pp. 165-183. https://doi.org/10.1108/CAER-10-2020-0255.

Yuan KH, Yang M, and Jiang G. (2017). Empirically Corrected Rescaled Statistics for SEM with Small N and Large p. Multivariate Behav Res. 2017 Nov-Dec;52(6):673-698. doi: 10.1080/00273171.2017.1354759. Epub 2017 Sep 11. PMID: 28891682.

Zehra, N. and Singh, U.B. (2023). Household finance: a systematic literature review and directions for future research. Qualitative Research in Financial Markets, 15 (5), pp. 841-887. https://doi.org/10.1108/QRFM-11-2021-0186.

Zeng, S., and Yu, F.(2024). Does farming culture shape household financial decisions?. Journal of Corporate Finance, 84. https://doi.org/10.1016/j.jcorpfin.2023.102533.

Zhao,Y., Yao, Y., and Wang, M. (2024). Risk-free rate puzzle: An explanation of the heterogeneity of consumer risk attitudes under China’s income gap. International Review of Economics & Finance, 89, pp. 940-960, https://doi.org/10.1016/j.iref.2023.10.039.

|

No. |

Variables |

Strongly Disagree (1) |

Disagree (2) |

Neutral (3) |

Agree (4) |

Strongly Agree (5) |

|

1 |

Confident in effectively managing family expenditures |

|||||

|

2 |

Carefully plan and budget for family expenditures monthly |

|||||

|

3 |

Consider family expenditures reasonable relative to income |

|||||

|

4 |

Prioritize essential needs in family spending |

|||||

|

5 |

Reduce unnecessary expenditures to improve budget management |

|||||

|

6 |

Satisfied with the distribution of family expenses across categories |

|||||

|

7 |

Family spending habits align with values and priorities |

|||||

|

8 |

Adjust family spending to match changes in income or circumstances |

|||||

|

9 |

Believe family spending is controlled and not excessive |

|||||

|

10 |

Ensure fair distribution of family expenditures among members |

|||||

|

11 |

Regularly review family spending for improvement opportunities |

|||||

|

12 |

Maintain transparency in discussing household expenses |

|||||

|

13 |

Ensure household expenditures align with needs |

|

No. |

Variables |

Strongly Disagree (1) |

Disagree (2) |

Neutral (3) |

Agree (4) |

Strongly Agree (5) |

|

1 |

Household expenses tracked regularly to monitor spending patterns |

|||||

|

2 |

Household expenses allow for future savings without sacrificing essentials |

|||||

|

3 |

Family expenses compare favorably to others in similar situations |

|||||

|

4 |

Family spending aligns with long-term financial goals. |

|||||

|

5 |

Family expenses optimized to increase savings |

|||||

|

6 |

Comfortable balance between core and discretionary spending in the budget |

|||||

|

7 |

Household expenses support a comfortable standard of living |

|||||

|

8 |

Confidence in the ability to handle unexpected financial challenges related to expenses |

|||||

|

9 |

Household expenses adjusted to accommodate changes in income or financial goals |

|

No. |

Variables |

Strongly Disagree (1) |

Disagree (2) |

Neutral (3) |

Agree (4) |

Strongly Agree (5) |

|

1 |

Concerned about rising costs affecting household expenses |

|||||

|

2 |

Concerned about inflation impacting household expenses |

|||||

|

3 |

Proud of budget adherence and responsible expense management |

|||||

|

4 |

Worried about unexpected expenses breaking the budget |

|||||

|

5 |

Believe household expenses are influenced by external factors |

|||||

|

6 |

Worried about debt burden from family expenses |

|||||

|

7 |

Stressed about expenses exceeding the budget |