Ekonomika ISSN 1392-1258 eISSN 2424-6166

2024, vol. 103(4), pp. 6–21 DOI: https://doi.org/10.15388/Ekon.2024.103.4.1

Musa Bayır

Bandırma Onyedi Eylül University, Turkey

Email: mbayir@bandirma.edu.tr

ORCID: https://orcid.org/0000-0002-6877-4032

Nazlıcan Zengin

Bandırma Onyedi Eylul University, Turkey

Email: zenginazlican@gmail.com

ORCID: https://orcid.org/0000-0002-8965-0557

Abstract. Economic growth has been a fundamental policy objective for countries throughout history. It signifies an enhancement in a country’s well-being and income levels. Education also plays a significant role in economic development and welfare improvement. This study aims to empirically examine and compare the impact of education expenditure on economic growth in developed and developing countries. The research employs a panel Autoregressive Distributed Lag method to analyze the influence of education expenditures on national income in 20 developing and 27 developed countries over the period 2000–2020. The findings indicate that variations in education expenditure positively affect national income in both developed and developing countries, with a more pronounced impact observed in developed countries. Based on these results, it is inferred that the prioritization of education expenditures in economic policies is crucial for fostering economic growth.

Keywords: Education Expenditures, Economic Growth, Developed and Developing Countries.

__________

* This paper is mainly based on the master’s thesis of the second author under the supervision of the first author.

Received: 28/08/2024. Revised: 05/09/2024. Accepted: 10/11/2024

Copyright © 2024 Musa Bayır, Nazlıcan Zengi̇n. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

__________

Economic growth plays a vital role in the development of both developed and developing countries. The enhancement of social welfare within a country is closely linked to the growth of its economy. While classical economic growth theories mainly associate economic advancement with fundamental production factors, subsequent periods have highlighted additional production factors that can impact economic growth. Of these factors, human capital stands out as particularly crucial, encompassing elements such as technological progress, knowledge, and skills. Given the importance of economic growth, countries establish goals pertaining to economic advancement and formulate their economic policies accordingly.

Education is vital for developing human capital, allowing individuals to systematically acquire knowledge. Nelson and Phelps (1966) assert that education inherently enhances individuals’ capacities to acquire, analyze, and comprehend information, thereby facilitating the development of human capital. Consequently, individuals are equipped to perform routine tasks and adapt to changes in their environments. The Neo-Classical economic framework posits that the ability to execute routine functions serves as a perfect substitute for physical capital, recognizing human capital as a factor that augments the productivity of both labor and physical capital. This perspective leads to the conclusion that human capital has a significant yet constrained role in economic growth (Lucas, 1988: 39). However, if adaptability to change is acknowledged as a component of human capital, the marginal productivity of human capital will remain positive as long as technological advancements persist (Nelson and Phelps, 1966). Thus, the impact of human capital on economic growth becomes dynamic. Education also contributes to social development, societal order, and public health. Consequently, countries allocate significant portions of their budgets to education, as shown in Figure 1, which indicates that developed nations spend a higher share of national income on education than developing ones. Despite differences in educational expenditures based on economic characteristics and policy goals, all countries prioritize educational investment.

The convergence hypothesis in Neo-Classical growth theory, which inadequately explained development disparities, led to the rise of endogenous growth models. Proponents like Lucas (1988) cited high growth rates in developed countries from 1960 to 1980. However, recent data shows that developing countries have outpaced advanced economies. The International Monetary Fund (IMF) reported that from 1980 to 1989, emerging markets had averaged growth of 3.29%, while advanced economies of 3.12%. From 1990 to 2020, emerging markets further excelled with an average growth rate of 4.9%, compared to just 2.21% for advanced economies.

This research investigates the impact of educational expenditures on national income in developed and developing countries, identifying disparities between them. It conducts a comparative analysis of how these expenditures affect economic growth, assessing their significance in both groups. The study also evaluates the assumptions of endogenous growth theory. Subsequent sections cover the theoretical framework, empirical literature, econometric methodology, and research findings, with the conclusion synthesizing the results.

Economists have analyzed economic growth dynamics from the classical economic perspective. Adam Smith identified capital accumulation, specialization, and the division of labor as key drivers, while David Ricardo emphasized diminishing returns and international trade. The Keynesian framework laid the foundation for modern growth theories, with Harrod (1939) and Domar (1946) introducing models focused on supply and demand interactions. The neoclassical growth model by Solow and Swan (1956) highlighted the relationship between labor and capital stock, asserting that long-term growth is mainly driven by technological progress. Despite its assumptions, including the international convergence hypothesis – which suggests developing countries will grow faster than advanced economies – Solow’s theory has faced criticism due to the lack of observed convergence and persistent high growth rates in developed countries.

The endogenous growth model, articulated by Lucas (1988), Romer (1986), Barro (1990), and Rebelo (1991), offers a significant alternative to the Neo-Classical growth model by asserting that economic growth is driven by internal variables within the economic system. Romer (1986) introduces endogenous technological progress, viewing new technology as a public good that facilitates knowledge dissemination and links capital stock to knowledge accumulation. This fosters specialization in machinery production, driving economic growth. Lucas (1988) emphasizes education as a key component of human capital and critiques the Neo-Classical convergence hypothesis. Barro (1990) highlights the role of government policies in stimulating growth, while economists led by Arrow stress that R&D expenditures enhance productivity and create new markets.

Endogenous growth models have advanced growth theory by recognizing a production function with increasing returns. This indicates that human capital accumulation can sustain long-term economic growth without technological progress. Consequently, if developing countries fail to take necessary actions, the income and welfare gap with developed countries may widen.

Growth disparities between developed and developing countries stem from key educational factors. Nelson and Phelps (1966) identify human capital as having two components: the ability to perform routine tasks and the ability to adapt to change. This distinction is vital for understanding the divergence between these countries. While many studies overlook adaptability, it is crucial in a continuously evolving technological landscape, enhancing the productivity of human capital. In adaptable societies, technology spreads rapidly, whereas countries lacking this trait tend to rely on traditional methods. Therefore, the return on education is greater in technologically dynamic countries.

An alternative viewpoint suggests that in contexts of diminishing returns, the marginal contribution of education for routine functions declines over time. To counter this, continuous development of new products and techniques is essential (Lucas, 1988: 28). Benhabib and Spiegel (1994) show that economic growth rates are more closely linked to the stock of human capital than to its accumulation rate, arguing that a larger stock enhances adaptability to advanced technologies and promotes frontier technology production.

Aghion (2009) identifies two types of activities that drive economic growth: imitation and innovation activities. Imitation is supported by long-term bank financing and subsidized loans, while innovation requires entrepreneurship, risk-taking, project identification, talent, and the cessation of unprofitable ventures. A competitive international environment and flexible labor markets are crucial for fostering these activities (Aghion, 2009: 33). Less developed countries below the global technological frontier can achieve rapid growth only through innovation, which necessitates transforming extractive institutions into investment-oriented ones, as highlighted by Acemoglu et al. (2002). These countries face significant challenges in this regard.

Lucas (1988) emphasizes the role of human capital in economic growth and its enhancement of a country’s comparative production advantages over time. Countries with initial production superiority can maintain their edge, even with similar human capital development rates as others. Baumol (2004) highlights the crucial role of R&D departments in large corporations in fostering entrepreneurial innovation, demonstrating their complementary relationship. Consequently, the performance of small entrepreneurs, when evaluated alone, tends to have a limited impact on economic growth (Baumol, 2004: 54).

Lucas (1988) argues that wage differentials for skilled labor drive human capital migration from less developed to advanced economies, effectively subsidizing the latter’s growth through educational investments. Research by Kerr and Kerr (2021), Hunt and Gauthier-Loiselle (2010), and Van Reenen (2021) supports this, showing that university-educated immigrants enhance the innovation capacity of advanced economies. Lucas (1988) presents an alternative view on growth disparities between less developed and developed economies, emphasizing economies of scale. He argues that economies of scale enhance learning potential, while lower production volumes reduce it. Thus, education’s impact on economic growth is likely weaker in economies with low-value-added production and reliance on raw material exports.

Human capital is vital for production, and countries enhance it through educational investments. Indicators like literacy rates and educational budgets reflect a country’s educational status (Sezgin and Bozdağlıoğlu, 2017). The effectiveness of education policy resource allocation depends on temporal and spatial factors. A literature review shows various studies on the relationship of education and economic growth, using diverse methodologies and outcomes.

Numerous studies have explored the link between education expenditures and economic growth in developing countries. Haini (2020), Liao et al. (2019), Odhiambo (2020), Suwandaru et al. (2021), Rambeli et al. (2021), Ziberi et al. (2022), and Ojha et al. (2020) identified a positive relationship, while Villela and Paredes (2022) found none. Jungo (2023) concluded that education expenditures impact economic growth in emerging countries. Maneejuk and Yamaka (2021) suggested that government spending per student has nonlinear effects on growth in the ASEAN-5, with higher education being more influential than secondary education. Coman and Nuta (2023) found a relationship in six of eleven former communist Eastern European countries, but not in the others. Some studies have examined the relationship between education expenditures and economic growth in developed countries. Artige and Cavenaile (2023) found a correlation between economic growth and public education spending in U.S. Delalibera and Ferreira (2018) suggested that reallocating funds to early childhood education could significantly boost U.S. per capita income. Marquez-Ramos and Mourelle (2019) emphasized the importance of secondary and higher education for human capital development and economic growth in Spain. Their 2018 study revealed a nonlinear relationship between education levels and economic growth. Agasisti and Bertoletti (2022) found that more universities in 284 European regions from 2000 to 2017 correlate with enhanced economic growth. Gardiner and Hajek (2023) and Chaabouni and Mbarek (2023) found that education expenditures positively impact economic growth in European countries.

Education expenditures promote economic growth in both developed and developing countries, but structural disparities raise questions about their varying impacts. Habibi and Zabardast (2020) studied the role of education in economic growth across Middle Eastern and OECD countries from 2000 to 2017. Their findings indicate that information and communication technologies have a more substantial positive effect on growth in countries with better educational access. However, there remains a significant gap in the literature regarding this inquiry.

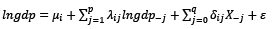

Panel data methods are significantly valuable in economic research conducted on country groups. Equation (1) presents a basic panel regression model tailored for the econometric framework of the research. Within this equation, i denotes the unit and signifies the cross-sectional dimension of the data. Variale t denotes the time dimension and pertains to the observations across a particular period for the units. In the equation, lngdp represents the dependent variable, while lnlnedu, lnfci, lnpop, lnhealth and lngov represent the independent variables. The slope parameters are denoted by βxi, and the error term is represented by u.

lngdp = β0i + β1ilnlnedu + β2ilnfci + β3i lnpop + β4i lnhealth + β4i lngov +u (1)

i =1,…..,;N;t,…..,T

In basic regression estimation, using differences to predict nonstationary series can lead to information loss and overlooked relationships. The cointegration approach addresses this by suggesting that a linear combination of nonstationary series results in a stationary process, indicating a long-term relationship. Various methodologies exist for estimating cointegration relationships, with the panel ARDL approach being particularly popular. Proposed by Pesaran and Smith (1995) and expanded by Pesaran, Shin, and Smith (1999), this method addresses heterogeneity across units and time periods, yielding consistent estimations. It models dynamic relationships by incorporating current and lagged changes and allows for a broader dataset through the inclusion of both endogenous and exogenous variables.

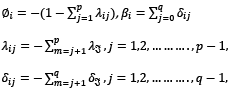

This methodology uses two primary approaches for coefficient estimation. Pesaran and Smith (1995) found that the Mean Group (MG) estimator provides consistent parameter averages but ignores potential group homogeneity. To address this, Pesaran, Shin, and Smith (1999) introduced the Pooled Mean Group (PMG) estimator, which allows for long-term homogeneity without assuming short-term parameter homogeneity. They suggested the PMG estimator for more consistent and efficient results (p. 627). The Hausman (1978) test was employed to evaluate the suitability of the MG and PMG approaches, indicating that the PMG estimator is expected to yield more reliable outcomes. The study model, shown in Equation (1), has been reformulated to fit the ARDL (p,q) equation.

(2)

(2)

where lngdp is the dependent variable, and X_j represents the vector of the control variables, λij are acalars, δij are the coefficients of the independent variables, μi represent the fixed effects.

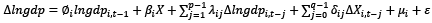

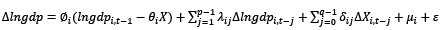

Equation (2) as an error correction equation can be written as

(3)

(3)

where

These expressions can be rewritten to obtain the error correction equation in Equation (4).

(4)

(4)

where ∅i < 0 signifies that there is a long-term relationship between lngdp and X. ∅i also represents the rapidity of short-term adjustments. λij and δij illustrate the short-term coefficients of lngdp and other explanatory variables.

The model in Equation (1) features a dependent variable, a primary independent variable, and four control variables based on economic theories. The dependent variable represents national income, while the main independent variable is education expenditures, which generally have a positive impact on economic growth, though some studies suggest an insignificant effect. The influence of education expenditures can vary by implementation level, country, and developmental stage. The control variables are derived from classical growth theories, focusing on fixed capital investments and the labor force. Fixed capital investments enhance production and are expected to positively affect national income. The model also includes the active population aged 15–64, indicating a larger labor force that is projected to positively influence income.

Two additional control variables are included in the econometric model based on endogenous growth models. Health expenditures are expected to positively affect income by increasing the healthy labor pool and enhancing productivity, thus raising human capital. Public expenditures are anticipated to promote economic growth when effectively managed to stimulate private investment, support skilled labor, and develop infrastructure and technology.

This research examines the impact of education expenditures on economic growth through panel data analysis of 27 developed and 20 developing countries from 2000 to 2020, classified according to the IMF’s system, with selection based on data availability.

|

Developed Countries |

||

|

Australia |

France |

Norway |

|

Austria |

Germany |

Portugal |

|

Belgium |

Greece |

South Korea |

|

Canada |

Ireland |

Singapore |

|

Croatia |

Israel |

Slovakia |

|

Czech |

Italy |

Spain |

|

Denmark |

Japan |

Sweden |

|

England |

Netherlands |

Switzerland |

|

Finland |

New Zealand |

USA |

|

Developing Countries |

||

|

Argentina |

Hungary |

Russia |

|

Brazil |

Malaysia |

South Africa |

|

Chile |

Mexico |

Thailand |

|

Colombia |

Peru |

Türkiye |

|

Egypt |

Philippines |

UAE |

|

India |

Poland |

Ukraine |

|

Iran |

Romania |

|

The dependent variable, lngdp, indicates the annual dollar value of goods and services produced by countries. The main independent variable, lnedu, reflects education expenditures by public and private sectors. Other independent variables include lnfci for fixed capital investment, lnpop for the active population aged 15–64, lnhealth for per capita health expenditure, and lngov for central government consumption expenditures, all in dollars. Data were sourced from the Worldbank database.

Table 2 presents summary statistics for variables from 20 developing countries and 27 developed countries, with 594 observations for each variable in developed countries and 440 observations for each variable in developing countries. It includes average values for lngdp, lnedu, lnfci, lnpop, lnhealth, and lngov, as well as the highest and lowest values for each variable in both country groups.

|

Developed Countries |

|||||

|

Variables |

Obs. |

Mean |

Sdt. E. |

Min |

Max |

|

lngdp |

594 |

27.0 |

1.3 |

28.8 |

30.7 |

|

lnedu |

594 |

23.9 |

1.3 |

20.4 |

27.5 |

|

lnfci |

594 |

25.5 |

1.3 |

22.2 |

29.2 |

|

lnpop |

594 |

16.1 |

1.1 |

14.7 |

19.1 |

|

lnhealth |

594 |

8.0 |

0.7 |

5.3 |

9.3 |

|

lngov |

594 |

25.4 |

1.3 |

22.2 |

28.8 |

|

Developing Countries |

|||||

|

Variables |

Obs. |

Mean |

Sdt. E. |

Min |

Max |

|

lngdp |

440 |

26.5 |

0.9 |

24.2 |

28.7 |

|

lnedu |

440 |

23.2 |

1.0 |

20.7 |

25.6 |

|

lnfci |

440 |

24.9 |

1.0 |

22.5 |

27.5 |

|

lnpop |

440 |

17.5 |

1.0 |

15.6 |

20.6 |

|

lnhealth |

440 |

5.6 |

1.0 |

2.7 |

7.3 |

|

lngov |

440 |

24.5 |

0.9 |

22.4 |

26.9 |

In panel data estimations, common shocks integrated into the error term and unobserved variables lead to cross-sectional dependence in error terms, affecting the accuracy of measurements and estimation results. To address this issue, a cross-sectional dependence test is conducted initially. Table 3 displays the results of the Breusch–Pagan LM and Pesaran CD tests for cross-sectional dependence. The tests reveal cross-sectional dependence in all series for both country groups.

|

Developed Countries |

Developing Countries |

|||

|

Breusch–Pagan LM |

Pesaran CD |

Breusch–Pagan LM |

Pesaran CD |

|

|

Variables |

Stat. |

Stat. |

Stat. |

Stat. |

|

lngdp |

5967* |

75.8* |

3435* |

58.4* |

|

lnedu |

5674* |

67.4* |

3098* |

55.0* |

|

lnfci |

4459* |

58.9* |

3106* |

55.2* |

|

lnpop |

4809* |

18.2* |

3576* |

17.2* |

|

lnhealth |

6249* |

78.2* |

3319* |

57.2* |

|

lngov |

6185* |

77.8* |

3373* |

57.8* |

In panel data analyses, it is commonly assumed that slope coefficients are homogeneous. However, a common issue arises from the heterogeneity of these coefficients, leading to potentially misleading and unreliable results due to unaccounted-for variables in the dataset (Phillips and Sul, 2003). Swamy’s S test and Pesaran and Yamagata’s (2008) delta (Δ) test were conducted to assess the homogeneity of slope coefficients, with results detailed in Table 4. The tests rejected the null hypothesis (H0: βi = β) based on the calculated Swamy S and Pesaran and Yamagata delta (Δ) test statistics for both country groups, indicating heterogeneous coefficients. Consequently, subsequent analyses will consider the cross-sections to have a heterogeneous structure when estimating variable parameters.

|

Test |

Developed Countries |

Developing Countries |

|

|

Stat. [Prob.] |

Stat. [Prob.] |

||

|

Swamy |

S Test |

9476 [0.000] |

5579 [0.000] |

|

Pesaran and Yamagata |

Δ |

16.6 [0.000] |

12.3 [0.000] |

|

Δadj |

20.1 [0.000] |

15.0 [0.000] |

Panel data models combine time series and cross-sectional data, requiring examination of time series issues. While time series analysis assumes time-independent mean and variance, covariance varies with time differences, indicating stationarity. However, many time series are nonstationary, necessitating stationarity assessment in panel data analysis. Panel unit root tests may be influenced by cross-sectional dependence. To address this, we applied Pesaran’s (2007) panel CADF unit root test, considering cross-sectional dependence in both country groups. Results are in Table 5.

|

Variables |

Developed Countries |

Developing Countries |

||

|---|---|---|---|---|

|

t stat. |

t stat. (constant+trend) |

t stat. |

t stat. (constant+trend) |

|

|

lngdp |

-2.128 |

-2.437 |

-2.521 |

-3.049 |

|

Δlngdp |

-2.631* |

-2.624* |

-3.049 |

-2.976 |

|

lnedu |

-2.500* |

-2.444 |

-3.045 |

-3.330 |

|

Δlnedu |

-2.958* |

-2.951* |

-3.283 |

-3.221 |

|

lnfci |

-1.915 |

-1.979 |

-2.420 |

-2.631 |

|

Δlnfci |

-2.491* |

-2.544* |

-2.837 |

-3.031 |

|

lnpop |

-2.235 |

-2.881* |

-2.338 |

-3.021 |

|

Δlnpop |

-2.357* |

-2.115 |

-2.263 |

-1.910 |

|

lnhealth |

-1.899 |

-2.077 |

-2.590 |

-3.237 |

|

Δlnhealth |

-2.424* |

-2.614* |

-3.508 |

-3.500 |

|

lngov |

-1.480 |

-1.972 |

-2.512 |

-3.212 |

|

Δlngov |

-3.590* |

-3.536* |

-3.326 |

-3.285 |

The stationarity of each variable was assessed for models with a constant and a constant trend. Analysis showed that all variables for both developed and developing countries are stationary at the level or after the first difference, supporting the use of the panel ARDL model for estimation.

The Hausman test determined that the PMG estimator was suitable for both sets of countries. Table 6 presents the long-term and short-term coefficients obtained using the PMG approach.

The findings for developed countries show a negative and statistically significant error correction term (ECT), indicating a long-term cointegration relationship. The ECT of -0.31 suggests that about 31% of any imbalance will be corrected in the next period. Long-term coefficients reveal that a 1% change in the lnedu variable positively impacts lngdp by 0.21%, while a 1% adjustment in the lnfci variable increases lngdp by 0.29%. The lnpop and lnhealth variables have statistically insignificant effects on lngdp. In contrast, a 1% change in the lngov variable positively affects lngdp by 0.44%.

In developed countries, a 1% change in the lnedu variable positively impacts lngdp by 0.08%, while a 1% change in the lnfci variable increases lngdp by 0.29%. The lnpop and lnhealth variables have statistically insignificant effects on lngdp. However, a 1% change in the lngov variable positively affects lngdp by 0.30%.

The results for developing countries indicate a significant negative error correction coefficient (ECT) of -0.39, suggesting that 39% of any imbalance will be corrected in the next period, moving towards long-term equilibrium. The long-term coefficients show that a 1% change in lnedu increases lngdp by 0.14%, a 1% change in lnfci raises lngdp by 0.29%, a 1% change in lnpop boosts lngdp by 0.24%, a 1% change in lnhealth results in a 0.21% increase in lngdp, and a 1% change in lngov leads to a 0.19% rise in lngdp. All independent variables positively and significantly impact lngdp in the long-term model.

In developing countries, a 1% change in the lnedu variable positively impacts lngdp by 0.11%, while a 1% change in the lnfci variable increases lngdp by 0.19%. Conversely, a 1% change in the lnpop variable negatively affects lngdp by -2.58%. A 1% change in the lngov variable positively impacts lngdp by 0.30%. The lnhealth variable has an insignificant effect on income.

|

Dependent Var. (lngdp) |

Developed Countries |

Developing Countries |

||

|

Coef. [Prob.] |

Sdt. Er. |

Coef. [Prob.] |

Sdt. Er. |

|

|

Long Term Coef. |

||||

|

lnedu |

0.211 [0.000] |

0.040 |

0.146 [0.000] |

0.252 |

|

lnfci |

0.295 [0.000] |

0.032 |

0.290 [0.000] |

0.012 |

|

lnpop |

0.066 [0.560] |

0.114 |

0.248 [0.000] |

0.762 |

|

lnhealth |

-0.077 [0.158] |

0.055 |

0.219 [0.000] |

0.030 |

|

lngov |

0.445 [0.000] |

0.067 |

0.196 [0.000] |

0.196 |

|

Short Term Coef. |

||||

|

ECT |

-0.315 [0.000] |

0.050 |

-0.398 [0.000] |

0.106 |

|

Δlnedu |

0.086 [0.017] |

0.036 |

0.118 [0.007] |

0.043 |

|

Δlnfci |

0.297 [0.000] |

0.026 |

0.199 [0.000] |

0.037 |

|

Δlnpop |

-0.103 [0.894] |

0.777 |

-2.585 [0.034] |

1.216 |

|

Δlnhealth |

-0.011 [0.820] |

0.051 |

-0.000 [0.981] |

0.041 |

|

Δlngov |

0.303 [0.000] |

0.064 |

0.308 [0.000] |

0.051 |

|

constant |

0.831 [0.000] |

0.128 |

22.18 [0.000] |

0.583 |

|

Hausman Test |

||||

|

Stat. [Prob] |

Stat. [Prob] |

|||

|

PMG <=> MG |

1.86 [0.867] |

1.00 [0.962] |

||

Education is crucial for equipping individuals with skills and knowledge, enhancing societal well-being, and positively impacting the labor market. It is vital for economic development in a changing global landscape. Since the 1950s, the concept of human capital has highlighted the link between education and economic growth. Studies show that higher educational attainment correlates with increased income, indicating that education is a societal investment that significantly contributes to economic progress.

The analysis examined the impact of education expenditures on national income in 27 developed countries, revealing a positive correlation in both the short and long term, with a stronger long-term effect. Control variables, such as fixed capital investments and government expenditures, also positively influenced national income, with government expenditures having the greatest impact. Conversely, population and health expenditures had no significant effect. In a subsequent analysis of 20 developing countries, a similar positive relationship was found between education expenditures and national income. Fixed capital investments, population, health expenditures, and government expenditures contributed to long-term growth, while government expenditures were the most influential in the short term. Notably, population growth negatively affected national income in the short term, while the negative impact of health expenditures was deemed insignificant.

An evaluation of empirical findings on education expenditures shows a positive correlation with national income in both developed and developing countries. Recent research, including studies by Haini (2020), Jungo (2023), and Ziberi et al. (2022), indicates that education significantly contributes to economic growth in developing countries. Similarly, Artige and Cavenaile (2023), Marquez-Ramos and Mourelle (2019), and Delalibera and Ferreira (2018) reached similar conclusions for developed countries. Our findings, which align with those of Habibi and Zabardast (2020), suggest that education has a greater impact on economic growth in developed countries. Therefore, it can be asserted that our empirical results are in alignment with the prevailing literature.

The long-term effects of education expenditures are notably more pronounced in developed countries than in developing ones. This disparity can be attributed to the increased significance of human capital in driving economic productivity within developed economies. The findings presented herein affirm the continued relevance of endogenous growth theories for the specified period. Consequently, the influence of education expenditures on economic growth in developed countries can be elucidated through this theoretical framework. Specifically, several key factors contribute to this phenomenon: in developed countries, the workforce, including both managers and employees, exhibits greater receptiveness to technological advancements, thereby facilitating the diffusion of technology. Additionally, the substantial accumulation of human capital fosters an environment conducive to the generation of high-value-added frontier technologies. The emergence of high-tech regions in developed countries – most notably in the United States and certain European countries – coupled with the presence of large corporations that allocate significant resources to research and development, enhances the capacity to translate investments in higher education into innovative outcomes. Moreover, large enterprises and investors in developed countries are positioned to support and capitalize on innovative ideas originating from various global contexts. For instance, in 2020, the number of patent applications submitted by residents in developed countries within our sample reached 27,884 per country, in stark contrast to only 4,467 in developing countries (Worldbank, 2024).

Despite rising educational expenditures, transforming extractive institutions in developing economies remains challenging. Consequently, the benefits of education often do not reach the wider population, impeding technological advancements and production growth. The analyzed developing countries – Argentina, Brazil, Egypt, Iran, Russia, Turkey, and Ukraine – are currently in the spotlight due to ongoing economic and political discussions. A key factor limiting the impact of educational expenditures to economic growth is the prevalence of small-scale production, as most lack the economies of scale achievable through exports. For instance, the United Arab Emirates, Iran, and Russia primarily depend on natural resources for exports. In contrast, countries other than the Philippines, Malaysia, and Thailand tend to export low-value-added and low-technology goods, leading to trade deficits. According to 2020 World Bank statistics, countries outside the three mentioned have an average high-technology export share of about 9%, compared to nearly 20% in developed countries (Worldbank, 2024). Furthermore, there is a notable trend of migration from developing to developed countries in recent years. Among the developed countries included in our analysis, all except Croatia and Greece are net recipients of migrants, while many developing countries are net exporters of migration (Worldbank, 2024). This suggests that developed countries are effectively subsidizing their human capital enhancement through educational expenditures in developing countries.

In conclusion, the other empirical findings also support endogenous growth theory. The model’s inclusion of the population control variable shows that population growth positively affects production in developing countries but has negligible effects in developed countries. The long-term impact of education expenditures is likely due to education’s growing contribution to economic growth, enhancing labor productivity and innovation capacity as educational attainment increases.

While fixed capital investments impact both developed and developing countries similarly, public expenditures significantly influence national income, with developed countries experiencing more than double the effect. This indicates that public spending in developed nations is more effective in stimulating private investment, enhancing infrastructure, and fostering technological advancements. The substantial impact of government expenditures in these countries is linked to their extensive social security networks and the state’s economic role, aligning with Acemoglu et al.’s (2002) framework on inclusive and extractive institutions.

Education expenditures exert a positive influence on economic growth. Although this correlation is more pronounced in developed countries, it remains applicable to developing countries as well. Consequently, it can be concluded that promoting education expenditure universally will contribute to the enhancement of welfare levels and income.

The results of the study suggest that the two most significant variables affecting the model are public expenditures and educational expenditures. Although a positive correlation between education, public expenditures, and national income is observable in both developing and developed countries, this relationship is particularly more pronounced in developed countries. The underlying factors contributing to this phenomenon have been addressed in prior discussions.

As previously noted, numerous studies that assess education through diverse indicators, including education quality and investment at various educational levels, have found that education can exert differing effects on production levels and productivity. For instance, a recent study indicated that secondary education in India has a more pronounced positive influence on production levels compared to higher education (Ojha et al., 2020). Furthermore, there are investigations that focus specifically on university policies (Aghion, 2009). In this regard, it is recommended that future research should explore the impact of various specific educational indicators on economic growth. At this juncture, if a country exhibits a deficiency in technological dynamism and innovation capacity, allocating resources to higher education may be unwarranted. Conversely, countries facing such circumstances should prioritize investments in secondary and high school education.

On the other hand, if a country is significantly lagging behind the global technology frontier, it is imperative for it to develop innovation capabilities to achieve rapid and sustainable economic growth. The existing literature underscores the importance of establishing high-quality and sustainable institutional capacity as a foundational step in this process. Following this initial phase, as demonstrated by a cohort of countries including South Korea and Singapore, efforts should be directed towards creating economies of scale and capitalizing on export opportunities. In light of the current intense global competition, it may be prudent for countries to focus on sectors where they hold comparative advantages on an international scale. In an environment characterized by established economies of scale, the acquisition of technological dynamism and innovation capabilities will be facilitated. Indeed, these East Asian countries surpass nearly all developed countries in terms of the number of patents filed, with only a few exceptions (Worldbank, 2024).

In the process of transitioning to a technologically dynamic and innovation-driven economy, it is essential to emphasize that government investments in education must become more strategically focused. Specifically, these investments should target areas of higher education that possess significant potential for transformation into high-tech and innovative sectors. A critical challenge faced by less developed countries, characterized by low per capita wage levels, is the emigration of skilled labor that has been educated with already limited resources to more developed countries. While the establishment of inclusive institutions is likely to enhance the competitive environment and subsequently increase wage levels for these individuals, it may be prudent for the central government to implement policies that subsidize this transition in the short term.

Acemoglu, D., Johnson, S. and Robinson, J. (2002). Reversal of Fortune: Geography and Institutions in the Making of the Modern World Income Distribution. The Quarterly Journal of Economics, 117(4), 1231-1294. https://doi.org/10.1162/003355302320935025.

Agasisti, T. and Bertoletti, A. (2022). Higher Education and Economic Growth: A Longitudinal Study of European Regions 2000–2017. Socio-Economic Planning Sciences, 81, 100940. https://doi.org/10.1016/j.seps.2020.100940.

Aghion, P. (2009). Higher Education and Innovation. Perspektiven der Wirtschaftspolitik, 9(1), 28-45. https://doi.org/10.1111/j.1468-2516.2008.00273.x.

Artige, L. and Cavenaile, L. (2023). Public Education Expenditures, Growth and Income Inequality. Journal of Economic Theory, 209, 105622. https://doi.org/10.1016/j.jet.2023.105622.

Baumol, W.J. (2004). Education for Innovation: Entrepreneurial Breakthroughs vs. Corporate Incremental Improvements. NBER Working Paper, No. 10578. https://doi.org/10.3386/w10578.

Barro, R.J. (1991). Economic Growth in a Cross Section of Countries. The Quarterly Journal of Economics, 106(2), 407-443. https://doi.org/10.2307/2937943.

Benhabib, J. and Spiegel, M. (1994). The Role of Human Capital in Economic Development: Evidence from Aggregate Cross-Country Data. Journal of Monetary Economics, 34, 143–173.

Chaabouni, S. and Mbarek, M. B. (2023). What Will Be the Impact of the COVID-19 Pandemic on the Human Capital and Economic Growth? Evidence from Eurozone. Journal of the Knowledge Economy, 15, 2482–2498. https://doi.org/10.1007/s13132-023-01328-3.

Coman, A. C., Lupu, D. and Nuţă, F. M. (2022). The Impact of Public Education Spending on Economic Growth in Central and Eastern Europe. An ARDL Approach with Structural Break. Economic Research, 36(1), 1261–1278. https://doi.org/10.1080/1331677x.2022.2086147.

Delalibera, B. R. and Ferreira, P. C. (2019). Early Childhood Education and Economic Growth. Journal of Economic Dynamics & Control, 98, 82–104. https://doi.org/10.1016/j.jedc.2018.10.002

Domar, E. (1946). Capital Expansion, Rate of Growth, and Employment. Econometrica, 14(2), 137–147.

Gardiner, R. and Hajek, P. (2023). The Role of R&D Intensity and Education in a Model of Inequality, Growth and Risk of Poverty: Evidence from Europe. Journal of the Knowledge Economy, 15(1), 1845–1870. https://doi.org/10.1007/s13132-023-01169-0.

Habibi, F. and Zabardast, M. A. (2020). Digitalization, Education and Economic Growth: A Comparative Analysis of Middle East and OECD Countries. Technology in Society, 63, 101370. https://doi.org/10.1016/j.techsoc.2020.101370.

Haini, H. (2020). Spatial Spillover Effects of Public Health and Education Expenditures on Economic Growth: Evidence from China’s Provinces. Post-Communist Economies, 32(8), 1111–1128. https://doi.org/10.1080/14631377.2020.1722586.

Harrod, R. F. (1939). An Essay In Dynamic Theory. The Economic Journal, 49(193), 14-33.

Hausman, J. A. (1978). Specification Tests in Econometrics. Econometrica, 46(6): 1251-1271.

Hunt, J. and Gauthier-Loiselle, M. 2010. How Much Does Immigration Boost Innovation?. American Economic Journal: Macroeconomics, 2(2), 31–56. https://doi.org/10.1257/mac.2.2.31.

IMF. (2024). Economic Growth Statistics. https://www.imf.org/en/home.

Jungo, J. (2024). Institutions and Economic Growth: The Role of Financial Inclusion, Public Spending on Education and the Military. Review of Economics and Political Science. 9(3), 298-315. https://doi.org/10.1108/reps-04-2023-0034.

Kerr, S.P. and Kerr, W.R. (2021). Immigration Policy Levers for US Innovation and Startups. In Innovation and Public Policy, edited by A. Goolsbee and B. F. Jones, chap. 3. Chicago: University of Chicago Press.

Liao, L., Du, M., Wang, B. and Yu, Y. (2019). The Impact of Educational Investment on Sustainable Economic Growth in Guangdong, China: A Cointegration and Causality Analysis. Sustainability, 11(3), 766. https://doi.org/10.3390/su11030766.

Lucas, R. (1988). On the Mechanics of Economic Development. Journal of Monetary Economics, 22, 3–42.

Maneejuk, P. and Yamaka, W. (2021). The Impact of Higher Education on Economic Growth in ASEAN-5 Countries. Sustainability, 13(2) 520. https://doi.org/10.3390/su13020520.

Marquez-Ramos, L. and Mourelle, E. (2018). Education and Economic Growth: An Empirical Analysis of Nonlinearities. Applied Economic Analysis, 27(79), 21-45. https://doi.org/10.1108/AEA-06-2019-0005.

Nelson, R. and Phelps, E. (1966). Investment in Humans, Technological Diffusion, and Economic Growth. American Economic Review, Papers and Proceedings 61(2), 69–75.

Odhiambo, N. M. (2020). Education and Economic Growth in South Africa: An Empirical Investigation. International Journal of Social Economics, 48(1), 1–16. https://doi.org/10.1108/ijse-04-2020-0259

Ojha, V. P., Ghosh, J. and Pradhan, B. K. (2021). The Role of Public Expenditure on Secondary and Higher Education for Achieving Inclusive Growth in India. Metroeconomica, 73(1), 49–77. https://doi.org/10.1111/meca.12353.

Pesaran, H. M. (2007). A Simple Unit Root Test in the Presence of Cross Section Dependence. Journal of Applied Econometrics, 22, 265–312.

Pesaran, M. H. and Yamagata, T. (2008). Testing Slope Homogeneity in Large Panels. Journal of Econometrics, 142(1): 50-93.

Pesaran, M. H., and Smith, R.P. (1995). Estimating Long-Run Relationships from Dynamic Heterogeneous Panels. Journal of Econometrics, 68(1), 79-113.

Pesaran, M. H., Shin, Y. and Smith, R. P. (1999). Pooled Mean Group Estimation of Dynamic Heterogeneous Panels. Journal of the American Statistical Association, 94, 621-634.

Phillips, P. C. B. and Sul, D. (2003). Dynamic Panel Estimation and Homogeneity Testing Under Cross Section Dependence. The Econometrics Journal, 6(1), 217–259.

Rambeli, N. N., Marikan, N. D. A., Podivinsky, N. J. M., Amiruddin, N. R. and Ismail, N. I. (2021). The Dynamic Impact of Government Expenditure in Education on Economic Growth. International Journal of Business and Society, 22(3), 1487–1507. https://doi.org/10.33736/ijbs.4318.2021.

Rebelo, S. (1991). Long-Run Policy Analysis and Long-Run Growth. Journal of Political Economy, 99(3), 500-521.

Van Reenen, J. (2021). Innovation and Human Capital Policy. Centre for Economic Performance Discussion Paper, No. 1763.

Romer, P. (1986). Increasing Returns and Long-run Growth. Journal of Political Economy, 94(5), 1002-1037. http://dx.doi.org/10.1086/261420.

Sezgin, Y. and Bozdağlıoğlu, E. Y. (2017). Human Capital Status in Turkey (2005-2015). Osmaniye Korkut Ata University Journal of Economics and Administrative Sciences, 1(1), 48–67.

Solow, R. M. and Swan, T. W. (1956) Economic Growth and Capital Accumulation. Economic Record, 32, 334-361. https://doi.org/10.1111/j.1475-4932.1956.tb00434.x.

Suwandaru, A., Thamer A. and Nurwanto, N. (2021). Empirical Analysis on Public Expenditure for Education and Economic Growth: Evidence from Indonesia. Economies, 9, 146. https://doi.org/10.3390/ economies9040146.

Villela, R. and Paredes, J. J. (2022). Empirical Analysis on Public Expenditure for Education, Human Capital and Economic Growth: Evidence from Honduras. Economies, 10, 241. https://doi.org/10.3390/economies 10100241.

Worldbank. (2023). Statistic Database. https://www.worldbank.org/en/home.

Worldbank. (2024). Statistic Database. https://www.worldbank.org/en/home.

Ziberi, B. F., Rexha, D., Ibraimi, X. and Avdiaj, B. (2022). Empirical Analysis of the Impact of Education on Economic Growth. Economies, 10(4), 89. https://doi.org/10.3390/economies10040089.