(1)

(1)Ekonomika ISSN 1392-1258 eISSN 2424-6166

2025, vol. 104(1), pp. 48–69 DOI: https://doi.org/10.15388/Ekon.2025.104.1.3

Banu Demirhan

Afyon Kocatepe University, Afyon, Turkey

E-mail: bdemirhan@aku.edu.tr

ORCID: https://orcid.org/0000-0002-0902-4629

Abstract. In the early 1980s, Turkey took steps towards financial liberalization. Accordingly, policymakers have implemented policies for the development of the financial system. Since then, developments in the banking sector have driven economic growth and met the private sector’s demand for funds. The research problem involves analyzing the relationship between financial development and economic growth in Turkey, which is crucial in determining the effectiveness of policies implemented for financial development. Determining the source through which financial development is vital for economic growth is also critical in designing these policies. This research examines the channels through which financial development impacts economic growth in Turkey. By using data from 1974 to 2023 for Turkey, this study conducted a Granger causality test based on VECM and the Toda Yamamoto method to analyze the causal relationship between economic growth and financial development. The analysis also included impulse response functions. Our study reveals that financial development contributes to economic growth. Policymakers should implement policies that prioritize the development of the financial system.

Keywords: Financial development, economic growth, VECM, Toda-Yamamoto, impulse response function, Turkey.

__________

Received: 11/08/2024. Revised: 09/09/2024. Accepted: 05/01/2025

Copyright © 2025 Erdal Demirhan. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Have Turkey’s financial development efforts over the years contributed to economic growth? If so, which components of the financial system play a role in this contribution? In 1980, the financial system began to advance in Turkey. The early 1980s witnessed significant measures implemented, including the development of the capital and interbank money markets. Furthermore, the Government implemented measures to liberalize foreign exchange legislation. These developments enhanced the efficiency of the financial system and had a positive effect on the real economy. Turkey adopted an open economy approach and liberalized its financial sector by implementing significant reforms since the 1980s. The process aimed to target the liberalization of capital flows on a domestic and international level and the expansion of trade volumes and foreign investment (Pamuk, 2019; Fırat, 2009).

Many studies on the relationship between financial development and economic growth use Turkish data. Studies analyzing the relationship between financial development and economic growth have mainly used time series methods. Examples of these studies are Kuzucu (2022), Coşkun and Kuloğlu (2022), Aşık (2023), Kılıç et al. (2019), and Eroğlu and Yeter (2021). These studies used loans to the private sector as an indicator of financial development. On the other hand, they did not analyze the development of the capital market. In addition, although the studies conducted by using quarterly data cover the data for 2023, the studies conducted using annual data include the latest data for 2019 only. Finally, the studies that used annual data did not incorporate significant structural changes in the Turkish economy into their models. Our study differs from recent studies in that it considers the development of the capital market, covers a more extended period, and examines structural changes in the Turkish economy. Therefore, the research problem in this study is whether the financial development policies implemented in Turkey for a long time contribute to economic growth. Another research problem is to determine the channels through which these policies contribute to economic growth. In other words, we aim to assess the contribution of the components of the financial system.

This study set out to answer the following questions: (1) Has financial development in Turkey since the 1980s impacted economic growth? (2) If so, what is the source of this impact? We expect the development of the Turkish banking system and capital markets to facilitate the transfer of savings to investments and boost consumption expenditures. Therefore, the study hypothesizes that financial development positively affects economic growth. Furthermore, given the high level of development in Turkey’s banking system, the study also hypothesizes that the source of financial development comes mainly from the banking system.

This study aims to investigate the channels through which financial development affects economic growth in Turkey. In this context, we will determine whether the banking system or the capital market is more effective for economic growth. For this purpose, we will frequently use time series methods, as used in the literature. First, we will apply VECM and impulse-response functions for our analyses. Next, we will conduct Toda-Yamamoto analysis to provide methodological support. We will also determine short-term and long-term effects by using these methods.

This study examines the causal relationship between financial development and economic growth in Turkey from 1974 to 2023. This study makes various contributions to the existing literature. First, this research analyzes the relationship between financial development and economic growth over a very long period, considering the structural breaks in the Turkish economy. The financial system in Turkey has undergone significant development since the 1980s; therefore, this study provides a long-term perspective on the consequences of the combinations of financial development. Secondly, the study uses components of financial development in Turkey in econometric models. In this framework, we will determine the effects of the banking system and the capital market on economic growth separately.

We organize the rest of the article as follows: Section 2 presents the theoretical and empirical literature. Section 3 describes the model specification and data. Section 4 includes the empirical estimations. Section 5 presents the robustness check. Section 6 presents a discussion, and the final section comprises the concluding remarks.

The financial system transfers surplus funds from economic units to those in need. This leads to an increased investment and economic growth. Current developments in the financial system enhance its positive impact on economies. The fact that the total value of all financial assets and liabilities exceeds that of the entire economy demonstrates the financial system’s critical role in the modern world. The significance of financial tools to economic growth is evident during the economy’s up and down cycles (Rutkauskas, 2015). King and Levine (1993) found a strong correlation between financial development, real per capita GDP growth, physical capital accumulation, and improvements in physical capital efficiency.

Schumpeter (1911) conducted the first study of the correlation between financial development and economic growth, thereby marking the beginning of theoretical explanations on this subject. According to the prevailing viewpoint, supported by Schumpeter’s seminal study in 1911, the stock market’s growth benefits the economy by providing liquidity and a method for distributing while minimizing risks. Furthermore, it facilitates the effective distribution of resources toward profitable projects, minimizes expenses related to information and transactions, and eventually empowers organizations to pursue successful ventures (Ibrahim, 2011). According to the Schumpeter’s model, the financial sector’s growth is one of the main factors that trigger economic growth.

Many economists have recognized the crucial role of financial markets in economic development. Schumpeter (1934) noted the role of financial intermediaries in directing resources toward more productive investments, while Bagehot (1873) and Hicks (1969) emphasized the significance of financial development for the economy. The authors believed that the presence of financial markets and institutions played a crucial role in facilitating the industrial revolution. This was achieved by enabling enterprises to borrow and lend, encouraging the adoption of new technologies, and pursuing riskier yet potentially more profitable investments (Capasso, 2004). Moreover, McKinnon (1973) and Shaw (1973) describe financial liberalization as establishing higher interest rates that equalize the demand and supply of savings. According to the two authors, higher interest rates will enhance savings and financial intermediation while improving savings efficiency (Balassa, 1990).

Patrick (1966) provided two definitions of the connection between financial development and economic growth. Economic growth closely correlates with the increasing demand for financial services. Financial development enables the effective transformation of savings into investments, which supports economic growth. Moreover, according to Robinson (1952), there is a correlation between the growth of the financial system and economic development. Certain viewpoints argue that financial development does not impact economic growth. The pioneer of these investigations, Lucas (1988), highlighted that physical and human capital and technological advancements drive economic progress.

Several analyses in the literature on the relationship between financial development and economic growth employ time series techniques for a specific country, while others rely on estimating panel data models that combine data from many countries. Some studies in the literature on financial development and economic growth employ time series techniques that focus on a particular country, while others combine data from multiple countries to construct panel data models. While several of these models focus on the influence of financial development on economic growth, others examine the causal relationship between these two variables.

Recent studies that conduct causality analyses based on panel data models demonstrate the relationship between economic growth and financial development. Mtar and Belazreg (2021) can be given as an example of these studies. Once more, recent studies (e.g., Nguyen et al., 2022; Pradhan et al., 2013; Çınar et al., 2024) have proven a two-way causality relationship between economic growth and financial development.

The relationship between financial development and economic growth in countries may also depend on their income levels. Canbaloğlu and Gürgün (2019) conducted a study where they found that there was no relationship between financial development and economic growth in countries in the upper-middle and high-income categories. Despite this, they discovered a unidirectional causality, indicating that financial development drives economic growth in countries classified as low- and lower-middle income.

Several studies have examined the relationship between financial development and economic growth by employing panel data techniques and combining data for country groups. For instance, the studies conducted by Ibrahim and Alagidede (2018) and Asante and Takyi (2023) have determined that the development of financial systems supports economic growth in sub-Saharan countries. Ahmed (2016) conducted another study on countries in sub-Saharan Africa, which found that international financial integration positively impacts economic growth by enhancing financial development. Bist (2018) demonstrates that financial development in low-income countries positively influences economic growth. In their study, Ekanayake and Thaver (2021) employed a large dataset to determine various panel relationships that exhibit differences across various country groups within developing countries. According to Abbas et al. (2022), financial development in middle-income countries contributes to economic growth, with a particularly significant impact in upper-middle-income countries. While most of the literature indicates that financial development has a positive effect on economic growth, some studies suggest that financial development has a negative impact on economic growth, as shown by Wen et al. (2022).

In addition to the impact of financial development on economic growth, some studies examine the consequences of financial reforms. For instance, Boikos et al. (2022) determined that financial reforms have a greater impact on economic growth than financial development in developed and developing countries. Furthermore, researchers have examined the relationship between financial development and economic growth on a sectoral basis. Ustarz et al. (2021) conducted a study that demonstrated the positive influence of financial development on the growth of the agriculture and service sectors. After a certain point, financial development begins to influence the industry sector.

Furthermore, researchers have conducted studies in the literature by using the panel data technique, employing data from industrialized countries. Swamy and Dharani (2019) found a long-term inverted U-shaped relationship between financial development and economic growth. Financial development facilitates firms’ financing of private investment, thereby supporting economic growth. Castro et al. (2015) used firm-level data to demonstrate how financial development in Brazil influences investments of firms.

Many studies have been conducted in Turkey to investigate the causal relationship between economic growth and financial development. Studies examining the causal connection between financial development and economic growth in Turkey have produced different findings. While some studies, such as Aşık (2023), Acaravcı et al. (2007), Eroğlu and Yeter (2021), and Şeyranlıoğlu (2024), indicate that financial development leads to economic growth, other studies, such as Aslan and Küçükaksoy (2006), Kandır et al. (2007), Taşseven and Yılmaz (2022), Atay (2020), and Özcan and Arı (2011), suggest that economic growth leads to financial development. Some studies (Demirhan et al., 2011; Kuzucu, 2022; Coşkun and Kuloğlu, 2022; Kılıç et al., 2019) have found a bidirectional causal relationship. Moreover, Atgür (2019) demonstrates that financial development does not significantly impact economic growth.

Furthermore, several studies in the literature indicate that there is no causal relationship between financial development and economic growth. Such studies include Nur (2021) and Tekin et al. (2024), Shahzadi et al. (2023), Çetin et al. (2023), Alhassan et al. (2022), and Li et al. (2021) have all recently conducted studies which undertook to estimate the relationship between financial development and variables such as energy consumption and air pollution. Moreover, Sghaier (2023), Asteriou et al. (2024), and Emara and Said (2021) have conducted research indicating that the influence of financial development on economic growth is dependent on trade openness, fiscal policy, and governance. Studies such as those performed by Younsi and Bechtini (2020) have investigated the influence of financial development on income inequality.

Econometric estimations cover the years 1974 to 2023. The reason for selecting this period was the availability of data. The models use annual time series data. The data used for the models is a yearly time series dataset. Financial development indicators were based on two variables. The first variable is the total bank credit to the private sector, expressed as a percentage of GDP (cre); the second is the share of the broadly defined money supply in GDP (m2). We depicted that previous studies frequently used these indicators. Since our research covered an extended period, we were able to obtain these indicators consistently. The dependent variable, economic growth, is defined as the natural logarithm of the real GDP (gdp). The control variable, trade openness, is the sum of exports and imports of goods and services expressed as a percentage of GDP (open). We sourced all variables from the World Bank (2024). After 1980, outward-oriented policies were implemented in the Turkish economy, and financial liberalization began. This situation made significant contributions to financial development. In addition, the Turkish economy faced two major crises in 1994 and 2001, independent of the global crises. In this context, we included dummy variables in the econometric models for the period after 1980 and the 1994 and 2001 crises. The Appendix displays summary statistics and correlation matrix in Tables A1 and A2.

The first step in analyzing the relationship between financial development and economic growth is to determine if the series has unit roots. This study employs the Augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) unit root tests to determine whether the series in question has a unit root (Dickey and Fuller, 1979 and 1981; Phillips, 1987; Phillips and Perron, 1988). We will proceed with our investigation by applying cointegration tests if we find a unit root, or I(1), in the series. This study employs the Johansen multivariate cointegration technique, as Johansen (1988) and Johansen and Juselius (1990) suggested. This method offers two likelihood ratio tests, employing trace and maximum eigenvalue statistics. In the trace and maximum eigenvalue tests, the null hypothesis is that the number of cointegrating vectors is less than or equal to r, where r is 0, 1, or 2. In the λtrace and λmax tests, the null hypothesis is tested against at least r + 1 cointegrating vector and r + 1 cointegrating vector, respectively.

We will perform the causality test after the cointegration test. According to Engle and Granger (1987) and Granger (1988), the cointegration of two time series variables results in at least a unidirectional Granger causality. Granger (1988) asserts that when cointegration exists between I(1) variables, the Granger causality test necessitates the incorporation of the error correction term derived from the cointegration equation. When there is a long-term relationship between the variables, we apply the causality analysis using VECM, as shown below.

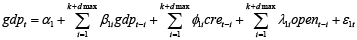

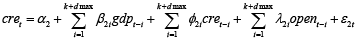

(1)

(1)

(2)

(2)

(3)

(3)

where ∆ is the difference operator, εt is zero mean, serially uncorrelated random error terms, p represents the number of lags, and zt-1 is the error correction term, the lagged values of the error term derived from the estimated long-term cointegration relationship. The error correction term shows the short-run deviations from the long-run equilibrium, reflecting the speed of adjustment of any disequilibrium to the long-run equilibrium. If there is no cointegration relationship, we estimate Equations (1–3) without using error correction terms. The choice of the model in this study relies on the existing cointegration relationship. We employ dummy variables in VECM to explore the effects of the 1994 and 2001 crises and the period of financial liberalization following 1980. We assign the dummy variable to one during periods of crisis and financial liberalization, and to zero otherwise.

To examine causality from financial development to economic growth, we computed the Wald test statistics under the null hypothesis that all coefficients of φ1i=0 as a group. Similarly, when performing the Wald test to determine causation from economic growth to financial development, the null hypothesis being tested is that all coefficients of β2i=0 as a group. After estimating Equations (1–3), if the null hypothesis of all coefficients of φ1i=0 or the coefficient of ψ1i=0 is rejected, then it is concluded that there is a causality from financial development to economic growth. On the other hand, if the null hypothesis of all coefficients of β2i=0 or the coefficient of ψ1i=0 is rejected, then the causality relationship is from economic growth to financial development.

We will also conduct causality analyses using the m2 variable, a different financial development indicator, instead of the cre variable in Equations (1–3). Rejecting the null hypothesis that the explanatory variables as a group are different from zero indicates a short-run causality from the explanatory variables to the dependent variables. The statistical significance of the coefficient ψ1i indicates long-term causality from explanatory variables to dependent variables.

Table A1 in the Appendix presents the descriptive statistics for the variables used in the econometric model. The Jarque-Bera test reveals a normal distribution of all variables at the 5% level. The standard deviation indicates the extent of dispersion in the data from the mean value. The data show the highest variation in cre. Table A2 in the Appendix displays the correlation between the variables. Table A2 shows a strong correlation between gdp, cre, m2, and open.

Table 1 represents the ADF and PP test results for the levels and first differences of all variables used in the econometric models. According to the ADF and PP tests, all variables are integrated in order one in first differences; thus, all variables are I(1) or non-stationary. We determine the optimal lag by minimizing Akaike’s FPE criterion. Since the unit root test results show that all variables are I(1), we can use the Johansen cointegration technique. We will, therefore, perform both short-term and long-term analyses. Table 2 presents the results of the Johansen cointegration test for the cre and m2 variables, which represent financial development indicators. Table 2 indicates that there is a statistically significant cointegration relationship between the variables. Therefore, we conclude that gdp, cre, and open have a long-run relationship. This relationship is also valid when m2 is considered the financial development variable. Table 2 displays the normalized cointegrating coefficients at the bottom.

|

Series |

ADF |

PP |

|

gdp |

0.40 (0) |

0.68 (5) |

|

∆gdp |

-6.80 (0)*** |

-6.87 (4)*** |

|

cre |

-2.19 (0) |

-0.94 (3) |

|

∆cre |

-2.06 (2) |

-4.71(1)*** |

|

m2 |

1.80 (10) |

-0.79 (17) |

|

∆m2 |

-5.35 (3)*** |

-16.03 (47)*** |

|

open |

-0.74 (2) |

-0.71 (7) |

|

∆open |

-6.71(1)*** |

-7.06 (12)*** |

|

(gdp, cre, open) |

(gdp, m2, open) |

||||||

|

Hypothesized No. of CE(s) |

Trace Statistic |

0.05 Critical Value |

Prob. |

Hypothesized No. of CE(s) |

Trace Statistic |

0.05 Critical Value |

Prob. |

|

r = 0* |

45.74 |

29.79 |

0.0009 |

r = 0* |

39.15 |

29.79 |

0.0305 |

|

r ≤ 1 |

12.60 |

15.49 |

0.3312 |

r ≤ 1 |

11.02 |

15.49 |

0.7438 |

|

r ≤ 2 |

1.29 |

3.84 |

0.5184 |

r ≤ 2 |

1.62 |

3.84 |

0.2215 |

|

gdp= 24.95 + 0.01 cre + 0.04 open (0.001) (0.002) |

|||||||

|

gdp= 24.87 + 0.02 m2 + 0.03open (0.005) (0.005) |

|||||||

Below Table 2, we display the results of the cointegration equation showing the long-term effect of financial development indicators on economic growth. The first equation shows that the effect of credit to the private sector on economic growth is positive. The second equation shows that the broadly defined money supply contributes positively to economic growth. According to the cointegration equation, both financial development indicators positively affect economic growth in the long run.

The Granger causality test based on VECM investigated the causal relationship between financial development and economic growth. The test results indicate that the credit supply to the private sector is the leading cause of short-term and long-term economic growth. Using money supply growth as the indicator for financial development revealed no causal relationship. The causality test results show a short-term causality from the openness indicator to bank credits given to the private sector. In addition, there is a two-way causality between the openness indicator and broadly defined monetary growth in the short term. Table 4 presents diagnostic tests at the bottom to assess the robustness of the model. Diagnostic tests include the Breusch-Godfrey serial correlation LM test, the Breusch-Pagan-Godfrey heteroskedasticity tests, and Jarque-Bera normality tests. The diagnostic test results show the absence of serial correlation, the absence of heteroskedasticity, and the presence of normality.

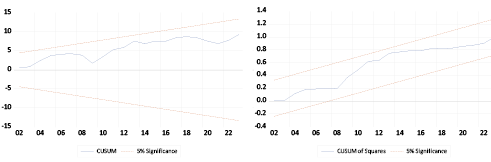

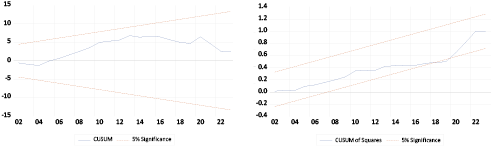

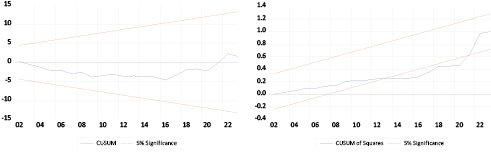

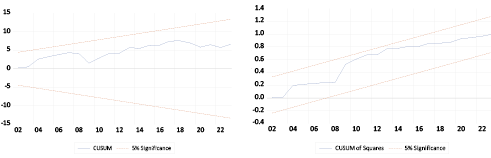

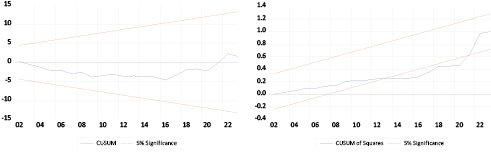

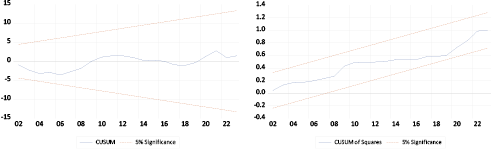

We apply the CUSUM and CUSUM-square tests to determine the structural stability of Equations (1–3). The CUSUM test is based on the cumulative sum of the recursive residuals, whereas the CUSUM-square test is based on the squared recursive residuals. According to the test results, the models have structural stability in general. CUSUM and CUSUM square tests for models where the dependent variables are gdp, cre, and m2 are shown in the Appendix in Figures (A1–A6).

|

Dependent Variable |

∆gdp |

∆cre |

∆open |

zt-1 (t) |

|

∆gdp |

- |

8.16** |

1.73 |

-0.10** |

|

∆cre |

4.60 |

- |

11.98*** |

- |

|

∆open |

3.47 |

4.01 |

- |

- |

|

Diagnostic Tests |

||||

|

Dependent Variable |

J.B. |

LM(2) |

B-P-G |

|

|

∆gdp |

0.11 |

0.75 |

0.90 |

|

|

∆cre |

0.52 |

0.36 |

0.55 |

|

|

∆open |

0.65 |

0.57 |

0.34 |

|

|

Dependent Variable |

∆gdp |

∆m2 |

∆open |

zt-1 (t) |

|

∆gdp |

- |

3.07 |

1.84 |

-0.10** |

|

∆m2 |

0.92 |

- |

15.29*** |

- |

|

∆open |

10.87** |

20.45*** |

- |

- |

|

Diagnostic Tests |

||||

|

Dependent Variable |

J.B. |

LM(2) |

B-P-G |

|

|

∆gdp |

0.15 |

0.32 |

0.92 |

|

|

∆m2 |

0.71 |

0.90 |

0.71 |

|

|

∆open |

0.19 |

0.10 |

0.70 |

|

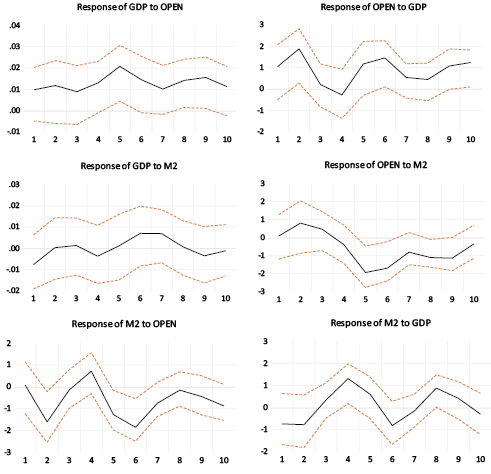

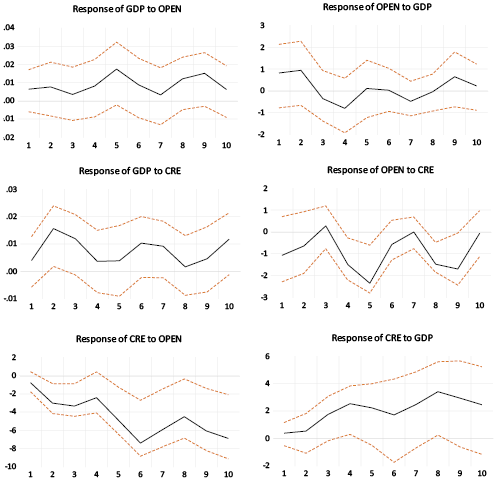

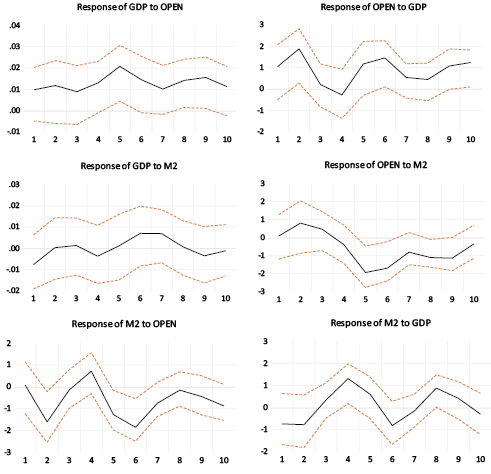

Impulse response function analyses were conducted to determine the relationship between financial development and economic growth. Impulse response functions describe the response of other variables to a one-standard deviation shock in the variables. Figures 1 and 2 display the impulse response functions. It is observed that economic growth responds positively to loans to the private sector, which is an indicator of financial development, in every period (first row, third chart in Figure 1). Furthermore, the response of bank credits to the private sector to economic growth is positive in all periods (second row, third chart in Figure 1). The response of economic growth to the broadly defined money supply, one of the financial development indicators, fluctuates but is generally positive (first row, third chart in Figure 2). On the other hand, the broadly defined response of the money supply to economic growth also shows an up-and-down trend (second row, third chart in Figure 2).

In the first part of the study, we carried out the causality relationship between financial development and economic growth based on VECM. In this part, we carried out two robustness checks to determine the reliability and validity of the findings obtained. Firstly, we conducted a Toda-Yamamoto (1995) (TY) causality analysis to ascertain the causal relationship between the variables. Second, we used market capitalization as the financial development indicator (cap) for the robustness check. In TY causality analyses, the variables do not need to be stationary at the same degree and have a cointegration relationship. We determine the maximum integrated degree (dmax) of the variables and the appropriate VAR model lag (k) when performing the Toda-Yamamoto causality test. Equations (4–6) show the models to which the Toda-Yamamoto causality test will apply. The stationarity test results (Table 1) showed that all variables were I(1). The optimal lag of the VAR model was determined according to the AIC criterion, which was 4. To estimate Equations (4–6), we used 5 lags (dmax=1 + k=4).

(4)

(4)

(5)

(5)

(6)

(6)

Tables 5 and 6 show the Toda-Yamamoto causality analysis results for the variables m2 and cre representing financial development indicators. The test results indicate a causality from the cre variable to the gdp variable, as in the VECM-based causality analysis (Table 3). In the Toda-Yamamoto causality analysis, unlike the VECM-based causality analysis, there is a causality from gdp to both cre and m2 variables. According to the Toda-Yamamoto analysis, these results indicate a two-way causality between cre and gdp. Diagnostic tests show that the models are generally acceptable. CUSUM and CUSUMSQ tests also show that there was no structural break during the period examined. The results of these tests are not given due to space constraints. They can be provided upon reasonable request.

|

Dependent Variable |

gdp |

cre |

open |

|

gdp |

- |

15.97*** |

5.78 |

|

cre |

11.41** |

- |

31.36*** |

|

open |

4.17 |

6.29 |

- |

|

Diagnostic Tests |

|||

|

Dependent Variable |

J.B. |

LM(2) |

BPG |

|

gdp |

0.01 |

0.24 |

0.86 |

|

cre |

0.49 |

0.01 |

0.64 |

|

open |

0.60 |

0.01 |

0.46 |

|

Dependent Variable |

gdp |

m2 |

open |

|---|---|---|---|

|

gdp |

- |

2.75 |

9.02* |

|

m2 |

16.40*** |

- |

22.99*** |

|

open |

8.96* |

21.02*** |

|

|

Diagnostic Tests |

|||

|

Dependent Variable |

J.B. |

LM(2) |

BPG |

|

gdp |

0.62 |

0.49 |

0.30 |

|

m2 |

0.59 |

0.11 |

0.73 |

|

open |

0.11 |

0.12 |

0.76 |

In the second robustness check, we use market capitalization as a percentage of GDP (cap) as a proxy for financial development. Since we obtained market capitalization data between 1993 and 2022 from the World Bank, we conducted the causality analysis for this period. We detected that the market capitalization variable is stationary at the level I(0). Since the economic growth and openness variables are stationary in their first differences, the Toda-Yamamoto test was performed in the causality analysis. We estimated Equations (4–6) by using the cap variable as the financial development indicator instead of the cre variable. The optimal lag of the VAR model was determined according to the AIC criterion, which was 2. We estimated Equations (4–6) with 3 lags (dmax=1 + k=2). Table 7 displays the results of the Toda-Yamamoto causality analysis for the variable cap representing the financial development indicator.

|

Dependent Variable |

gdp |

cap |

open |

|

gdp |

- |

19.45*** |

1.13 |

|

cap |

0.73 |

- |

0.70 |

|

open |

4.24 |

1.15 |

- |

|

Diagnostic Tests |

|||

|

Dependent Variable |

J.B. |

LM(2) |

BPG |

|

Gdp |

0.63 |

0.20 |

0.09 |

|

Cap |

0.44 |

0.29 |

0.56 |

|

open |

0.84 |

0.10 |

0.45 |

Table 7 indicates a one-way causality from the cap variable to gdp. The results of the causality analyses (Table 3), which used loans to the private sector to indicate financial development, are consistent with this finding. As seen in Table 7, there is no causality from economic growth to the cap variable. This finding is also consistent with the results presented in Table 3. Diagnostic tests show that the models are generally acceptable. CUSUM and CUSUMSQ tests also show that there was no structural break during the period under examination. The outcomes of these tests are not given due to space constraints. They can be provided upon reasonable request. Robustness check results generally show that the causality from financial development to economic growth is valid. These results confirm the findings based on VECM.

This study aimed to analyze the relationship between financial development and economic growth in Turkey. The results indicate a unidirectional causal relationship from financial development to economic growth, both in the short and long term, over the period under investigation in Turkey. The results of our research demonstrate that financial development contributed to economic growth in Turkey. Considering the TY method, we find a causality from economic growth to financial development.

The causality from financial development to economic growth is valid for loans provided to the private sector and market capitalization. This result shows that economic growth is quite sensitive to developments in the banking system and capital market. The broadly defined money supply, representing financial development, does not cause economic growth. This is because the expansion in the money supply could lead to high inflation, negatively affecting economic growth. Moreover, the impact of economic growth on financial development is mainly due to the banking system. In periods of economic growth, the increasing investment appetite can increase the loans provided to the private sector by the banking system. Additionally, financing increased consumption expenditures, mainly through individual loans, during economic growth may have contributed to this outcome. The results show that capital markets in Turkey can be more sensitive to foreign capital inflows and political developments than to the development of the economy.

These results confirm the validity of the Schumpeterian theory, which posits that financial development is a causal factor in Turkey’s economic progress and corroborates Patrick’s (1966) supply-leading approach. On the other hand, Robinson’s (1952) ‘demand following hypothesis’ corroborates the findings from the TY method. In this context, the results run in parallel with the theoretical explanations in this field.

Turkey has implemented policies for developing and stabilizing financial markets for many years. The findings are essential because they provide evidence that Turkey’s financial development and financial stability policies have yielded positive results. The possible results of the findings can be explained as follows: (1) The development of the financial system in Turkey will positively affect the economy in the future. (2) Giving more weight to the development of the banking system compared to the capital market will significantly impact the economy. (3) Bank loans are a tool for implementing policies to stimulate the economy. (4) There will be an acceleration in bank loans during periods of economic growth.

The results of our research support the findings of previous studies (Aşık, 2023; Acaravcı et al., 2007; Şeyranlıoğlu, 2024; Eroğlu and Yeter, 2021), which showed that financial development led to economic growth. Moreover, the finding that economic growth causes financial development, obtained by using the TY method, confirms the studies of Özcan and Arı (2011) and Atay (2020).

Policymakers can benefit from the significant policy recommendations provided by the empirical findings. The research findings indicate that the financial system’s growth in Turkey since the 1970s contributed to economic growth. Implementing policies to enhance the financial system is crucial to sustaining an average growth rate of 4.5 percent. The empirical results suggest that the financial system is vital for economic growth in Turkey, which is an economy with a robust banking system. Policymakers must prioritize policies designed to eliminate constraints on the financial system’s development and ensure financial stability. High inflation has been an ongoing problem in Turkey for a long time. To prevent inflation, policymakers limit the credit possibilities of the financial system, which, in turn, restricts the financial system’s influence on economic growth. In this context, it is favorable to implement fiscal and monetary policies rationally so that to ensure that the financial system can perform its functions to the highest level.

Further studies are needed to investigate whether the impact of financial development on economic growth is sensitive to monetary and fiscal policies. Monetary and fiscal policies can play a role in the effect of financial development on economic growth. Implementing monetary policies that effectively reduce inflation will decrease uncertainty and stimulate the private sector’s demand for credit, thereby fostering economic growth. Furthermore, the establishment of fiscal discipline will be the foundation for allocating additional resources to the private sector, thereby supporting economic growth. Considering the current implementation of economic policies in Turkey which prioritize price stability and financial stability, further study is necessary to investigate the relationship between the financial system and monetary policies. Moreover, further studies will provide more detailed information on the effects of financial development on sectoral growth rates.

Certain limitations of this study could be addressed in future research. Firstly, we performed analyses with limited data, as we only obtained the annual data. Second, significant economic and political developments affected the Turkish economy during the period examined. Our models incorporate structural changes and crises but do not include economic policies implemented since 2021. This is due to the unavailability of time data necessary to measure the impact of these policies. Despite all these limitations, the study findings provide important information about the relationships between financial development and economic growth.

Analyzing the relationship between financial development and economic growth, as well as determining the source of financial development in Turkey, is crucial for assessing the effectiveness of policies implemented for financial development. This study analyzed Turkey’s data of 1974–2023 with various time series methods. The results show that financial development contributed to economic growth during the discussed period. This contribution comes mainly from the banking system. The results show a unidirectional causal relationship from financial development to economic growth in Turkey in the short and long term. Although economic growth affects financial development, methodological differences are observed. The results confirm the validity of the Schumpeterian theory that financial development is a trigger factor in economic growth. The results also support Patrick’s (1966) supply-leading approach.

Policymakers in Turkey have long encouraged financial market development and stability. Evidence suggests that Turkey’s financial development and stability measures are working. In this context, the development of the financial system in Turkey will significantly impact economic growth in the future. In particular, the development of the banking system will increase this impact. Empirical evidence supports the argument that policies aimed at enhancing financial development in Turkey yield gains by stimulating economic growth. In this context, it is beneficial to continue implementing policies to develop the financial system and ensure financial stability. These policies will enable the private sector to access the funds it needs and increase economic growth.

Abbas, Z., Afshan, G. & Mustifa, G. (2022), The effect of financial development on economic growth and income distribution: An empirical evidence from lower-middle and upper-middle income countries. Development Studies Research, 9. https://doi.org/10.1080/21665095.2022.2065325

Acaravcı, A., Öztürk İ. & Kakilli S.A. (2007). Finance-growth nexus: Evidence from Turkey. International Research Journal of Finance and Economics, 11, 30-40, http://dx.doi.org/10.2139/ssrn.1104693

Ahmed, A.D. (2016). Integration of financial markets, financial development and growth: Is Africa different? Journal of International Financial Markets, Institutions and Money, 42, 43-59. https://doi.org/10.1016/j.intfin.2016.01.003

Alhassan, H., Kwakwa, P.A. & Donkoh, S. A. (2022), The interrelationships among financial development, economic growth and environmental sustainability: Evidence from Ghana. Environmental Science and Pollution Research, 29, 37057-37070. https://doi.org/10.1007/s11356-021-17963-9

Asante, G. N. & Takyi, P. O. (2023). The impact of financial development on economic growth in sub-Saharan Africa. Does institutional quality matter? Development Studies Research, 10, https://doi.org/10.1080/21665095.2022.2156904

Aslan, Ö. & Küçükaksoy İ. (2006). Finansal gelişme ve ekonomik büyüme ilişkisi: Türkiye ekonomisi üzerine ekonometrik bir uygulama. Ekonometri ve İstatistik, 4, 12-28.

Asteriou, D., Spanos, K. & Trachanas, E. (2024). Financial development, economic growth and the role of fiscal policy during normal and stress times: Evidence for 26 EU countries. International Journal of Finance and Economics, 29 (2), 2495-2514 https://doi.org/10.1002/ijfe.2793.

Aşık, B. (2023). The asymmetric relationship between financial development and economic growth in Turkish economy. Journal of Emerging Economies and Policy, 8(2). 543-558.

Atay, E. (2020). Finansal gelişme ve ekonomik büyüme ilişkisi: Türkiye Örneği (1961-2015). Haliç Üniversitesi Sosyal Bilimler Dergisi. 3/2, 305-326.

Atgür, M. (2019). Finansal gelişme, ticari açıklık ve ekonomik büyüme ilişkisi: Türkiye örneği. Atatürk Üniversitesi İktisadi ve İdari Bilimler Dergisi, 33(2), 553-571.

Bagehot, W. (1873). Lombard Street. Richard D. Irwin, Homewood. (1962 Edition)

Balassa, Bela A. (1990). Financial liberalization in developing countries. Studies in Comparative International Development, 25 (4), 56-70. https://link.springer.com/article/10.1007/BF02806290

Bist, J. P. (2018). Financial development and economic growth: Evidence from a panel of 16 African and non-African low-income countries. Cogent Economics and Finance, 6.

Boikos, S., Panagiotidis, T. & Voucharas, G. (2022). Financial development, reforms and growth. Economic Modelling, 108 (2). https://doi.org/10.1016/j.econmod.2021.105734

Canbaloğlu, B. & Gürgün, G. (2019). Finansal sektör gelişimi, ticari açıklık ve ekonomik büyüme ilişkisi: Yükselen piyasa ve gelişmekte olan ekonomiler panel VAR örneği. Yönetim ve Ekonomi Araştırmaları Dergisi, 17 (1), 441-457 http://dx.doi.org/10.11611/yead.423374

Capasso, S. (2004). Financial markets, development and economic growth: Tales of informational asymmetries. Journal of Economic Surveys, 18 (3), 267-292. https://doi.org/10.1111/j.0950-0804.2004.00222.x

Castro F., Kalatzis, A. E.G. and Martins-Filhoc, C. (2015). Financing in an emerging economy: Does financial development or financial structure matter? Emerging Markets Review, 23, 96-123. https://doi.org/10.1016/j.ememar.2015.04.012

Çetin, M., Sarıgül, S.S., Topcu, B.A., Alvarado, R. & Karataser, B. (2023). Does globalization mitigate environmental degradation in selected emerging economies? assessment of the role of financial development, economic growth, renewable energy consumption and urbanization. Environmental Science and Pollution Research, 30.100340-100359. https://doi.org/10.1007/s11356-023-29467-9

Çınar, M., Cebecioğlu, F. F. & Taş, C. (2024). Finansal gelişme ve ekonomik büyüme arasındaki nedensel ilişki: Karşılaştırmalı panel veri analizi. Erzurum Teknik Üniversitesi Sosyal Bilimler Enstitüsü Dergisi, 18, 59-77. https://doi.org/10.29157/etusbed.1302825

Coşkun H. & Kuloğlu, B. K. (2022). Türkiye’de banka kredilerinin ekonomik büyüme üzerindeki etkisi. International Journal of Economics, Business and Politics, 6 (1), 44-58. https://doi.org/10.29216/ueip.1076973

Demirhan, E., Aydemir, O. & İnkaya, A. (2011). The direction of causality between financial development and economic growth: Evidence from Turkey. International Journal of Management, 28 (1), 3-19.

Dickey, D. A. & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74, 427- 431.

Dickey, D. A. & Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica, 49, 1057-1072. https://doi.org/10.2307/1912517

Ekanayake, E.M. & Thaver, R. (2021). The Nexus between financial development and economic growth: Panel data evidence from developing countries. Journal of Risk and Financial Management, 14(10), 1-24, https://doi.org/10.3390/jrfm14100489

Emara, N. & El Said, A. (2021). Financial inclusion and economic growth: The role of governance in selected MENA countries. International Review of Economics & Finance. 75, 34-54. https://doi.org/10.1016/j.iref.2021.03.014

Engle, R.F. & Granger, C.W.J. (1987). Cointegration and error correction: Representation, estimation, and testing. Econometrica, 55, 251-276.

Eroğlu, İ. & Yeter, F. (2021). Finansal gelişme ve ekonomik büyüme ilişkisi: Türkiye için nedensellik analizi. Journal of Emerging Economies and Policy, 6(2), 272-286.

Fırat, E. (2009). Türkiye’de 1980 sonrasi yaşanan üç büyük kriz ve sonuçlarının ekonomi-politiği. Selçuk Üniversitesi İİBF Sosyal ve Ekonomik Araştırmalar Dergisi, 9( 17), 501-524.

Granger, C.W.J. (1988). Some recent developments in the concept of causality. Journal of Econometrics, 39, 199-211.

Hicks, J. (1969). A theory of economic history, Oxford, Claredon Press.

Ibrahim, M.H. (2011). Stock market development and macroeconomic performance in Thailand. Inzinerine Ekonomika-Engineering Economics, 22 (3), 230-240. http://dx.doi.org/10.5755/j01.ee.22.3.513

Ibrahim, M. & Alagidede, P. (2018). Effect of financial development on economic growth in sub-Saharan Africa. Journal of Policy Modeling, 40 (6), 1104-1125. https://doi.org/10.1016/j.jpolmod.2018.08.001

Johansen, S. (1988). Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control, 12 (2-3), 231-254.

Johansen, S. & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration-with applications to the demand for money. Oxford Bulletin of Economics and Statistics, 52, 169-210.

Kandır, S., İskenderoğlu, Ö. & Önal B. (2007). Finansal gelişme ve ekonomik büyüme arasındaki ilişkinin araştırılması. Çukurova Üniversitesi Sosyal Bilimler Enstitüsü Dergisi, 16(2), 311-326.

Kılıç, M., Gürbüz, A. & Ayrıçay, Y. (2019). Finansal gelişme ve ekonomik büyüme ilişkisi: Türkiye örneği. Kahramanmaraş Sütçü İmam Üniversitesi İİBF Dergisi, 9 (1), 53-68.

King, R. G. & Levine, R. (1993). Finance and growth: Schumpeter might be right. Quarterly Journal of Economics, 108 (3), 717-737. https://doi.org/10.2307/2118406

Kuzucu, S. C. (2022). Türkiye’de kullandırılan kredilerin ekonomik büyüme üzerindeki etkisi. Bilge Uluslararası Sosyal Araştırmalar Dergisi, 6 (2), 128-132. https://doi.org/10.47257/busad.1216074

Li, F., Wu, Y-C., Wang, M. C., Wong, W. K. & Xing, Z. (2021). Empirical study on CO2 emissions, financial development and economic growth of the BRICS countries. Energies, 14 (21). https://doi.org/10.3390/en14217341

Lucas, R. E. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22, 3-42. https://doi.org/10.1016/0304-3932(88)90168-7

McKinnon, R. I. (1973). Money and capital in economic development. Washington, D.C., The Brookings Institution.

Mtar, K. & Belazreg, W. (2021). Causal nexus between innovation, financial development, and economic growth: The case of OECD countries. Journal of the Knowledge Economy, 12, 310-341. https://doi.org/10.1007/s13132-020-00628-2

Nguyena, H.M., Le, Q. T-T., Ho, C.M., Nguyen, T.C. & Vob, D.H. (2022). Does financial development matter for economic growth in the emerging markets? Borsa Istanbul Review 22 (4), 688-698. https://doi.org/10.1016/j.bir.2021.10.004

Nur, T. (2021). Finansal açıklık, finansal gelişme ve ekonomik büyüme ilişkisi: Türkiye üzerine eşbütünleşme ve nedensellik analizi. Ekonomi, Politika ve Finans Araştırmaları Dergisi, 6 (3), 627-645. https://doi.org/10.30784/epfad.823635

Özcan, B. & Arı A. (2011). Finansal gelişme ve ekonomik büyüme arasındaki ilişkinin ampirik bir analizi: Türkiye örneği. Business and Economics Research, 2(1), 121-142.

Pamuk, Ş. (2019). Türkiye’de 1980 sonrasında iktisadi politika ve kurumların evrimi. İktisat ve Toplum, 100, 7-11.

Patrick, H.T. (1966). Financial development and economic growth in underdeveloped countries. Economic Development and Cultural Change, 14(2), 174-189. http://dx.doi.org/10.1086/450153

Phillips, P. (1987). Time series regression with unit roots. Econometrica, 55, 277- 301.

Phillips, P. C. B. & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75( 4), 335-346. https://doi.org/10.1093/biomet/75.2.335

Pradhan, R.P., Dasgupta, P., & Samadhan, B. (2013) Finance development and economic growth in BRICS: A panel data analysis. Journal of Quantitative Economics, 11(1-2), 308-322

Robinson, J. (1952). The rate of interest and other essays. Macmillan, London.

Rutkauskas, V. (2015). Financial stability, fiscal sustainability and changes in debt structure after economic downturn. Ekonomika, 94(3), 70-85. doi:10.15388/Ekon.2015.3.8788

Schumpeter, J. A. (1911). The Theory of Economic Development. Cambridge, MA: Harvard University Press.

Schumpeter, J. A. (1934). The theory of economic development. Leipzig, Cambridge MA:Harvard University Press.

Şeyranlıoğlu, O. (2024). Türkiye’de sermaye piyasası temelli finansal gelişme ile ekonomik büyüme arasındaki ilişkinin Fourier yaklaşımlar ile analizi. 11 (24), 167-197. https://doi.org/10.58884/akademik-hassasiyetler.1299131

Sghaier, I. M. (2023). Trade openness, financial development and economic growth in North African countries. International Journal of Finance and Economics, 28 (2), 1729-1740. https://doi.org/10.1002/ijfe.2503

Shahzadi, H. N., Sheikh, S. M., Sadiq, A & Rahman, S.U. (2023). Effect of financial development, economic growth on environment pollution: Evidence from G-7 based ARDL cointegration approach. Pakistan Journal of Humanities and Social Sciences, 11 (1), 68-79. https://doi.org/10.52131/pjhss.2023.1101.0330

Shaw, E. S. (1973). Financial deepening in economic development. New York, Oxford University Press.

Swamy, V. & Dharani, M. (2019). The dynamics of finance-growth nexus in advanced economies. International Review of Economics and Finance, 64, 122-146. https://doi.org/10.1016/j.iref.2019.06.001

Taşseven. Ö. & Yılmaz, N. (2022). Finansal gelişme göstergeleri ile ekonomik büyüme ilişkisi: Türkiye örneği, Doğuş Üniversitesi Dergisi, 23(1), 105-125. https://doi.org/10.31671/doujournal.1008152

Tekin, D., Şimşek, İ., & Dışkaya, S. (2024). Finansal gelişme ve ekonomik büyüme arasındaki ilişkinin araştırılması: Türkiye ve G7 ülkeleri üzerine bir değerlendirme. Muhasebe ve Finans İncelemeleri Dergisi. 7(1), 46-57. https://doi.org/10.32951/mufider.1432778

Toda, H.Y. & Yamamoto, T. (1995). Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics. 66, 225-250. http://dx.doi.org/10.1016/0304-4076(94)01616-8

The World Bank. (2024) World Development Indicators. https://databank.worldbank.org/source/world-development-indicators

Ustarz, Y., Fanta, A.B. & Poon, W. C. (2021). Financial development and economic growth in sub-Saharan Africa: A sectoral perspective. Cogent Economics and Finance, 9. https://doi.org/10.1080/23322039.2021.1934976

Wen, J., Mahmooda, H., Khalid, S, & Zakaria, M. (2022). The impact of financial development on economic indicators: A dynamic panel data analysis. Economic Research, 35 (1), 2930-2942.

https://doi.org/10.1080/1331677X.2021.1985570

Younsi, M. & Bechtini, M. (2020). Economic growth, financial development, and income inequality in BRICS countries: Does Kuznets’ inverted U-shaped curve exist? Journal of the Knowledge Economy, 11. 721-742. https://doi.org/10.1007/s13132-018-0569-2

|

gdp |

cre |

m2 |

open |

|

|

Mean |

26.72 |

29.99 |

37.47 |

41.42 |

|

Median |

26.69 |

20.67 |

33.73 |

45.19 |

|

Maximum |

27.85 |

70.90 |

71.60 |

81.17 |

|

Minimum |

25.69 |

13.59 |

18.03 |

9.10 |

|

Std. Dev. |

0.63 |

18.27 |

13.73 |

16.15 |

|

Skewness |

0.14 |

1.06 |

0.55 |

-0.07 |

|

Kurtosis |

1.85 |

2.53 |

2.25 |

2.69 |

|

Jarque-Bera |

2.93 |

9.82 |

3.73 |

0.23 |

|

Probability |

0.23 |

0.01 |

0.15 |

0.89 |

|

Obs. |

50 |

50 |

50 |

50 |

|

gdp |

cre |

m2 |

open |

|

|

gdp |

1 |

|||

|

cre |

0.81 |

1 |

||

|

m2 |

0.94 |

0.88 |

1 |

|

|

open |

0.93 |

0.67 |

0.87 |

1 |